Survey: Providers have work to do on the journey to value

Although U.S provider organizations still show a willingness to take on risk by adopting alternative payment models, progress has been slow, and it may not pick up speed as quickly as many industry observers suggest.

A recent HFMA study found that the more revenue a healthcare organization has at risk in value-based contracts, both today and anticipated, the more robust its capabilities for managing risk contracts.

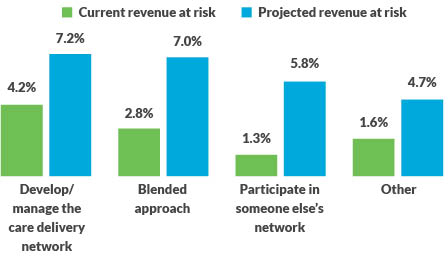

The survey, which was sponsored by GHX, investigated the current percentage of revenue at risk from healthcare provider organizations’ participation in advanced alternative payment models (APMs), and the organizations’ projection for how they expect that percentage will increase in the next five years.a Among 274 organizations participating in the survey, the average responses ranged from 1.3% to 4.2% of their net patient service revenue being at risk in APMs, depending on which of the following four risk strategies the organization was pursuing:

- Those that were managing their own care delivery network

- Those that were participating in otherorganizations’ networks

- Those that had adopted a blended approach that combines the two approaches mentioned above

- Those that had adopted another approach not described by the previous three approaches, including nonparticipation in APMs

Amount of revenue at risk, based on approach to taking on risk

The four approaches were defined in the survey as follows.

- Develop/manage the care delivery network (33.9% of respondents): The organization will take population-based risk for cost and quality outcomes across as many payer classes as possible (e.g., a health-system-based Medicare Next Gen ACO).

- Blended approach (42.3% of respondents): Depending on the payer and the model, the organization might develop and manage the care delivery network or it might participate in someon e else’s network (e.g., a hospital in CJR and participating as a preferred provider in a physician-led ACO’s network).

- Participate in someone else’s network (16.9% of respondents): The organization will partner with other entities taking population-based risk in their care delivery networks (e.g., a hospital participating as a preferred provider in a physician-led ACO’s network).

- Other (6.9% of respondents): The organization described an approach that differs from the three others described in the survey.

These current numbers are lower than many would expect, but industry observers might also be surprised by the survey’s findings of projected revenue at risk in the next five years. Even though organizations in all four categories anticipate taking on increased APM-related risk, none of the projected increases were profound.

The comments of one respondent provide some perspective on how organizations view this journey. Donna Littlepage, senior vice president, accountable care strategies, for Carilion Clinic in Roanoke, Virginia, described her organization’s focus on value-based care as a reflection of her organization’s commitment to improving the health of the communities it serves.

“Value-based care prompts us to intervene sooner with our patients to create better outcomes for them and, as a by-product, to avoid unnecessary medical spend,” Littlepage said. “So we are taking on risk in some contracts to receive potential financial rewards to fund the resources we are utilizing to create these results for our patients. At the same time, we must remain aligned to today’s dominant payment models to ensure we can financially afford this work. We must balance the work we are doing and the pace at which we move to risk-based contracts to achieve long-term viability.”

In responding to the survey, Littlepage indicated that Carilion’s revenue at risk amounted to between 0.1% and 3.0% of total revenue. But she noted that the question is somewhat complicated by definitions. “If one looks at payments we receive under these models, it is a very small percentage of the health system’s net revenue. However, if you look at the fee-for-service dollars included in the reconciliation of these contracts, it is more like one third of our net revenue.”

Focus on capabilities required for successful risk contracting

The survey also focused on the capabilities deemed essential to success under risk contracts, along with other considerations around risk contracting. These capabilities included:

- Care coordination across care settings

- Application of business intelligence and analytics to reduce variation in care

- Physician engagement in risk-management activities

- Clinical pathway redesign

Not surprisingly, organizations that have developed and are managing their own networks have the most sophisticated capabilities. And in addition to their tendency to have more revenue at risk in APMs today, they anticipate assuming greater risk than other organizations in the future. Organizations pursuing a “blended model” or participating “only in others’ networks” have less developed capabilities, despite their projections of having almost as much revenue at risk in five years as the first group. This finding suggests organizations in these two groups have a significant gap to close if they are to credibly execute their stated strategy — that is, to provide a lower total cost of care at either the population level (under the blended approach) or the episode level (under either the blended approach or through participation in others’ networks) — and gain volume from other risk-bearing organizations.

