Hospitals and health systems remain optimistic, overall, about APMs

The COVID-19 pandemic has been a reminder for the nation’s hospitals and health systems of one of the benefits of value-based payment contract.

The pandemic has reinforced the premise that participating in risk-based alternative payment models (APMs) provides a reliable revenue stream that can protect organizations from unanticipated or uncontrollable declines in fee-for-service [FFS] revenue. Although it may not have prompted hospitals and health systems to accelerate their movement toward increased participation in APMs, it has contributed to the positive rationale for pursuit of such a strategy.

This point was one notable takeaway from a survey conducted by HFMA under sponsorship by GHX in August 2020, investigating the impacts of COVID-19 on healthcare organizations’ strategy for embarking on risk contracts under APMs, such as accountable care organizations (ACOs) and bundled payment.

3 key takeaways from the HFMA-GHX research

- COVID-19 has not dissuaded organizations that had plans to take on more risk prior to the pandemic to alter their plans.

- Value-based payment contracts afford greater protection against revenue disruption during disasters such as COVID-19, which can have a profoundly adverse effect on fee-for-service revenue.

- There is widespread optimism around improving collaboration and cooperation with APM partners (e.g., other hospitals and health systems, physicians, post-acute care providers and supply chain partners) in efforts to succeed under value-based payment.

“COVID-19 has shown us that the fee-for-service model does not serve the community and that current reimbursement trends are unsustainable without participation in APMs in order to share risk,” said Robin Damschroder, MHSA, FACHE, executive vice president and CFO of Henry Ford Health System in Detroit. Damschroder noted that 50% of her organization’s net revenue is in risk and/or value-based contracts, and that compared with FFS, such contracts provide a different and valuable basis for making decisions to get desired quality, safety and experience outcomes.

The benefits of value-based payment relative to FFS also were underscored by a number of respondents within the survey, who variously noted the following:

- COVID-19 has highlighted the risk of traditional volume-based payment.

- There is increased interest in exploring more capitation models in the future.

- Prepaid revenue streams/healthcare plans allow for better care.

- Taking risk protects against volume declines.

The survey also explored organizations’ perspectives regarding coordination and collaboration with various APM partners around efforts to succeed with value-based payment, including:

- Partner hospitals and health systems

- Employed and community physicians

- Post-acute care providers

- Supply chain partners, both internal and externala

Respondents were asked to rate whether coordination and collaboration with each of these partner groups has been worse, somewhat worse, unchanged, somewhat better or much better during the COVID-19 pandemic. They also were asked to rate their expectations for coordination and collaboration along similar lines in five years.

Following are key findings and additional takeaways from this research.

Impact of COVID-19

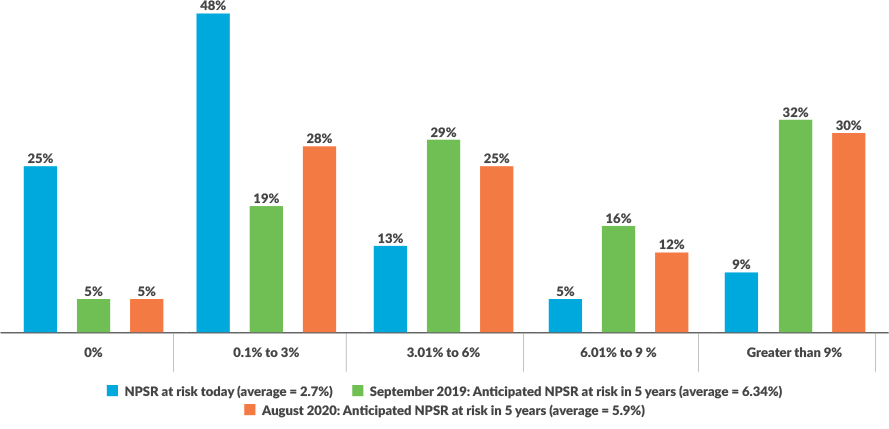

COVID-19 has had a negligible effect on the percentage of revenue survey that respondents project they will have tied to risk contracts in the next five years. The average amount respondents projected would be at risk in five years was 5.9%, compared with an average of 6.35% projected by respondents to an earlier HFMA-GHX survey, conducted prior to the COVID-19 pandemic. This difference of less than 0.5% was offset in the survey findings by other, more favorable outlooks regarding the coordination and collaboration with APM partners that is so essential to success with risk contracts, as described below.

Hospital and health system survey respondents’ percentages of revenue at risk in value-based payment contracts, today and projected in 5 years

Source: HFMA-GHX survey, August 2020

It also bears noting here that, among respondents to the more recent survey, nearly 30% said they anticipate having more than 9% of revenue at risk in five years, while a small percentage (4.5%) said they had no plans to take on risk.

