Allocating capital to medical technology in the age of value-based payment

- Medical technology has been identified as one of the leading causes of rising healthcare costs.

- While the traditional equation for calculating risk-return for capital expenditures yields valuable insight, it fails to explicitly identify the fundamental drivers of value and risk in a value-based payment environment.

- Conducting an extensive technology assessment helps healthcare organizations consider multiple criteria to help inform practical investment decisions.

Medical technology has led to gains in quality and quantity of life; however, it has also been identified as one of the leading causes of the rising cost of healthcare (Jessup, A., Health Care Cost Containment and Medical Innovation, Office of Science and Data Policy, Office of the Assistant Secretary for Planning and Evaluation, U.S. Department of Health and Human Services).

The acquisition of high-cost medical devices and equipment requires more extensive ROI analyses than traditional finance-based methods decision-makers use to determine if assets create value.

Ideally, the shift from fee-for-service (FSS) to value-based payment causes hospital decision-makers to blend the notion of value with a patient outcomes-based perspective of value. This will encourage a comprehensive approach to allocating capital that supports value creation.

Traditional finance-based perspective

Many hospitals have adopted a corporate finance methodology to investing in medical technology. To pursue investment opportunities, hospitals need access to capital, which often comes from external sources such as equity and/or debt investors. In exchange for supplying capital, investors expect ROI. This expected return is a function of the investment risk. It also represents a cost of capital to the organization that receives the funds.

The following equation shows the basic investment risk-return relationship and it also reveals the simplified formula for determining an organization’s cost of capital. Where E(Ri) is an investor’s expected return, Rf is the risk-free rate of return and RPi is the risk premium (Pratt, S., Cost of Capital, John Wiley & Sons, Inc., 2014, Chapter 6, iBooks).

E(Ri) = Rf + RPi

The Rf is the minimum rate of return required to compensate investors for the time value of money. It takes into consideration expected inflation and the corresponding diminishing purchasing power of the dollar (Peterson, P., Fabozzi, F., Capital Budgeting: Theory and Practice, John Wiley & Sons, Inc., 2002).

The risk-free rate is often determined based on the interest rate set for government-backed treasury bonds. The risk premium, RPi, compensates investors for the risk associated with when and how much cash flow will be received from an investment. (Pratt, Cost of Capital, Chapter 6). Thus, if an investment is deemed risky due to the uncertainty surrounding its future cash flows, investors will place a higher risk premium on the investment and in turn expect a higher rate of return.

Cost of capital and the value of an asset

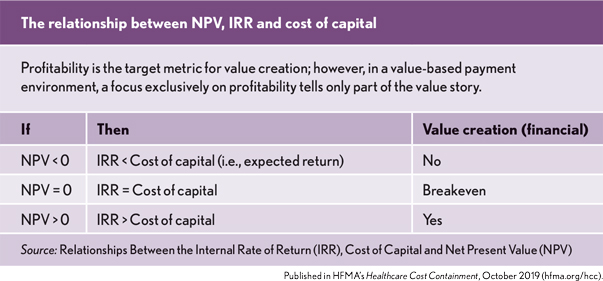

Cost of capital is an important corporate finance concept. It is the hook from which the value of an asset hangs. Two of the primary measures that are used to determine if value has been created are net present value (NPV) and internal rate of return (IRR). These metrics use the cost of capital to help ascertain the return generated over the life of an asset (Nowicki, M., “Determining the Value of a Capital Expense,” Leadership newsletter, HFMA, July, 2014).

The NPV expresses an asset’s profitability in dollars and is defined as the present value of future cash flows generated by an asset minus the initial cost of the asset. Cash flows are discounted to a present value via the organization’s cost of capital. Relatedly, IRR expresses profitability as a percentage and reflects the minimum rate of return required to achieve breakeven. It is the return that makes the NPV of an investment equal to zero. Thus, from this perspective, value is created when an asset generates a positive NPV and/or its IRR exceeds the organization’s cost of capital.

Patient-outcomes-based perspective

While the traditional risk-return relationship highlighted in the equation above yields valuable insight, it fails to explicitly identify the fundamental drivers of value and risk in a value-based payment environment. Healthcare policymakers are increasingly interested in a concept of value that links payment for healthcare services to improvements in patient outcomes at the lowest possible cost of care. Considering this extended notion of value, it is neither enough nor insightful to prioritize medical technology investment decisions based solely on the traditional corporate finance risk-return relationship. Although the traditional relationship accounts for certain types of market and project-specific risks, it does not explicitly analyze the risks associated with how cash flows are impacted by whether a technology improves patient outcomes at the lowest possible cost of care.

