Following the COVID-19 liquidity crisis, lines of credit should get a fresh look

Healthcare organizations’ finance and treasury leaders should consider the role of a line of credit as part of a global resource allocation effort.

In the face of widespread shutdowns and heightened market uncertainty in the early months of the COVID-19 pandemic, many hospitals and health systems secured commitments to lines of credit to ensure they would have adequate liquidity to respond to widespread pandemic-related revenue dislocations. This initial period of disruption saw a range of line utilization strategies, with variations in facility sizing and in drawn or undrawn status. With the liquidity crisis behind us, should health systems now trim back on credit lines or shift their utilization strategy? To answer this question, health system leaders must consider the credit line’s purpose in a greater context.

The credit line’s larger purpose

A line of credit is a resource-enhancing strategy wherein an organization pays a commitment fee plus undrawn or drawn fees to access supplemental liquidity from a commercial bank provider. For most organizations, a line offers the prospect of leveraging available cash, ideally coordinated with an organization’s other resources, including working capital, long-term investments, debt capacity and cash flows. Employing a line of credit is a decision involving the total balance sheet that must integrate several concerns.

Traditionally, organizations maintain lines for times when they do not have enough cash or unrestricted liquidity resources to effectively manage operating cash flow variability. In such a case, the line of credit has a clear functional role and the focus should be on transactional characteristics such as amount, tenor and fees.

For organizations that have enough cash and liquidity, the focus shifts to the strategic rationale for the line and how this external resource works in combination with internal resources to enhance the organization’s total risk-return profile.

Today’s environment poses several challenges to organizations seeking to strike an optimized balance between responding to operating/strategic risks and headwinds and pursuing return. Resources — specifically unrestricted cash and investments — that can serve as a throttle in managing this risk-return balance are particularly valuable in this environment; and resources such as lines of credit that can introduce prudent leverage into the equation can add value by freeing cash and investments to prioritize the pursuit of return.

Thus, a line of credit’s role is less about a debt-financing decision in isolation and more about holistic financial management that extends into optimizing cash and investment substrategies.

A line of credit is not a substitute for cash and investments. But it may enable better stewardship of those resources when applied in the context of a broader resource management plan.

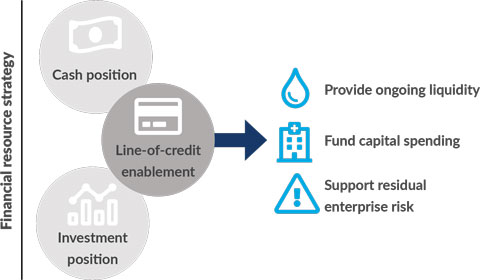

The role of the line of credit in an organization’s financial resource strategy

How a line of credit can be used

An organization might consider using its line of credit to address varying cash demands typically reserved for financial resources, including the following.

Providing ongoing liquidity. Under this commonplace use of a line of credit, organizations hold a limited amount of operating cash to cover recurring items and rely on the line of credit to address irregular draws, when needed. This approach frees resources that would have been playing a “liquidity-first” role to move into less-liquid, higher-returning strategies.

Funding capital spending. Under this approach, a line of credit is used to address the interplay of cash management and capital spending by smoothing cash needed so it is not subject to investment inefficiency while waiting to be spent. Effectively, the line is used to fill a long-term financing bucket that gets drained from a longer-term financing when enough need is aggregated. For those familiar with tax law, lines of credit allow organizations to lock in board-approved tax-exempt qualifying expenditures for later tax-exempt refinancing with new money without worry of expiring.

Supporting residual enterprise risk. Lines of credit also can serve as a backstop to hedging residual enterprise risks. Total resource deployment should always be informed by an organization’s risk position, with the goal of achieving balance. Ordinarily, organizations would ensure a suitably sized “resiliency” segment of cash and investments to provide this needed backstop. Having a line of credit to partially fill this role could allow them to redeploy investments into strategies that can generate more return, even if they also carry increased illiquidity.

How to ensure the line of credit is there when needed

Although unfunded lines of credit are generally an easily accessible and reliable option, organizations should consider several factors before committing to use of credit lines as a backstop to actualized resources. The intended support use of the credit line will affect how organizations weigh these factors and determine whether the line of credit will fulfill its intended use.

Reliability. Once a bank has committed to a line of credit, it is difficult to revoke the line. Generally, it can be revoked only upon maturity of the facility or if the borrower misses a payment or defaults. Borrowers relying on credit lines as a backstop should keep a close eye on maturity dates and ensure that lines are renewed before they expire. Borrowers should understand methods to access the line and timing requirements of the draw: For example, is it necessary to speak to a banker on the phone, or is it enough to simply submit a written request?

Terms. Key considerations include the length and pricing of the commitment. Lines of credit usually have a term of several years, although credit lines secured early in 2020 may have had a shorter maturity (e.g., one year) and a higher commitment fee. Organizations that secured shorter-term credit lines may want to explore the possibility of renegotiating the terms.

Sizing. Lines of credit are designed to cover short-term gaps in liquidity; they must be repaid over a relatively short period of time or replaced with longer-term debt. This consideration should be a key factor in determining the appropriate size of the credit line. Organizations also should have planned exit strategies for repaying or replacing the liability when they do draw on a line.

Carrying costs. The commitment fee is the primary carrying cost for a line of credit and will vary depending on the terms and size of the line. While not insignificant, the commitment fee can also be seen as insurance against unanticipated demands on resources.

Credit rating. An unexpected event that requires a draw on a line of credit may adversely affect an organization’s credit rating, depending on factors such as the size, duration and cause of the event. The liquidity available from a committed credit line may help mitigate the impact. But again, it is important to have a clear exit strategy from the liability resulting from a draw that can be communicated to rating agencies.

A stewardship consideration

For many organizations, it is time to reevaluate whether a line of credit has a role in their total resource formation strategy. By taking an integrated approach that considers their credit lines’ utility beyond a compartmentalized focus on debt or cash management, hospital and health system finance and treasury leaders may find that the lines can promote better stewardship of resources across the balance sheet and enhance the organizations’ total risk-return profile. In an environment marked by routine disruption, it is worth taking a fresh look at an old idea.