HOPDs vs. ASC: Understanding Payment Differences

Health plans and consumers continue to pressure hospitals and health systems to shift the delivery of qualifying outpatient surgeries away from hospital outpatient departments (HOPDs) to ambulatory surgery center (ASC) settings. Revenue for the ASC industry in the United States is projected to grow at a 5.83 percent compounded annual growth rate from 2016 to 2022, which is faster than the growth of the overall U.S. economy.a

Market Dynamics

Perhaps the most significant contributing factor of ASC growth is the industrywide push toward value-based care. With health plans pressing for the implementation of value-based payment contracts, ASCs afford providers and administrators a more efficient surgical setting, reducing payer costs. Government payers, organized provider networks, self-funded employer health plans, and other organizations at risk for rising healthcare costs are increasingly encouraging patients to use ASCs.

Patients also are becoming savvy, price-sensitive consumers who recognize the out-of-pocket savings ASCs offer. For instance, in a survey of healthcare consumers performed by the Urgent Care Association and Solv Health, 70 percent of respondents noted they seek healthcare price information, indicating that consumer behavior in health care is beginning to exhibit retail characteristics.b This shift is expected to drive business to lower-cost settings at an accelerated pace.

Finally, the continued desire of physicians and health systems to partner for ASC ownership affects patient migration and site-of-service patterns. While surgeons have long sought ownership opportunities to enhance patient experience, efficiency, and the degree of physician operational influence, as well as earn attractive ROI, the pace of hospital and health system investments in ASCs continues to grow. As reported in one recently published survey, 41 percent of health system respondents “own or are affiliated with a freestanding ASC.”c Particularly interesting, of those hospitals or health systems with current ASC ownership or affiliations, 48 percent “anticipate making additional ASC investments/affiliations in the coming years.” Also, the fierce competition that in the past has characterized the relationships between hospitals and physician owners or investors in ASCs is fading. About two-thirds of ASCs with hospital or health system ownership are set up as joint ventures with physicians. The changing competitive landscape among hospitals, health systems, and physicians interested in investing likely will result in continued growth in ASC volume.

Payment Overview and Research

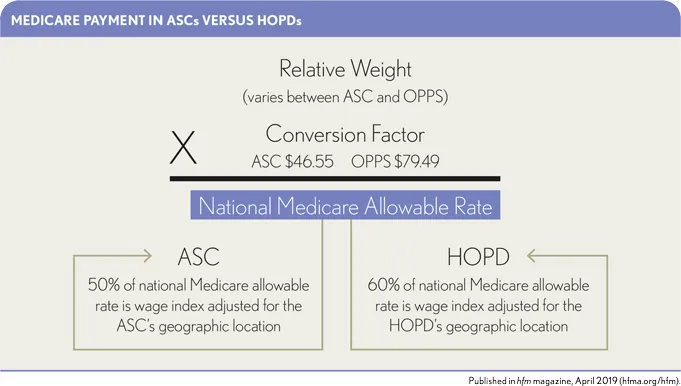

Given the continued increase expected in ASC volume, it is important to understand the payment differences between ASCs and HOPDs. In general, ASCs command lower rates than their HOPD counterparts. Using Medicare as an example, when outpatient surgeries shift from an HOPD setting to a freestanding ASC, the Medicare payment methodology changes from the Outpatient Prospective Payment System (OPPS) to the ASC fee schedule. This shift is impactful because, although the ASC fee schedule is linked to OPPS payments, the inputs and adjustments to the calculation are not the same. The exhibit below outlines the calculation methodology and highlights the differences. A single example of this difference would be that, using 2018 national Medicare rates, a diagnostic colonoscopy (CPT® code 45378) would have an allowable payment rate of $709.98 in an HOPD setting, while the same procedure would have an allowable payment rate of $369.84 in a freestanding ASC (about 52 percent of the HOPD rate).

Differences in Methodology Lead to Different Payment

Three main factors contribute to the differences in payment between ASCs and HOPDs.

Relative weight. The relative weight is the numerical value associated with the service provided, as defined by the Centers for Medicare & Medicaid Services (CMS). This value is multiplied by the conversion factor to determine the national Medicare allowable rate. The relative weight is lower in the freestanding ASC setting due to OPPS’s proportional adjustments to relative weight to maintain budget neutrality. This methodology resulted in a 10.1 percent reduction to the ASC relative weight (when compared with the HOPD relative weight) for 2018.d

Conversion factor. The ASC conversion factor is now based on the hospital market basket, whereas previously it was based on the Consumer Price Index. The change to the hospital market basket promotes site neutrality between hospitals and ASCs, and encourages the migration of services from the hospital setting to the lower-cost ASC setting. Thus, the ASC conversation factor is $46.55 for 2019, and the OPPS conversion factor, also based on the hospital market basket, is $79.49 for 2019. As such, the ASC conversion factor is about 59 percent of the OPPS conversion factor ($46.55 / $79.49 = 59 percent).

