Collecting with compassion: Patient financial care grows in importance

Health system leaders increasingly believe more communication is better when it comes to telling patients what they owe.

When the pandemic began, Henry County Health Center’s revenue cycle department took a gamble to relieve the financial stress of care for patients. Executives for the 25-bed, Mount Pleasant, Iowa, critical access hospital, which serves a large Medicare and Medicaid population, opted to hit pause on discussions around healthcare costs before care was delivered.

“We didn’t want cost to be a barrier to care,” said David J. Muhs, CFO, Henry County Health Center, which also houses a 49-bed long-term care unit. “Formerly, we talked to each and every patient before they came in for care to say, ‘Here is the amount you’re going to owe. How would you like to handle that out-of-pocket cost?’ But in the early months of the pandemic, we knew that fear of the unknown — health-wise and financially — was strong in our rural community. We decided to postpone those discussions until after care had been delivered to keep financial worry from influencing decisions around care.”

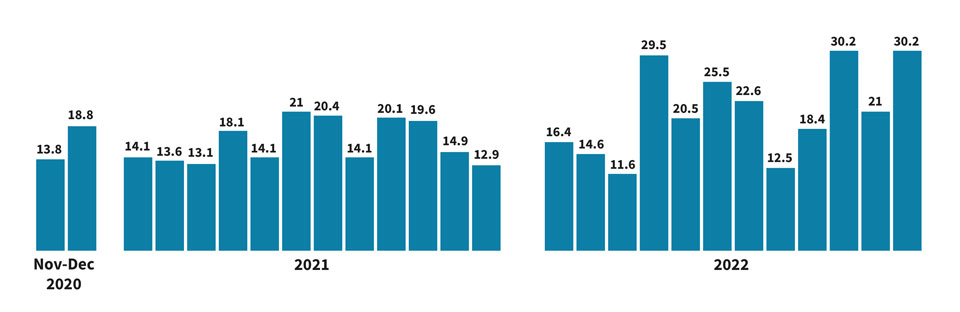

The change in Henry County’s approach to patient financial communications — which members of the community had praised — was a move the revenue cycle team made by keeping a pulse on consumer sentiment during the pandemic. Roughly nine months after the coronavirus emerged, Henry County reignited patient financial conversations prior to the point of care — and saw point-of-service (POS) collections dramatically increase, from 10.2% of all collections in FY19-20 to 14.1% in FY20-21. Through December of FY2022/23, the not-for-profit health center’s POS collections averaged 22.5%.

“We’re pretty active with upfront collections where we can be, including in the emergency department,” Muhs said. “We talk a lot about protecting patients’ financial health, making sure they know what is expected of them and what their care is really going to cost, because the last thing we want is for someone to get a big bill they weren’t expecting. But in this scenario, we believed we could better support our patients by moving these conversations to the back end for a time, until the initial fear around receiving care during a pandemic had passed.”

Henry County Health Center point-of-service (POS) cash collection

A change in patient financial communications has been followed by an increase in the percentage of total cash payments that are collected at POS.

Source: Henry County Health Center

NEGATIVE PORTRAYAL

Meanwhile, the media is applying pressure on the healthcare industry for its financial collection and billing practices, with a big focus on hospitals. The New York Times put not-for-profit health system collection tactics under a microscope in December in its series called “Profits over patients: How not-for-profit health systems lost their way.” The series took aim at health system billing practices, charity care practices, the ways in which they use 340B drug program money and other practices.

“Many of the country’s largest nonprofit hospital systems have drifted far from their charitable roots,” a series article states. “The hospitals operate like for-profit companies, fixating on revenue targets and expansions into affluent suburbs.”

