Healthcare organizations prepare for sicker patients in 2021 due to deferred care

Healthcare organizations are bracing for a sicker patient population due to pandemic-era disruptions in care, even as they scramble to prevent that outcome.

Providers and health plans are increasingly worried that patients under-treated during the pandemic could re-emerge sicker — and costlier — in 2021.

“Anybody who says that they are not concerned about that is not telling you the truth,” said Humana CMO William Shrank, MD. “This has been the biggest disruption in healthcare delivery in modern history.”

Although emerging 2020 data has shown steep decreases in screenings, tests, imaging and acute case volumes, the effects on the population’s health will not be clear until 2021. But the early data indicate how providers and health plans financially responsible for the health of patients could face challenges.

Robert Fields, MD, senior vice president and CMO of population health for Mount Sinai Health System, has seen trends indicating reduced cancer screening and immunizations. Those were driven by both provider capacity issues and delays or cancellations by consumers fearful of contracting COVID-19. The health system’s ED volumes remain lower than pre-COVID-19 levels.

“So you start to wonder, ‘What happened to all of those heart attacks and strokes and heart failure patients and all of those other presentations we would see from folks with chronic conditions?’” Fields said in an October interview. “They certainly didn’t magically disappear.”

Such patients with acute conditions could be suffering in their homes out of fear of the SARS-CoV-2 virus, where they are ignoring early symptoms “that are going to re-emerge someplace else,” Fields said.

Many providers saw patient volumes rebound after they collapsed during the initial spring wave of the pandemic. By late summer and early fall, many patient volumes had rebounded but remained short of pre-COVID levels. And then smaller volume declines occurred.

“We do still think folks are delaying care out there in some way, either for preventive services or sick services, primarily out of fear,” Fields said.

Fields expects that patient fear will decline if virus levels in surrounding communities remain low, but the virus has broadly resurged going into the winter.

“If we get another wave, the fear will come back, and we’ll see the same patterns again,” Fields said.

He expected many patients wouldn’t return for treatment or preventive services until a vaccine is widely available. The timing of wide availability of SARS-CoV-2 vaccines remains uncertain.

Patient volumes, testing, screening and acute ED patient trends were similar across the country, according to data from more than 900 hospitals tracked by Syntellis. Through September — compared with the same period in 2019 — Syntellis found decreases of:

- 30% for colonoscopies

- 16% for mammograms

- 12.2% for cardiology visits

- 8.6% for endocrinology visits

- 8.4% for oncology visits

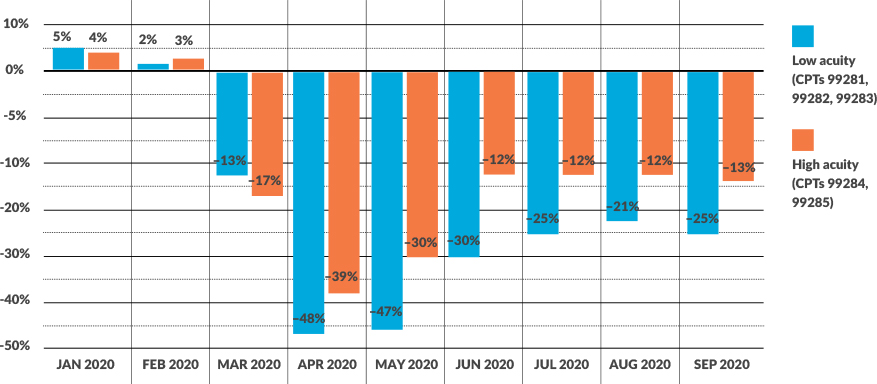

Further, high-acuity ED volumes in September remained 13% lower than they were in September 2019, Syntellis found.

ED visit acuity is shifting as COVID-19 affects volumes

As ED visits have fallen, COVID-19 has caused a shift toward higher-acuity ED visits

“It’s not a pretty picture when you look at those screenings and what it means to their quality scores, the baselines that they will be building plans off into their coming years,” said Steve Wasson, a general manager for Syntellis. “This is going to be a pretty disruptive event — not just from a COVID perspective,” he said, also pointing to the challenges of managing the populations, negotiating contracts and establishing metrics of success.

In addition to widely avoiding screenings and care for major conditions, patients with diagnosed chronic conditions have reduced or stopped needed maintenance care, according to surveys.

For instance, a mid-September consumer survey by PricewaterhouseCoopers, or PwC, found that since March 1:

- One-third of patients overall delayed care

- 56% of patients with multiple complex chronic

conditions delayed care - 45% of patients with cancer delayed care

- 57% of patients delaying care delayed more than half of scheduled care

“That data suggests that the maintenance that you would expect from those with complex chronic, or even [single] chronic conditions are not being rescheduled, and it likely also indicates an increased risk for next year for those doing value-based payment,” said Gurpreet Singh, a partner at PwC.