The survey did elicit a diverse range of responses to the question “Have your views, intentions and expectations regarding APMs changed as a result of the COVID-19 pandemic?” Nearly 50% of respondents answered no to this question, while about 20% said yes and about 30% were unsure. Yet these responses showed no statistically significant correlation with responses to any other question in the survey: The “yes,” “no” and “unsure” responses cut across every other grouping, from those with the most revenue at risk to those with the least. It could be that the “yes” response reflected a concern unrelated to risk contracts, such as the severity of COVID-19’s impact on the organizations (e.g., those hit hardest in terms of numbers of cases).

The 5-year outlook is favorable toward risk

Despite the more recent, slightly more conservative average projection of revenue at risk in five years, the survey findings overall indicate organizations have an optimistic outlook toward risk-based contracts and are holding course with their plans from prior to the pandemic. Indeed, some organizations have already taken significant steps in the transition from volume-based to value-based payment.

“We have already invested heavily in moving to value-based care and building out an integrated delivery system,” said Laura Zehm, senior vice president and chief administrative officer, Montage Health in Monterey, California. “We formed an insurance/population health company five years ago, have launched a Medicare Advantage plan and are contracted to partner with commercial insurers on HMO and ACO business. This company is co-owned with our closest competitor. In addition, we have taken our medical group from a few primary care physicians to a 70-physician multispecialty group.”

The survey’s finding of widespread optimism around improving coordination and collaboration with APM partners was a major takeaway, given that such optimism goes hand in hand with a positive outlook regarding risk contracts in general. This optimistic outlook becomes apparent when one compares responses regarding the immediate effects of COVID-19 on coordination and collaboration with APM partners with responses regarding expectations for such coordination and collaboration in five years.

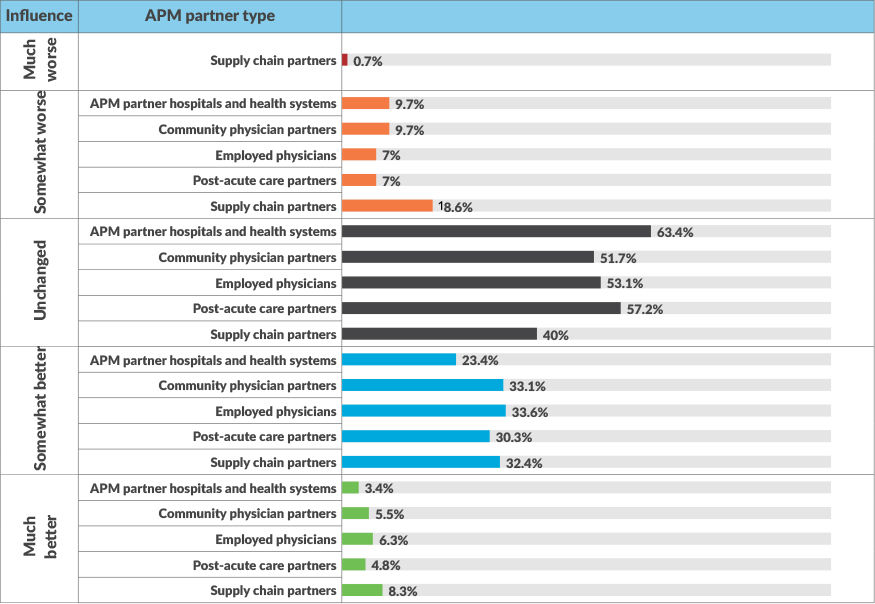

Immediate impact of COVID-19. The majority of respondents indicated coordination and collaboration between organizations and their various partners in APMs have remained unchanged or improved somewhat during the COVID-19 pandemic. These two outlooks represented roughly 85% to 87% of responses regarding all partner groups besides supply chain partners, where about 72% of respondents expressed these outlooks (see the exhibit below).

To what degree has coordination and collaboration on alternate payment models (APMs) been influenced by the COVID-19 pandemic?

The only partner group where coordination and collaboration were seen by anyone to be “much worse” was supply chain partners, although the percentage was small (0.7%). Another 18.6% ranked such relationships as somewhat worse. However, these percentages could very well reflect challenges around accessing adequate supplies of personal protective equipment during the pandemic — a problem that many organizations experienced acutely in the early days of the pandemic. On the other hand, 40.7% of respondents rank relationships with supply chain partners as somewhat or much better, higher than other APM groups. The survey also noted increasing interest among finance executives in outcomes-based contracting with manufacturers, in which the prices paid for products are determined in part by the actual performance of the product.