READ: 5 tips to ensure the right financial care is being provided to each patient

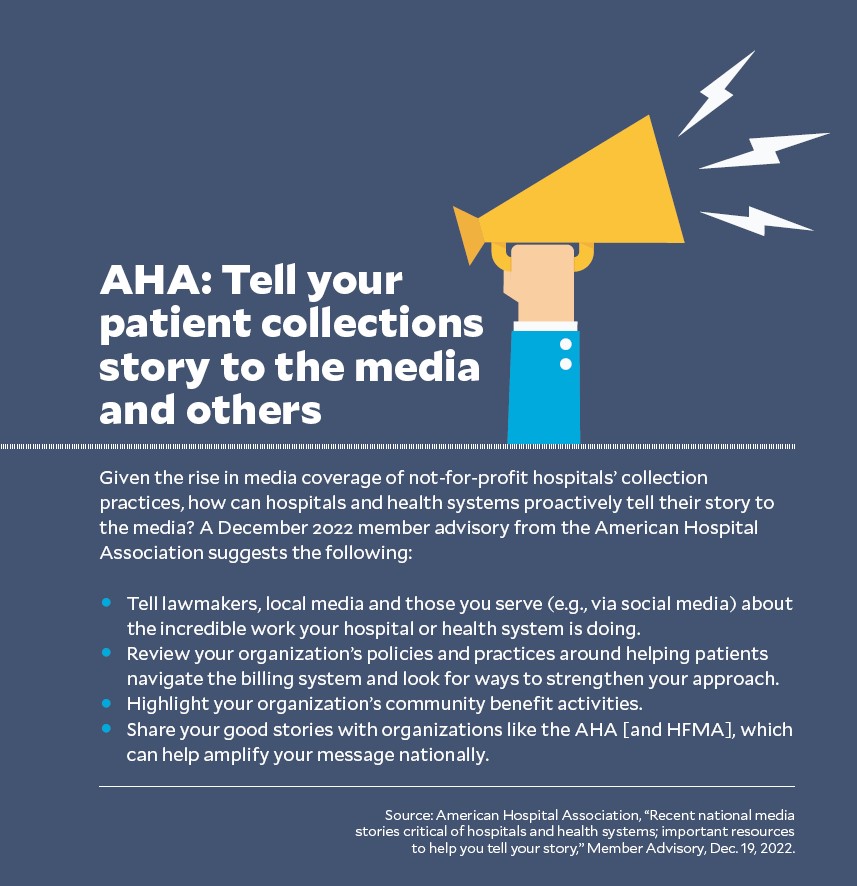

And while the American Hospital Association said the series “presented a flawed narrative of America’s hospitals — specifically not-for-profit health systems,” the impression left by the headlines will be hard for the industry to shake.

Regardless of what the media is saying, some hospital and health system executives are bolstering patient financial communications and services to the benefit of the patient and the provider organization, industry experts say.

“The delivery of patient financial discussions really needs to start being looked at as a holistic approach to that patient’s care, not separate from or an afterthought to the medical treatment they received,” said Shawn Stack, director, perspectives and analysis, for HFMA. “Otherwise, consumers will put off the care they need, and their condition will become more acute over the long term. We need to break down the silos between clinical and financial care, so patients do follow through with care.”

GAUGING COST SENSITIVITY IN HEALTHCARE

Numerous factors contribute to rising sensitivity around healthcare costs, from the increase in high-deductible plans — through which coverage jumped to 55.7% of private-sector workers in 2021 — to soaring prices across industries, dwindling consumer spending power and fears about the economy.

A December 2022 Fast Company/Harris poll found 56% of U.S. adults feel at least somewhat anxious about their personal financial situation in the year ahead. Meanwhile, other studies found that 58% of U.S. consumers were concerned about their ability to pay an unexpected medical bill as of March 2022, and that eight out of 10 planned to rethink or reduce their spending.

Inflation may be beginning to ease, but the aftershocks of periods of high inflation in 2022 — combined with the financial constraints of the pandemic — are likely to be felt throughout 2023. As of early February, Americans were quickly burning through the savings they accumulated during the first two years of the pandemic, when many consumers squirreled away federal relief checks and discretionary funds, according to a Wall Street Journal story. The article cites an estimate by Goldman Sachs that 65% of consumers’ savings could be depleted by the end of 2023.