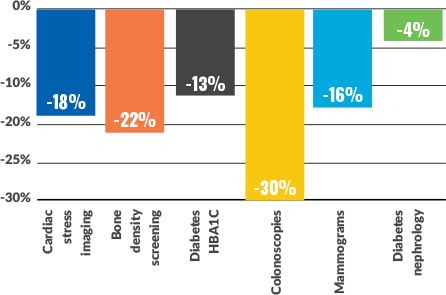

Steep declines in chronic screenings and varying recoveries

Chronic screening declines in 2020 YTD (September) from September 2019 levels

Oncology screenings were still suffering more than visits in the patient funnel in August:

- Diabetes screenings were down 13% year-to-date, versus the same period last year compared to 9% for endocrinology visits as a whole.

- Cardiac stress imaging was down 18% year-to-date, compared to 12% for cardiology visits as a whole.

- While oncology visits decreased 8% year-to-date, mammograms and colonoscopies outpaced oncology visits by decreasing 16% and 30%, respectively.

Mitigating efforts

Both providers and health plans have undertaken extensive efforts throughout 2020 to prevent a broad decline in patient health, especially among those with chronic health conditions.

Geisinger Health Plan has broadly supported an increase in telehealth visits to counter situations where patients were unable or unwilling to seek in-person care. Telehealth visits by plan enrollees increased sharply from less than 1% of visits before the pandemic. Although they dropped off after the spring, by October such visits remained 10% of all visits, said John Bulger, MD, CMO for the health plan.

Mental health televisits have especially increased. But the telehealth expansion did not head off an ongoing 10% to 20% drop in ED volumes at hospitals covered by the health plan or that there were many fewer stroke and heart attack patients. The overall ED reduction contributed to reducing the total cost of care — since some were likely low acuity — but some of the decrease may have resulted in increased morbidity and mortality, Bulger said.

The health plan and Geisinger Health System have tried to reach out to chronically ill patients and those at risk for chronic disease with campaigns to get them to return to care. Other efforts have included hosting virtual town halls, advertising on social media, holding Facebook Live events, reaching out to business leaders and creating remote sites for patients concerned about COVID-19. Other changes included increasing provider payment rates for telehealth and reducing patient copays for virtual care.

The health plan and health system also continued their long-standing strategy to push care closer to home, such as through its Geisinger at Home program, which sends caregivers to homes of high-risk patients with chronic disease to help with management. Other programs continued during the pandemic to bolster patient health included those providing food for people without access to fresh food or to a vehicle or other easy mode of transportation.

“We have a concern of what it is going to look like on the provider and payer side, but we’re trying to mitigate it the best we can,” Bulger said.

Mount Sinai expanded remote monitoring for heart failure and hypertension and is working to expand remote monitoring for more conditions, like diabetes, Fields said. The health system also changed its care management to add broad-based texting, self-screening tools and telecare management. Online screening tools looking for social and clinical signs of deteriorating health can convert to live chat for care management.

“It’s a little different than the traditional care management models,” Fields said. “We’ve had to reinvent how we do it.”

CommonSpirit Health found that when ambulatory care declined during the pandemic, its care coordination enrollment tripled.

“That’s part of our team-based model; when they can’t come in in person, we are thoughtful about who needs to be reached out to early and pro-actively and maintain that connection to care providers,” said Nick Stine, MD, senior vice president of population health for the health system.

The health system has focused on catching up on annual wellness visits for its senior population and on extending the time for comprehensive health risk assessments. Those now include screening for depression, assessing fall risks, determining functional status at home and providing preventive care services. Health plans only recently started paying for the health system’s virtual annual wellness visits.

In 2019, nationally only 15% to 25% of seniors in local markets got virtual or in-person annual wellness visits. The health system is aiming to increase that by five percentage points in each market in which it operates.

“We haven’t really known what to do with the concern about the disruption in the continuity in prevention services, and this gives a nice rallying effort to make sure that we have our virtual capabilities expanded and optimized, in addition to what we’re able to do in person,” Stine said.

The health system is still trying to clarify which patients truly need in-person visits, but it has found that vulnerable and low-income populations are as likely to use virtual healthcare services it offers as is any other population.

For Humana, which has yet to see its enrollees’ visit volumes return to pre-pandemic levels, efforts to spur more to seek needed care include eliminating cost-sharing for telehealth primary care visits and behavioral health visits, sending PPE to enrollees to boost confidence in returning to healthcare settings and sending home preventive testing kits, such as for colon cancer and diabetes screening.

“We’re seeing a return of many of those visits but not quite to the point that we would have expected in the absence of the pandemic,” said Humana’s Shrank.

Value pay effects?

Many public and private health plans operating value-based payment models offered providers wide latitude in 2020, especially protections from downside financial risk. It remains unclear whether any such financial protection for providers in those models will be offered in 2021.

Like many providers, Mount Sinai performed well in the modified 2020 models in which it participates. That is because financial performance in many value-based-care models is driven by utilization, and 2020 utilization “went down pretty dramatically,” Fields said.