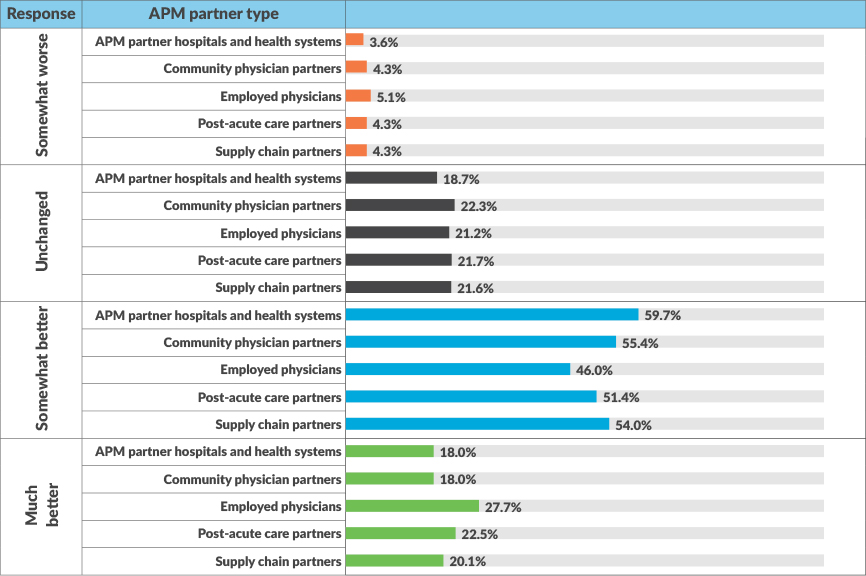

Expectations for five years from now. The overarching pattern among responses between today and five years from now is that coordination and collaboration with APM partners will improve, and this optimism applies to every APM partner group. Roughly between 73% and 78% of respondents believe they will see improved coordination and collaboration with every group, which bodes well for success under risk-based contracts. This level of optimism also suggests organizations will take steps to actively promote engagement with APM partners, such as sharing data and information, increasing transparency and providing partners (and physicians, in particular) with leadership roles in developing and guiding the value-focused strategy.

To what degree do you expect current levels of coordination and collaboration on alternate payment models (APMs) to change in the next 5 years?

Moreover, there is no sense that COVID-19 will be the driving factor in this trend. The implication is that, once the nation has recovered from COVID-19, organizations will move ahead deliberately in their plans to take on risk.

“We believe our relationships with APM partners will continue to improve because the pressure to reduce the overall total cost of care for people that we provide care to is only going to increase,” said James Dietsche, CFO and COO of Bellin Health System in Green Bay, Wisconsin. “This means that individuals, businesses and governmental payers like Medicare and state Medicaid programs are trying to balance their budgets and cannot afford the level of increases for healthcare that have been experienced in the past.”

In describing Bellin Health’s response, Dietsche pointed to the actions his organization has taken with physician groups and with other healthcare delivery systems, including Holy Family Memorial, which is a member of the organization’s ACO, Bellin Health Partners.

“They have experienced the positive results achieved in improving the overall quality of care delivery combined with financial success experienced with pay-for-performance programs,” Dietsche said.

Post-acute care partners play an important role in Bellin Health’s strategy.

“As with most regions across our nation, we are experiencing the aging of the “baby-boomers,” Dietsche noted. “And certainly as we age, we see the total costs of care escalate significantly. Our evaluation of our data has also shown a significant increase for Medicare patients who end up hospitalized for an event and need a recovery stay within a skilled nursing facility. We have found significant variation in the length of stay among the skilled nursing facilities that we discharge patients to. As a result, we have developed ‘strategic partnerships’ with some of the skilled nursing facilities within our region to work on operational improvement to rehabilitate those patients and support their clinical care to reduce the skilled nursing facility length of stay and improve the quality of life for the individual.”

Zehm underscored the importance of Montage Health’s APM partnership on an insurance/population health company, which, as noted previously, it co-owns with its closest competitor.

“Running a successful MA program requires improvements in all areas — medical management, member engagement, risk score documentation, Stars measure/HEDIS, increasing membership, optimal premium structure, to name the most obvious, among others,” Zehm said.

Correlation of optimism with amount of revenue at risk

One finding that perhaps is not surprising is the apparent correlation between respondents’ levels of optimism regarding improved coordination and collaboration with APM partners and their revenue at risk (both current and five-year projections).