“Financial pressures from the pandemic made an impact on consumers’ purchasing behaviors, and inflationary changes are influencing that behavior as well,” said Jason Considine, chief commercial officer, Experian Health. Based on industry reports, people are turning to less costly alternatives in healthcare, from choosing generic or over-the-counter medications over brand-name drugs to relying on discount retailers or virtual care for their healthcare needs, he said.

Delayed care also is a symptom of financial stress, and the impact for hospitals runs deep. Regarding the first year of the pandemic, when one out of five American adults delayed care or was unable to receive care due to concerns about the COVID-19 virus, 57% of U.S. adults responding to a Harvard study reported having experienced negative health consequences from delayed care. This is likely the reason hospitals experienced a rise in patient acuity in 2021, driving increased labor, drug and supply costs and contributing to hospitals’ financial challenges, the American Hospital Association reported.

HOW HOSPITALS AND SYSTEMS SHOULD RESPOND

“Healthcare organizations must factor economic unpredictability into their revenue cycle management strategy,” Considine said.

That includes developing a patient financial communications strategy that can effectively engage consumers in conversations around medical payment even amid an inflationary and pandemic-

stressed environment.

“Medical payment is definitely an emotional topic,” said HFMA’s Stack, adding: “You’re speaking with patients who need a critical service and may be feeling the stress associated with their health as well as the financial costs of care, yet a hospital or health system still has to operate as a business to keep the doors open. Coming out of the pandemic, which strained consumer finances, and into an inflationary environment, where costs are higher across the board, the strength of an organization’s patient financial services approach is going to be more in the line of sight of leaders in 2023.”

Organizations must consider how they will determine whether a patient needs financial assistance in a non-threatening way, Stack said. They also must assess the types of support needed to help patients apply for a government program such as Medicare or Medicaid or charity care, where appropriate.

“These conversations need to be conducted with a level of sensitivity that ensures patients feel comfortable and trust the organization enough to come back for follow-up care,” Stack said. “Compassionate communications around financial obligations for care are vital to protecting the relationship with the patient and the organization’s financial health.”

FINANCIAL COMPASSION IN ACTION

Leading organizations are taking a fresh look at their patient financial communications policies, their options for payment and the ways in which they engage with patients — in person and virtually — to more effectively engage and assist patients in their financial responsibility for care.

At OhioHealth, based in Columbus, Ohio, the health system’s revenue cycle department had adopted a new approach to financial communications two months before the pandemic.

“We held a Kaizen event to determine: ‘How can we touch as many patients as possible without interrupting their care?’” said Mary Cox, revenue cycle director for OhioHealth. “We developed a tracker board to help determine when our team could enter a patient room to initiate discussions around cost of care after a patient has been registered and financially cleared for service.

“With that tracker, we can see when a patient is ready for discharge, including in the emergency department [ED], when a patient is waiting on a script or when the patient has been stabilized and taken to an inpatient room. It’s a tool that helps us ensure patients have the time they need with their providers yet still gain transparency into the cost of their care and the options available for payment.”

VIRTUAL POPULARITY

After the pandemic emerged, OhioHealth sought to implement a virtual approach to patient financial counseling in combination with a third-party vendor that assists with outreach to patients who are eligible for Medicaid but aren’t yet enrolled in coverage. The health system began with virtual patient financial counseling in the ED. Then, it expanded the service to inpatient areas and to patients who had been discharged but needed assistance navigating their out-of-pocket expenses for care.

Today, half of OhioHealth’s patient financial counseling sessions take place virtually, compared to fewer than 5% prior to the pandemic. Virtual financial counseling is available 24/7.

“We often get compliments from patients, like, ‘Oh, I’m so glad you came to visit me, because now I know there is help for me,’ or, ‘Now I know what steps I need to take next,’” Cox said.