Organizations acknowledge the importance of having the aforementioned capabilities to perform this work effectively. Littlepage underscored this point: “We have to be able to understand the attributes of our patient population to proactively address their healthcare needs,” she said. “We have to share that information with providers to enable them to best manage the care of their patients. And we need robust care coordination to spend more time with patients to work with them on self-management of their disease state.”

Littlepage also pointed to one more capability her organization regards as being essential: “A robust system to measure performance is helpful to succeed under risk contracts. We have a system to measure performance of our care coordinators. We measure both the caseload of our care coordinators as well as graduation rates for our attributed members. This allows us to know that what we designed is working effectively.”

Following are some highlights of findings with respect to these essential capabilities.

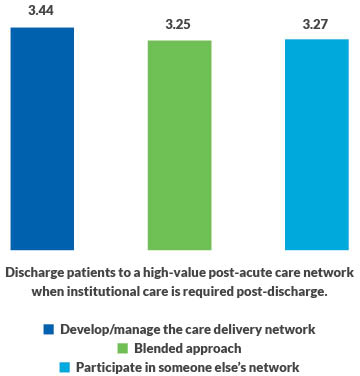

Care coordination. Within each capability examined, respondents were asked to rate their level of competence on a scale of 1 to 5 (with 5 being highest) regarding various aspects of the capability. Again, not surprisingly, organizations that had developed their own networks rated their care coordination capabilities higher on average than did those using the other approaches.

What was surprising, however, was how the three groups rated themselves regarding one key aspect of care coordination: the ability to discharge patients to a high-value post-acute care (PAC) network as necessary. Regarding this capability, the differences in self-ratings among the same three groups were narrower (i.e., 3.44, 3.25 and 3.27, respectively). The closeness of the ratings among the three groups and their relatively low levels were surprising because inefficient use of PAC often represents one of the most significant opportunities to improve outcomes and reduce the cost of care in both bundles and shared savings contracts.b

Care coordination

This finding suggests the journey to value continues to challenge providers no matter where they are on the journey and what their adopted strategy is.

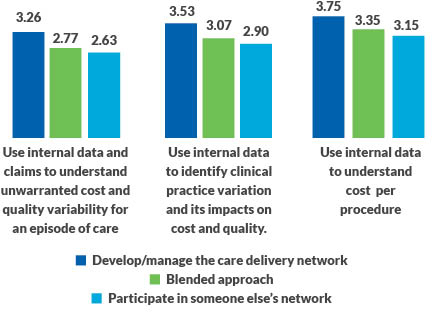

Business intelligence. The survey also uncovered some unexpected findings with respect to how respondents rate their ability to use business intelligence to understand and manage costs of care and to use data to engage physicians in such efforts.

As in almost every other area, organizations managing their own networks rated themselves much higher on business intelligence capabilities than did organizations in other categories. This gap is surprising because having strong business intelligence capabilities is imperative regardless of an organization’s approach to participating in APMs. The findings suggest organizations pursuing a blended model or participating in others’ networks have considerable work to do to achieve the necessary competency in this area.

That said, all respondents (including those managing their own networks) tended to give themselves relatively low ratings in three areas that are key to success under value-based contracts:

- Use of internal and claims data to understand unwarranted cost and variation in quality for episodes of care

- Use of internal data to identify clinical practice variation and its impact of cost and quality

- Use of internal data to understand cost per procedure

Business intelligence and data analytics

The importance of having well-developed competencies in business intelligence cannot be overstated. It is a key to engaging physicians in efforts to address both procedural cost and practice variation. And without engaged physicians, organizations cannot redesign clinical care pathways for high-risk patients, select procedures or redesign care processes within a service line, which are essential capabilities.

“Hospitals taking on more risk-based contracts can take advantage of a growing interest among physicians for data on cost and practice variation,” says GHX’s vice president for healthcare value, Karen Conway. She cited a 2018 study by Lumere, a GHX company, in which the vast majority of specialists (86% to 91%) said such data would improve care quality, while less than half reported that their hospitals were actively pursuing such strategies.[c]

The importance of having well-developed business intelligence capabilities is further underscored by the strong emphasis that organizations that have achieved substantial success under risk contracts place on developing and expanding on these capabilities.