In two instances, the correlation between projected revenue in five years and optimism around improved coordination and collaboration was statistically significant: Among organizations that anticipate much better coordination and collaboration with APM-partner hospitals and health systems and with post-acute care partners, projected percentages of revenue at risk were 7.6% and 7.8%, respectively. Meanwhile, the projected percentages of revenue at risk were 3.6% and 4.0%, respectively, among organizations that anticipated somewhat worse levels of coordination and collaboration.

Correlation of outlook for employed physicians with outlook for supply chain partners

An additional statistically significant correlation bears mentioning: The survey found that respondents’ common belief that coordination and collaboration with physicians is better during COVID-19 and will improve in five years goes hand in hand with a similarly positive outlook regarding coordination and collaboration with supply chain partners, as shown in the exhibit below.

Correlation of responses regarding current and 5-year expectations for coordination and collaboration with employed physicians with responses regarding 5-year expectations for supply chain partners

|

Respondents projections of coordination and collaboration with supply chain partners in 5 years |

Coordination and collaboration with employed physicians today as a result of COVID-19 | |||

|

|

Somewhat worse |

Unchanged |

Somewhat better |

Much better |

|

Worse |

3.91% |

7.03% |

0.76% |

|

|

The same |

3.13% |

25.78% |

7.81% |

3.13% |

|

Better |

|

|

24.22% |

2.34% |

|

|

Coordination and collaboration with employed physicians in 5 years | |||

|

Worse |

3.15% |

2.36% |

2.36% |

3.15% |

|

The same |

0.79% |

13.39% |

21.26% |

5.51% |

|

Better |

1.57% |

7.09% |

22.83% |

16.54% |

This correlation aligns with the idea that risk-based payment models have a strong tendency to promote the formation of a triadic relationship among physicians, supply chain organizations and finance. Such approaches create the opportunity not only to reduce the cost of care for discrete procedures/services, but also to gainshare the internal savings with physicians.b

How might this relationship develop and why? As organizations become more successful under risk-based contracts, they will see increased physician engagement in working with finance to reduce variation, including in supplies used. Physicians bring their clinical knowledge and perspective to bear in guiding sourcing decisions, while financial and internal supply chain executives will play key roles in negotiating prices and contracts with external supply chain partners. Such three-way coordination and collaboration will be an essential ingredient in any successful venture into value-based payment.

In prior research conducted by Lumere, a GHX company, physicians said they believe having increased access to data on clinical variation and costs would improve the quality of care delivered.c

Karen Conway, vice president of healthcare value for GHX, underscored the important role the supply chain can play in supporting clinical efforts to redesign care based on evidence about what improves quality.

“Beyond the price of products, the supply chain can provide data on variation in both the supply choices made by physicians and the impacts on quality and financial metrics, such as complication rates, procedural time and length of stay,” Conway said. “Physicians, in turn, can make decisions that improve quality, which can result in lower total costs of care by reducing hospital-acquired conditions and unplanned readmissions.”

Concluding observation

The fact that the survey findings clearly suggest COVID-19 will have no long-term effect on organizations’ appetite for risk is telling, if only to suggest that organizations with ongoing plans to build on their plans to pursue risk-based contracts seem solidly committed to this course.

This conclusion is supported by the survey’s finding that the substantial majority of respondents anticipate increased coordination and collaboration among their APM partners toward success with risk contracts, which would not likely occur without deliberate actions by the respondents’ organizations toward promoting such an outcome.

“Developing the capability to successfully manage risk under alternative payment systems, is, in my view, the only way to address the rising healthcare costs,” Zehm said. “My perspective is that some commercial insurers are reverting to fighting with providers over fee-for-service rates. This will never address the underlying cause of the increasing cost of healthcare, which is the overutilization of expensive services. The overutilization is occurring because there is a lack of integration between sick care, wellness, social determinants of health and disease management, not because of bad actors. We either work together, or our U.S. employers will find another way, and we will all pay the price.”

Footnotes

a. Supply chain partners here include both internal supply chain leaders, and external partners, such as suppliers, manufacturers and group purchasing organizations.

b. See, for example, Long, A., and Senn, G., “Hospitals need engaged physicians to manage supply preferences,” HFMA Financial Sustainability Report, April 2020.

c. Falk, S., Cherf, J., Schulz ,J., Huo, A., “Cost and outcomes in value-based care,” Physician Leadership Journal, Jan. 13, 2019.

Effect of health plan ownership on plans to take on risk

The survey conducted by HFMA and GHX in August found that healthcare organizations that own a health plan are more inclined to take on risk. The difference between the projected amount at risk in five years was statistically different between organizations that own a health plan and those that do not, with averages of 7.3% versus 4.3% of revenue at risk, respectively. This finding does not answer the question of which came first, the decision to pursue risk contracts or the decision to acquire a health plan.