Under the FFS payment system, hospitals and health systems could more easily afford to adopt technologies without explicitly evaluating their impact on patient outcomes. However, as hospitals are increasingly being paid via value-based payment methods, capital allocated to medical technology based on the traditional corporate finance risk-return model will fail to capture the complete risk-return profile of the investment opportunity. As value-based payment and risk-bearing contracts become more prevalent, hospital leaders will be incentivized to broaden their analytical toolbox to incorporate methods that provide increased transparency and evidence into whether a technology adds value by improving patient outcomes at the lowest possible cost of care.

There is evidence that hospitals are responding to the new economic realities imposed by a changing payment system. One example is the development and implementation of hospital value-analysis committees. These are multi-disciplinary committees that utilize standard processes, data and evidence-based methodologies to determine the safety and value of new medical products and services (Premier, Value Analysis Guide, 2nd ed.).

Value-analysis versus healthcare technology assessment

Extensive health technology assessments (HTAs) take the concept of value analysis a step further. Although the HTA process is similar to value analysis, it is viewed as a more systematic and methodologically rigorous analytical tool.

HTA considers multiple criteria to help inform practical investment decisions, and they are conducted with the specific intent of evaluating and synthesizing the clinical benefits, risks, costs and comparative effectiveness of medical technologies, interventions

and practices (del Llano-Senaris, J., Campillo-Artero, C., Health Technology Assessment and Health Policy Today: A Multifaceted View of Their Unstable Crossroads, Springer, 2015).

The International Network of Agencies for HTA, 2014, identifies the formal objectives of HTA as follows (Hopkins, R., Goeree, R., Health Technology Assessment: Using Biostatistics to Break the Barriers of Adopting New Medicines, CRC Press, 2015):

- Identify evidence, or lack of evidence, on health intervention costs and benefits.

- Synthesize health research findings about the effectiveness of different health interventions.

- Evaluate the cost and cost-effectiveness of health technologies.

- Appraise social and ethical implications of the diffusion and use of health technologies and their organizational implications.

- Identify best practices in healthcare.

While the primary developers and users of HTAs are government and commercial payers, hospital decision-makers also need to be armed with increasingly sophisticated tools to help them make more evidenced-based decisions on how to allocate capital to medical technology. Therefore, hospital-based health technology assessment (HB-HTA) was developed to help tailor the context of HTA to the hospital environment. HB-HTA is a focused type of technology assessment with the specific purpose of assisting hospital leaders with making value-based technology investment decisions (Sampietro-Colom, L., Martin, J., Hospital-Based Health Technology Assessment: The Next Frontier for Health Technology Assessment, Springer, 2015).

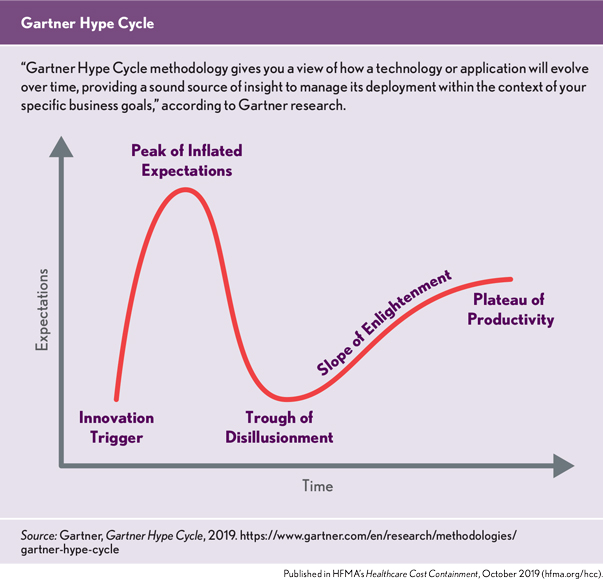

Hospitals need these tools to manage the array of new medical technologies. Many innovations have improved patient life expectancy and quality of life. However, there are a growing number of new technologies that claim these benefits at higher prices, but are supported by limited evidence. Compounding this problem is the awareness that some hospital decision-makers are influenced by the Gartner Hype Cycle, (Sampietro-Colom, L., Martin, J., Hospital-Based Health Technology Assessment: The Next Frontier for Health Technology Assessment, Springer, 2015), which suggests that technology expectations follow five key phases over a product’s life cycle (Gartner Inc., Gartner Hype Cycle, 2019).

