How to get a handle on Medicare bad debt

- Recovery of Medicare bad debt is a significant revenue opportunity for many hospitals; however, CMS has stringent rules and reporting requirements to realize this revenue.

- Patient financial responsibility represents more than 30% of a hospital’s annual revenues.

- When tackling uncompensated care, specifically as it relates to Medicare bad debt, it is important to address the problem holistically, to ensure all your earned revenue is realized.

Healthcare is becoming increasingly unaffordable to many, and patient bad debt is an escalating issue. Although many people struggle to pay for healthcare, the issue is particularly prevalent among Medicare beneficiaries, who are often retired and on a fixed income.

Consider that patient financial responsibility represents more than 30% of a hospital’s annual revenues, primarily because of expanded numbers of patients having high-deductible health plans. (DARK Daily, Sept. 22, 2017).

Each year, hospitals claim more than $3 billion dollars in Medicare bad debts on their cost reports, representing about 15% of Medicare recipients’ out-of-pocket responsibility (Cost Reports HCRIS data, CMS.gov). This is a significant source of revenue leakage for hospitals, one that is often inadequately addressed.

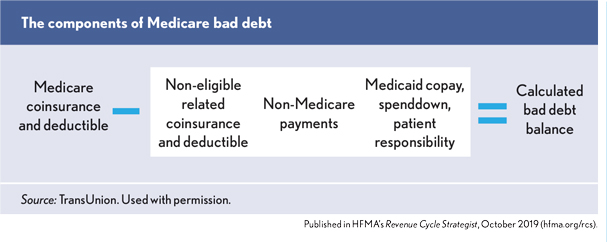

Medicare bad debt is defined as Medicare coinsurance and deductible amounts that are unpaid and uncollectable from the patient.

The Centers for Medicare and Medicaid Services (CMS) pays hospitals 65% of their gross Medicare bad debt if the documentation is in place to demonstrate appropriate collection efforts and the patient’s inability to pay (Acute Care hospital inpatient Prospective Payment System, CMS.gov, February 2019).

The Notice of Program Reimbursement (NPR) is the finalization of the cost report and occurs after a Medicare Administrative Contractor (MAC) audits and/or reviews the cost report submission. Hospitals have three years from the date of the NPR to ask the MAC to re-open the cost report for further reimbursement or correction of errors. MACs can deny this re-opening request at their discretion. The current trend is that many MACs are denying re-opening requests.

Challenges collecting Medicare bad debt

Recovery of Medicare bad debt is a significant revenue opportunity for many hospitals. However, CMS has stringent rules and reporting requirements to realize this revenue. To accurately and efficiently identify accounts and dollar amounts eligible for Medicare bad debt, large amounts of complex and disparate data sets need to be aggregated. Unfortunately, many hospitals lack the internal resources and technology to correctly determine eligible Medicare-bad-debt payment, or they rely on inaccurate internal reports. As such, hospitals spend a lot of time manually identifying accounts.

If hospitals are under-claiming relative to their peer groups, they are likely leaving money on the table. Internal reporting processes are highly dependent on accuracy of financial transaction data obtained from the patient accounting system. Although many hospitals struggle with inconsistent and inaccurate data, adding a technology-driven process can help address this problem.

Take a holistic approach

When tackling uncompensated care, specifically as it relates to Medicare bad debt, it is important to address the problem holistically, to ensure all your earned revenue is realized. Sophisticated analysis of all the relevant data must validate the thousands of opportunities. This can be a burdensome process, detracting from the primary goal of the billers and follow-up team to ship out claims and audit reimbursement. It is critical to evaluate assistance from third parties in this process in order to help free time for revenue cycle management staff to focus on other important issues. Cost report filing time is stressful for reimbursement departments, but external software and consultation can off-load weeks or even months of work.

4 considerations before determining a solution

When evaluating a buy-versus-build approach in this area, here are some considerations:

- Review internal efficiencies. Partners in this space can typically yield a ~20% increase in recoveries beyond a hospital’s internal efforts. Closely evaluate whether the revenue cycle team has the bandwidth to take on another project to capitalize on missed revenue. Both fully outsourced service and software as a service (SaaS) options are available.

- Analyze the data. Examining accounting and transaction codes should provide an in-depth analysis to find bad debts that are payable but may have been missed. Consider having an outside partner analyze the data, which may uncover missed or previously unknown opportunities.

- Determine crossover bad debt. Ensure a sophisticated regressive analysis is used to match the information from Medicare claims against state Medicaid paid claims to determine which cross-over bad debts can be claimed as Medicare bad debt.

- Secure defendable documentation. Medicare doesn’t like giving money back, so reports need to be defensible on audit. Ensure the process delivers results with the full documentation required for submission to Medicare.

Hundreds of millions of dollars of unrealized Medicare bad debt revenue can be recovered at scale if reporting and analysis are performed efficiently with automation — whether via a fully outsourced consulting service or by using a SaaS solution. Recoveries can be close to a half a million dollars per provider (TransUnion Healthcare proprietary data).

To a hospital, every dollar of payment means a better opportunity to deliver excellent patient care. By finding the right partner and tools, hospitals can accurately and efficiently recover Medicare-bad-debt revenue. The money is waiting — go get it.