“Most of my colleagues in this space believe that in 2021 things are going to re-emerge and probably re-emerge to a greater degree,” Fields said.

The health system is preparing for a 2021 surge in utilization, but that could be delayed until mid-year, depending on distribution time frames for COVID-19 vaccines, he said.

Among the 400,000 lives for which the health system is at varying levels of financial risk, its 2020 outreach has focused on those at highest risk for deterioration. In addition to the increased complexity of outreach and management due to the pandemic, the size of the population at risk has increased because of worsening social determinants, Fields said.

That pool includes those who have lost employer-sponsored insurance and were on the edge of being at risk of chronic disease, as well as a growing Medicaid population, for whom the health system assumes full financial risk.

“So that now changes our risk pool pretty dramatically,” Fields said.

CommonSpirit Health’s 2.6 million lives attributed to value-based payment are roughly divided evenly among Medicaid, Medicare and commercial health plans.

The health system has found capitated models provided some financial cushion during the pandemic, because it was easier to redeploy resources based on patient needs, without requiring billable codes, Stine said. But the health system is not tailoring its outreach to chronically ill patients based on their enrollment in any value-based payment models.

“The premise of those value-based models for us is the more proactive and the more responsive we are to our populations’ needs, that’s the business model and that’s what appeals to us,” Stine said. “It’s such a mission-aligned business model.”

However, the health system sees its Medicaid populations — including capitated arrangements with California Medicaid plans — as experiencing an amplified version of 2020 stresses, including economic struggles, racial inequity stresses, disruptions in schooling and challenges for working parents.

“It only adds to a general concern that we want to be applying efforts to the total population,” Stine said.

Specific model effects

It remains unclear for those tracking value-pay models whether worsening overall patient health will affect financial performance under value-based payment models.

For instance, providers in Medicare accountable care organizations (ACOs) were worried only the sickest would be attributed to them because they were the only ones seeking care early in the pandemic, said Noah Champagne, a consulting actuary for Milliman, which advises ACOs. But ACO providers saw patient volumes in primary care restored quickly through telehealth expansions. By June, most of the ACOs’ primary care provider revenue was restored, although ED care still lagged.

Data lags make it hard to tell if ACO enrollees have gotten sicker from missed care, so ACOs don’t yet know whether their telehealth initiatives have helped or not, Champagne said.

In terms of financial risk, Medicare led commercial health plans in eliminating much of the 2020 downside risk for ACOs. However, it’s unknown whether such latitude will be extended into 2021 and if ACO model risk adjustments would be sufficient to cover the increased morbidity of its patient population, Champagne said.

What’s more concerning for hospitals are the financial ramifications of sicker 2021 populations in Medicare bundled payment programs, said Aisha Pittman, MPH, director of quality policy and analysis for Premier. That fear stems from the episodic design of the bundles, where providers are held accountable for outcomes in short and defined episodes of care that do not allow for long-term management.

“So there is definitely a concern that next year it is going to have an impact on the bundled payment programs and that the cases they are treating are going to have higher comorbidities and [be] at greater risk, which often leads to greater cost across all of the bundled payments,” Pittman said.

But overall, providers in value-based payment models feel confident that they were well prepared for the pandemic challenge because they developed enhanced data analytics, care management, telehealth and aligned networks across the continuum, Pittman said.

“Where they had these systems in place, they were better able to respond and therefore feel like they have a better handle on their populations and [have] been able to manage them,” Pittman said.

Healthcare costs projected to increase

Employer-sponsored health plans are bracing for increased costs in 2021, due to missed care in 2020, said Sunit Patel, chief actuary for Health at Mercer. His company has found 20% fewer diabetes diagnoses occurred through July, as well as “double digit” reductions in diagnoses for cardiovascular disease, asthma and cancers.

“Wrapping it all together, what does that mean, we don’t know because we don’t have the data,” Patel said.

But Mercer’s clinician advisers expect worsening health among patients with chronic conditions will increase their costs 5% to 10% in 2021, he said. That would translate to a 1% to 2% increase in total healthcare costs, which could increase by much as 4%. Emerging vaccines could add another 1% to 2% in total healthcare costs for health plans. The projected increasing costs from worsening health conditions do not include secondary costs, like those from increased accidents or injuries resulting from untreated chronic conditions.

Mercer also has not analyzed the costs in major areas, like cancer, from reduced diagnosis and treatment.

“It’s been disturbing to see how many people are not getting cancer screenings,” Patel said.

Overall, employer-sponsored plans and commercial health plans expect a 4% to 6% increase in costs in 2021.

The only possible offsets to the cost increases are resurgences of COVID-19 driving more enrollees to forgo care or more employment cuts reducing access to more generous private plan coverage.

Patient care data from later in the year could change those projections because a three-month delay in care is much less significant than delays of nine months or longer, Patel said.