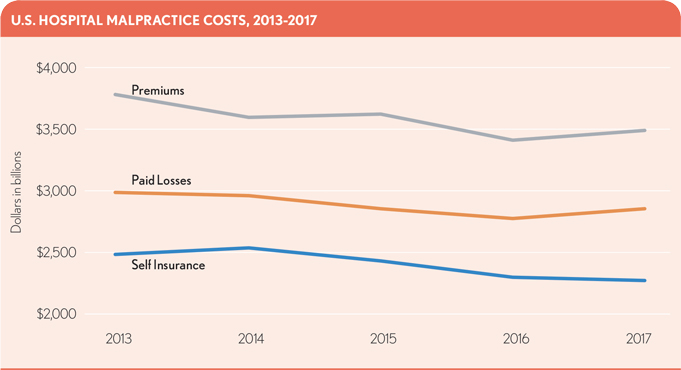

Malpractice cost analysis shows declines in premiums, paid losses and self-insuranceMalpractice cost analysis shows declines in premiums, paid losses and self-insurance

To shield against potential legal damages from malpractice claims, hospitals carry malpractice insurance, sometimes as a self-funded vehicle. As with any cost of doing business, this area should not be overlooked for changes over time. An analysis of data reported by U.S. acute-care hospitals in Medicare cost reports — looking at malpractice premiums, paid losses and self-insurance costs for all reporting hospitals with a filing available ending between 2013 and 2017 — found a decline in the combined cost for all three categories over the five-year period.1 Although the changes appear slight, they do also seem to represent a consistent trend.

It is possible that the hospital industry’s heavy investment in recent years toward quality initiatives, documentation improvement and new technologies to improve patient care is behind this decline. Many of these efforts were undertaken to ensure the hospitals received maximum appropriate payment from CMS programs focused on improving quality of care, encouraging electronic health record adoption and generating measures the public can use to examine the value of care offered in their own communities. However, this decline also may be an unanticipated benefit from better documentation aimed at assisting in defense of claims and from quality initiatives that have eliminated some mistakes.

Hospital operators may benefit from reviewing their own coverage and claims history to assess their own changes over recent years and ensure coverage levels are still appropriate.

Footnotes

1 Only partial data were available for 2018 at the time of publication, and these data therefore were not included.