Safety net hospitals could see increase in payments if CMS updates estimates of uninsured in 2021 IPPS final rule

- Using data from the CMS Office of the Actuary, the uninsured rate in the 2021 IPPS proposed rule is 9.5%.

- That estimate is likely low given the economic impact of COVID-19 and the resulting spike in unemployment.

- If CMS updates its estimate of the 2021 uninsured rate in the final rule it could increase UC DSH payments to eligible providers significantly.

A bit of background is required before I get into the main topic of this post, which is how the dollars available for allocation to eligible safety net hospitals is the product of two national factors.

After passage of the ACA, 25% of DSH payments are considered traditional. These are paid by multiplying the Medicare DRG payment times an adjustment factor that includes the difference between the disproportionate patient percentage and the DSH qualifying threshold.

The other 75%, Uncompensated Care (UC) DSH, is based on two national factors — the topic of this post — and a third hospital-specific factor of how much indigent care a hospital provides relative to all other hospitals. The rationale for this is that post-ACA coverage would expand, and the uninsured population and the need for Medicare to provide safety net hospitals with additional indigent care payments would decrease.

Two national factors

Factor one. Factor one is what CMS projects 75% of Medicare Disproportionate Share (DSH) payments to hospitals will be in 2021.

Factor two. Factor two is one minus the change in the rate of uninsured from pre-ACA to the current year. You multiply those two numbers together, and you get the pool of dollars that are allocated to DSH-eligible hospitals based on the relative amount of uncompensated care they have provided during the fiscal year. So if in a given year, the rate of uninsured is 40% lower than what it was pre-ACA, then the UC DSH pool is reduced by 40%.

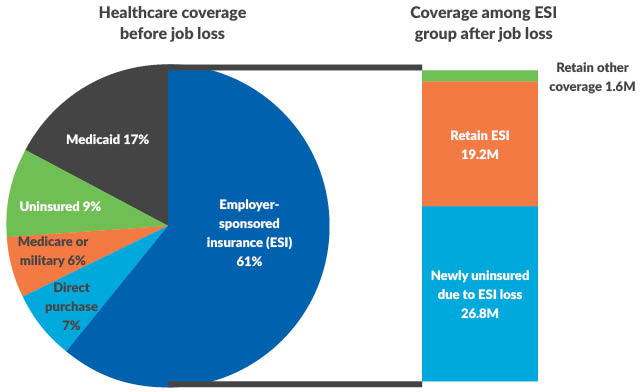

In the 2021 IPPS proposed rule, factor one is $11.519 billion. So little changes in factor two are important. The proposed rule estimates, using data from the CMS Office of the Actuary, the uninsured rate for federal fiscal 2021 is 9.5%. If that estimate of the uninsured rate seems low to you, it’s because the estimate was generated prior to COVD-19 economic downturn, which has resulted in at least 26.8 million individuals losing their job-related health insurance. By January 2021 — squarely in the middle of next FFY — of those 26.8 million, 23 million are eligible for Medicaid or exchange coverage. The remaining 3.8 million individuals are ineligible for Medicaid or the exchanges for a variety of reasons.

Health insurance coverage before and after job loss among people in a family experiencing job loss as of May 2, 2020

Notes: “Retain Other Coverage” refers to individuals holding multiple sources of coverage prior to family job loss. “Retain ESI” refers to individuals in families with multiple workers accessing ESI through separate employment-based policies.

Source: Garfield, R., Claxton, G., Damico, A., and Levitt, L., KFF online, “Eligibility for ACA Health Coverage Following Job Loss,” May 13, 2020, accessed June 8, 2020.

As an illustrative example (Exhibit I, below), let’s assume (probably optimistically) that 75% of those eligible for Medicaid or exchange coverage actually enroll, which still leaves another 5.75 million uninsured who could have a source of coverage. In total, the uninsured population increases by 9.55 million or 2.9% of the total U.S. population of 330 million.

Exhibit I: Estimated increase in U.S. uninsured population

| Individuals millions | Uninsured in Jan 2021 – Individuals millions | |

| Ineligible for Exchange/Medicaid Citizenship | 0.5 | |

| ESI | 0.5 | |

| Income | 0.9 | |

| Coverage gap | 1.9 | |

| 3.80 | ||

| Exchange eligible (assumes 75% uptake) | 6.2 | 1.55 |

| Medicaid (assumes 75% uptake) | 16.8 | 4.2 |

| Total increase | 9.55 | |

| 2020 U.S. population | 331 | |

| Percentage | 2.89% |

What happens if you add the additional 2.9% of the population that I’m assuming for purposes of the example will be uninsured in January 2021 to the OACT’s 9.5% pre-COVID estimate and recalculate the UC DSH pool available for distribution to eligible providers?

Exhibit II: Estimated increase in U.S. DSH pool available for allocation

| 2021 Proposed IPPS Rule | Estimated Based on Increase in Uninsured | |

| Current | 9.50% | 12.39% |

| Pre-ACA | 14.00% | 14.00% |

| Difference | -4.50% | -1.61% |

| Percentage change | -32.14% | -11.53% |

| Factor 2 | 67.86% | 88.47% |

| Factor 1 | $11,519,000,000 | $11,519,000,000 |

| UC DSH pool | $7,816,464,286 | $10,190,362,646 |

| Estimated increase | $2,373,898,360 | |

| Percent increase | 30.37% |

Takeaway

It increases significantly — about $2.37 billion or a 30.4% increase in the size of the pool compared to the proposed rule. While the actual numbers will vary based on the uninsured rate CMS uses in the final rule, the important point is: A small percentage point increase in the uninsured rate will have a big impact on the dollars available to safety net hospitals at a time when they are financially struggling due to COVID-19.

HFMA, along with other associations, will ask CMS to update its estimates of the uninsured in its comments on the proposed rule. It would behoove hospitals to submit comments and ask the same.