OhioHealth also “loosened the reins” on its payment plans in response to the financial stress patients felt during the pandemic, said Randall Gabel, system director, revenue cycle. The system used to have a strict one-year payment plan, Gabel said. Now, it allows patients to select a plan of up to three years. There’s no need for patients to apply — all qualify.

“We’ve even added the functionality for patients to set up a payment plan via MyChart, which adds a layer of convenience to this process,” he said.

A WINNING APPROACH

At Henry County Health Center, financial conversations at the point of care in the ED have made a significant difference in the health center’s ability to collect out-of-pocket balances.

Initially, Muhs was hesitant to deploy this approach, as he feared the community would not respond well. However, his team convinced him that patients would appreciate both the level of transparency the approach provides and the fact that it is performed in close collaboration with the medical team to avoid interruptions in care.

“I’d describe it as a soft touch,” Muhs said. “We just want to make sure patients get the financial information they need as quickly as possible.”

Staff bring the same level of sensitivity to conversations with patients who are scheduling care.

Muhs tells the story of being in the hospital cafeteria before the pandemic when a woman stopped him to say she really liked what the health center had done up front.

“I thought, ‘Did we get some new furniture?’” he said. She said her son needed surgery, and with his coverage being a high-deductible plan, she was worried about how she was going to pay for it. But she told Muhs that health center staff gave her plenty of options.

“That really hit home with me,” Muhs said. “It underscores the benefits of a transparent approach for the people you serve.”

5 tips to ensure the right financial care is being provided to each patient

How can hospitals and health systems provide the right financial care in a cost-conscious environment? Health system leaders and industry experts offer these tips.

- Incorporate a face-to-face element — even virtually — as one option for financial counseling. “We’ve leaned into face-to-face connections for virtual counseling because it gives these sessions a more personal feel,” said Mary Cox, revenue cycle director with OhioHealth in central Ohio. “The last thing we want is for patients to be hesitant to receive care because they think they can’t afford it. We look for opportunities to ease patients’ fears one on one.”

- Build a diverse patient financial services team — one that reflects the community you serve. This will better position your team to navigate sensitive conversations around payment. “When people see themselves in your care team — including your financial care team — there is a greater level of trust,” said David J. Muhs, CFO of Henry County Health Center, Mount Pleasant, Iowa. “Your team also will be more likely to understand the nuances in communication that are vital to engagement.”

- Involve clinicians in introductions to the patient financial services team. This is especially valuable when meeting with patients in emergency rooms and inpatient units. “By having a nurse introduce the patient to a financial counselor and introducing that person not as someone who is there to collect money, but as a trusted resource, clinicians can help to establish patient financial services as an important part of the continuum of care,” said Shawn Stack director, perspectives and analysis, HFMA.

- Implement a solid digital front door. “Look for tools that will have a big impact on patient satisfaction and a provider’s ability to manage their collection practices more effectively with patients,” said Jason Considine, chief commercial officer, Experian Health. “That includes tools for price transparency, payment and payment plan enrollment as well as options to reach a counselor digitally. In the same way that 61% of patients say they would reevaluate a physician who did not offer easy-to-use digital tools for patient engagement, they would likely hold providers to the same standard for a patient-friendly billing experience.” Those that invest in tech for creating price estimates and offer an easy online, digital or mobile experience will be better able to meet patients’ needs during this inflationary period.

- Assess the ROI of tech-enabled tools for patient financial engagement. “This is an area of increased focus for hospitals over the past three years, and now that technology is a bit more affordable for hospitals to invest in,” Stack said. “Look at your population’s needs. Do they want to come in and talk to a financial counselor about payment arrangements, or can this be accomplished through a secure patient portal or a virtual format? What types of digital options might appeal to your patients, and which options might best meet their needs? Some still prefer a paper-based approach, but the proportion of patients across demographics who indicate a preference for electronic communications is increasing. It’s important to meet patients where they are.”