One organization that exemplifies this point is Kaiser Permanente in Oakland, California. Michael Rowe, senior vice president and chief business development and strategic relationships executive, noted that Kaiser’s unique structure — as a health plan with a fully integrated delivery network spanning eight states — enables it to provide exemplary care, with results that routinely exceed those achieved by other organizations that lack full integration as a core driving principle. Kaiser has invested in data integration to the point that even receptionists are able to alert a patient of a need for follow-up care, such as a woman who is late for a mammogram.

Rowe also underscored that Kaiser sees improving its business intelligence and data analytics as an ongoing process, and it is actively exploring developing artificial intelligence and other innovative capabilities.

“We are committed to developing robust capabilities in areas such as AI,” he said. “We have a strong focus on our telehealth and telemedicine capabilities to help us expand our reach and service. And we remain focused on our physical capabilities to meet members’ needs when patients and clinicians need to be in person.”

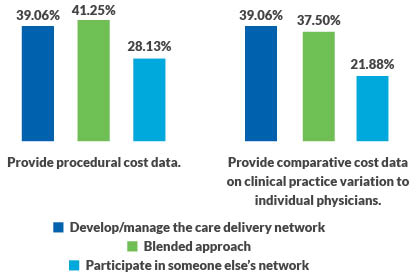

Physician engagement. Survey respondents also were asked whether their physician engagement strategy involved certain tactics for engaging physicians using different types of cost data. Respondents whose organizations are managing their own networks and using a blended approach report providing procedural cost data and practice pattern variance data to engage physicians with similar frequency. However, this tactic is used by a smaller percentage than expected of organizations only participating in someone else’s network.

Physician engagement

These percentages indicate that many organizations have much work to do to develop these capabilities, which all organizations participating in APMs require, regardless of the organizations’ APM strategy.

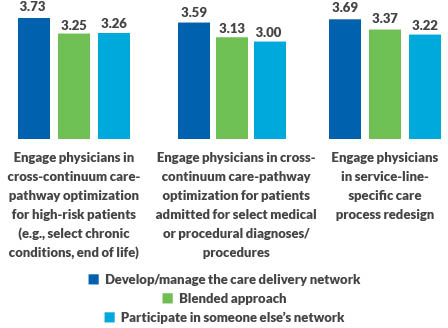

Clinical pathway development. The inability to engage physicians has adverse consequences on an organization’s ability to redesign clinical care pathways. This capability is important, and once again, organizations that manage their own networks are ahead of the pack in having developed it. Yet all groups are lagging in every area of optimizing care processes where clinician engagement is essential.

Clinical pathway redesign

Implications of the survey findings

Regardless of an organization’s strategy, success under risk contracts will remain elusive without the capabilities described here. Organizations partnering with other health plans (either in a blended model or participating in someone else’s network) must be able to offer competitive per unit rates for inpatient and outpatient services to capture share and be able to efficiently manage total cost of care for episodes. The same is true for organizations that have developed their own networks. They must manage cost efficiently to offer the lowest possible rates to their partners so the low costs can be reflected in the premium, leading to increased market share.

About the survey

274 HFMA members participated in the survey

Some large organizations increase (skew) the average number of beds

- Mean number of beds: 1,168

- Median number of beds: 375

- An equal number of organizations have more than 375 beds as have fewer than 375 beds

Mean and median physician counts imply some homogeneity among organizations

- Mean number of physicians: 219

- Median number of physicians: 250

Some large organizations increase (skew) the average net patient service revenue (PSR)

- Mean net patient service revenue: $1,206,934,307

- Median net patient service revenue: $750 million

- An equal number of organizations have more and less than $750 million of net PSR

Footnotes

a. GHX (ghx.com) is a healthcare business and data automation company based in Louisville, Colorado.

b. See, for example, Mulvany, C., “Why PAC Discharge choices are key to success under risk-based payments,” hfm, July 2019.

c. Falk, S., Cherf, J., Schulz, J., Huo, A., “Research: Cost and outcomes in value-based care,” American Association for Physician Leadership, News, Jan. 23, 2019.