Wage index adjustment. Once the national Medicare allowable rate (allowable rate) is determined, it is further adjusted by the geographical wage index of each individual HOPD/ASC. The geographical wage index for each HOPD/ASC is determined by calculating the ratio of the average hourly wage for its labor market (typically its county) to the national average hourly wage. This geographical wage index adjustment varies for HOPD payments and freestanding ASC payments. For freestanding ASCs, 50 percent of the allowable rate is adjusted. For HOPDs, 60 percent of the allowable rate is adjusted. This difference in methodology and weighting (as it relates to the labor portion of the payment) can have a positive or negative impact on ASC payment rates when compared with the OPPS rates, depending on the applied wage index.

Payment Analysis

In its March 2018 Report to the Congress the Medicare Payment Advisory Commission (MedPAC) provides an analysis of the top 20 ASC procedures (regardless of specialty) based on 2016 claims data.

This analysis demonstrates the reduction in payments for the top 20 ASC codes is generally consistent at 48 percent when compared with the HOPD rates. That trend is not universal, however, and cannot be applied to all CPT® codes. Applying a single reduction rate across all specialties and all procedures may lead to significant inaccuracies when calculating the expected payment impact of shifting cases from an HOPD setting to a freestanding ASC setting.

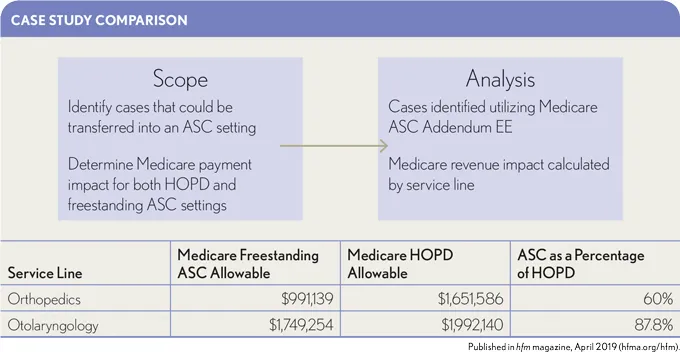

To better demonstrate the potential variability of payment per case among different specialties, consider the following case study based on analysis of fictitious data. The study utilizes the volume from various CPT® codes that were easily grouped into two common ASC service lines—orthopedics and otolaryngology. That comparison is shown in the exhibit below.

This case study contains calculations of Medicare payment impacts resulting from HOPD-to-ASC conversion ranging from about a 12 percent reduction to a 40 percent reduction. This analysis demonstrates the significant errors in payment estimates that can result from applying a single/common payment impact factor. Careful consideration and analysis of the specific circumstances are necessary.

As physicians, payers, and the public push for increased usage of lower-cost, more consumer-friendly sites of service such as ASCs, hospitals and health systems are increasingly active investors. Because of this trend, it is ever more important for hospitals and health systems to anticipate and accurately project expected impacts on payment. As these impacts are considered and projected, it is also important for decision-makers to concurrently contemplate key strategic questions, such as the following:

- Can the use of an ASC improve quality metrics, patient experience, and/or provider satisfaction?

- Are there opportunities to partner with physicians to help further align the hospital or health system with physicians in the market?

- Does the hospital or health system have the ability/demand to backfill the services transferring to the ASC?

- If an ambulatory site of service is not developed, will insurers and providers consider other options in the market?

Accurately projecting payment impacts and ensuring that key strategic considerations have been evaluated will help hospitals and health systems minimize negative bottom-line impacts in the short term and ensure they better position themselves in the market as the healthcare industry continues to shift focus toward lower-cost and more consumer-friendly access points.

Footnotes

a. Vertical IQ, Inc. Ambulatory Surgery Centers, August 2018.

b. Fernandez, H., “ The Rise of the Practical Patient: What Do Healthcare Consumers Really Want?” Medium, May 1, 2018.

c. Clark Hill Strasburger and Avanza Healthcare Strategies, Positioning Ambulatory Surgery Centers for Success , September 2018.

d. Medicare Payment Advisory Commission, “ Report to the Congress: Medicare Payment Policy,” March 2018.