An Integrated Approach Can Direct Risk and Resource Allocation

The NASDAQ Composite entered bear territory, defined as a drop of 20 percent from its previous high, on Dec. 21, 2018. The other two major stock market indexes, the S&P 500 and Dow Jones Industrial Average, also entered correction territory, with declines of over 15 percent from their all-time highs. Every major asset class or index struggled relative to historical performance standards. No classes or indexes even surpassed the rate of inflation, which was 1.9 percent.

Pronounced volatility occurred marketwide as 2018 drew to a close. The VIX index, which measures the expectation for stock market volatility as implied by S&P 500 index options for the next 30 days, was up 102 percent for the year. VIX was by far the leading investment alternative for 2018. The next closest alternative was natural gas, which was up 23 percent for the year.

Certain fundamentals persist in the market, namely trade tensions with China, arguably a late-stage economic expansion, and a Federal Reserve that remains interested in shrinking its balance sheet and raising short-term rates. In view of these factors, volatility likely will persist, and global markets likely will remain challenged until these factors subside.

Potential Damage from Capital Market Risks

Following severely lackluster investment performance in 2018, the question now is whether healthcare organizations remain properly positioned to fund near-term strategic initiatives, major capital planning cycles, and even routine capital spending plans on a projected basis. The combined risk factors of lower investment returns and net asset values coupled with lower interest rates also now may call for additional pension contributions.

Because net income available for debt service (NIADS) remains an important source of capital for many healthcare organizations, a recent study investigated the extent of damage done to NIADS by capital market risks.a

The study found that realized investment income constitutes about 25 percent of NIADS in aggregate. The proportion varies by rating category—but only to a limited degree. Based on 2018’s investment performance, many organizations likely generated NIADS much lower than needed to fund their projected capital needs.

Get Integrated to Get Smart

Many compartments of risk reside within a hospital operating company. Some are controllable; others are not. Some can be hedged; others need to be owned and managed. Organizations whose finance executives have properly mapped risk exposures and allocated resources accordingly are likely well-positioned to maintain their capital commitments.

Identifying the contributors to cash flow variability is the first step to a better planning approach. Once such contributors are identified, it is possible to quantify risk characteristics and how risks might manifest themselves.

Integrating strategic financial planning with balance sheet modeling (both assets and liabilities) is the best way for an organization to position itself to achieve strategic and financial objectives while protecting itself against the cash-flow variability generated by different kinds of risk.

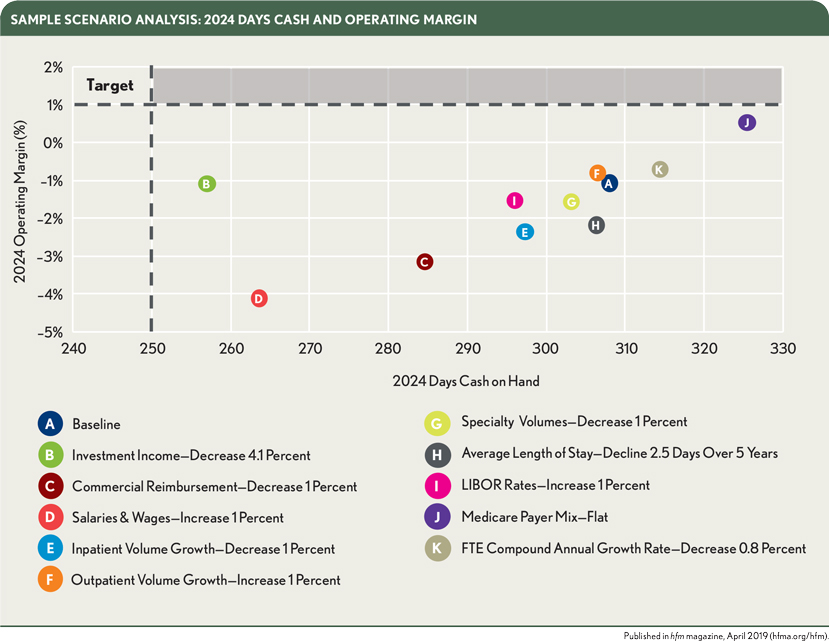

The exhibit above, a relatively simple sensitivity analysis, shows the impact on both days cash on hand and operating margins of lower-than-projected performance with various growth, payment, and other assumptions. Of note is the linear trend line for most scenarios relative to baseline projections (Scenario A), which indicated 308 days cash and approximately a -1 percent operating margin in 2024. Also of note is Scenario B, which shows the impact of a 4.1 percent lower investment income during the forecast period. This scenario is non-correlated with operating performance, but the outcome of Scenario B’s 51-days cash drop to 257 days is a stark departure from the baseline credit position of 308 days with Scenario A.

This sort of top-down scenario analysis is helpful, but a more thorough approach is required. Time and again, an organization’s balance sheet and invested assets are the hedge of last resort against otherwise unmanageable risks. With that in mind, it is critical that finance executives consider what they can do to protect their organizations’ ability to fund strategic and operational commitments while also positioning their balance sheets to grow and generate investment income.

Enterprise Resource Allocation

To address this challenge, organizations can use an integrated approach to stewarding cash and invested assets that involves looking across the organization for the broad role that cash and invested assets play relative to operations, strategy, and liabilities.b Within core operations, a wide array of exposures exist, and reliance only on top-down scenario analysis is insufficient. Interviews with key stakeholders throughout the organization, coupled with thoughtful analysis and quantification, are necessary to understand the exposures common to hospitals and health systems.

Simultaneously, this approach aims to facilitate balanced growth and income from invested assets, while it buffers assessed operational and balance sheet risks. Further, the approach maintains key duties of cash, such as the preservation of credit ratings and funding access, coverage of demand debt, and maintenance of liquidity covenants. Under this view, invested assets serve many roles and should continuously serve as the balancing agent for resources and risk across the enterprise, given their adjustment capabilities compared with other risk-bearing pursuits of the organization.

The interconnectivity of the three elements of an organization’s treasury function—debt and derivatives, treasury operations, and invested assets—is important to consider. But even more critical to success is the integration of treasury within the broader organization’s strategic, financial, and capital planning process. Identifying and managing financial risks across the organization requires an integrated approach to both resource and risk allocation.

Footnotes

a. Study by Kaufman Hall based on audited 2017 financial results, using data from Moody’s Investors Service.

b. Jordahl, E., and Ratliff, D., “Stewarding Cash and Invested Assets to Support Organizational Challenges.” Kaufman, Hall & Associates, LLC, January 2018.