According to Gartner: “Each Hype Cycle drills down into the five key phases of a technology’s life cycle.

Innovation trigger. A potential technology breakthrough kicks things off. Early proof-of-concept stories and media interest trigger significant publicity. Often no usable products exist and commercial viability is unproven.

Peak of inflated expectations. Early publicity produces a number of success stories — often accompanied by scores of failures. Some companies take action; many do not.

Trough of disillusionment. Interest wanes as experiments and implementations fail to deliver. Producers of the technology shake out or fail. Investments continue only if the surviving providers improve their products to the satisfaction of early adopters.

Slope of enlightenment. More instances of how the technology can benefit the enterprise start to crystallize and become more widely understood. Second- and third-generation products appear from technology providers. More enterprises fund pilots; conservative companies remain cautious.

Plateau of productivity. Mainstream adoption starts to take off. Criteria for assessing provider viability are more clearly defined. The technology’s broad market applicability and relevance are clearly paying off.”

Thus, it has been suggested by the authors of Hospital-Based Health Technology Assessment that another benefit of implementing an HB-HTA is to help manage the hype cycle by controlling expectations and shortening the time period from innovation trigger to plateau of productivity (Sampietro-Colom, Hospital-Based Health Technology Assessment, Springer).

Comprehensive perspective

To gain a more comprehensive understanding of the risk-return profile of a medical technology and to minimize the impact of the technology hype cycle, it is my belief that it would be prudent for hospital decision-makers to formally imbed the evidence generated from value analysis or HB-HTA into the capital allocation evaluation process.

The standard risk-return equation (see page 5) conveys the expected return and cost of capital as a function of the risk-free rate of return and risk premium. Baked into this formula is the cost of capital for the overall health system or hospital. (Louis C. Gapenski, Financial Analysis & Decision Making for Healthcare Organizations, Irwin, 1996).

However, the organization-wide cost of capital figure may not account for the unique evidence risk associated with investing in medical technology in a value-based reimbursement environment.

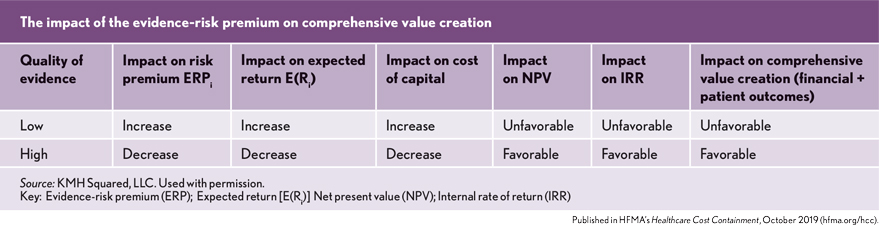

One way to account for this risk is to add an explicit risk premium, which can be thought of as an evidence-risk premium, to the organization’s standard cost of capital calculation. This is done to gain a more comprehensive risk-return assessment. An evidence-risk premium would reflect the results of value analysis or HB-HTA by revealing the level, quality and strength of evidence that supports the clinical and economic effectiveness of the technology. This evidence premium would have a direct impact on the expected return, cost of capital and discount rate used in medical technology investment valuation. The following equation is an example of how an evidence-risk premium (ERPi) would modify the traditional risk-return equation.

E(Ri) = Rf + RPi + ERPi

The intuition behind this formula is that an investment in medical technology that is supported by low-quality evidence would necessitate a higher-evidence risk premium (ERPi). Conversely, technology that is supported by high-quality evidence would require a lower ERPi.

It is acknowledged that adding an evidence-risk premium is a highly subjective exercise. However, the argument for the addition of an evidence-risk premium is that an evaluation of the clinical and economic evidence supporting the effectiveness of medical technology should be explicitly accounted for when assessing the cash flow risk of investing in medical technology.

In an FFS payment environment, the traditional corporate finance risk-return relationship serves as a good framework for determining the value derived from allocating capital to medical technology. However, as policymakers seek to transform healthcare from a volume-driven system to a value-based system based on improved patient outcomes at the lowest possible cost of care, decision-makers will need to place more emphasis on the level, quality and strength of clinical evidence that supports medical technology value propositions.