With the rise of high-deductible health plans and the escalating costs of health care, patients are becoming increasingly responsible for significant portions of their healthcare bills. Although this dynamic has been emerging for several years, many organizations still wrestle with finding the best ways to engage patients in financial conversations and collect prompt and complete payments. Organizations that lack strong processes to educate patients and capture revenue are likely to experience negative financial consequences. Moreover, patient satisfaction and retention also can be adversely affected if those processes are not timely and patient-focused.

To learn more about organizations’ perspectives and strategies around patient payment, HFMA interviewed a number of its members during its 2018 Annual Conference. The following Research Highlight, sponsored by Parallon, delves into several key takeaways from these discussions.

Patient Collections Efforts Are Moving Up Front

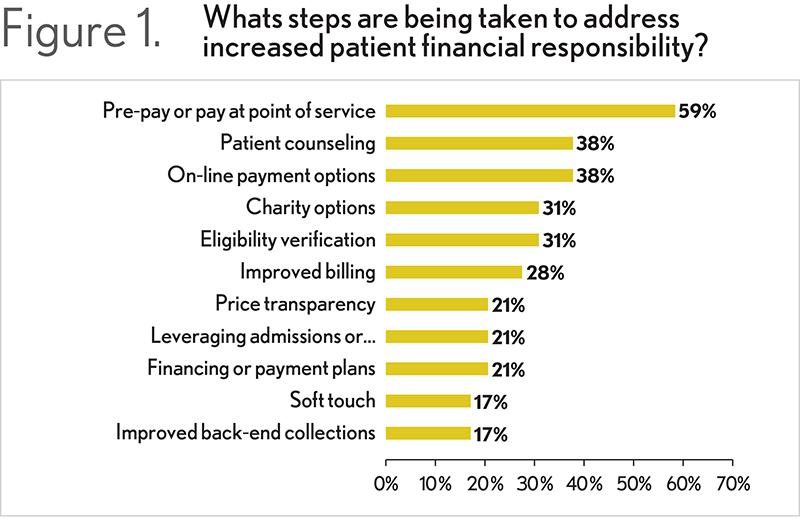

As a group, respondents agreed that shifting patient revenue collections earlier in the patient encounter is critical to improving the timeliness and comprehensiveness of collections. Embracing a proactive and transparent process can shrink days in accounts receivable (A/R) and lessen the likelihood of bad debt. Most respondents indicated that this type of approach is superior to back-end strategies to obtain patient payment, regardless of whether back-end efforts are in-house or outsourced. (See Figure 1)

Respondents also stated that a robust pre-service screening process is necessary to determine a patient’s eligibility for care and inform the patient about what he or she owes. Staff can then encourage the patient to make a payment or, if necessary, counsel the patient on payment and financing alternatives.

“There are a host of reasons why pre-service screening is important,” says Sandra Wolfskill, director of healthcare finance policy and revenue cycle MAP for HFMA. “Not only does it ensure the provider matches the patient to the correct medical record, but it also confirms insurance coverage—both eligibility and benefits—and helps the patient understand the financial obligation attached to the upcoming service. It also offers a good opportunity to obtain any necessary pre-authorizations. In addition to improving financial communications with patients, having a solid pre-service process ensures the organization collects accurate information needed to process a claim after services are provided. This can reduce payment delays and denials and increase patient satisfaction, because claims are resolved accurately and promptly.”

Many survey respondents noted that their organizations’ patient access teams use appointment-setting discussions or appointment confirmation calls as an opportunity to begin dialogues with patients regarding estimated costs and payment policies, as well as resources available for those who require assistance. Depending on the respondents, either internal staff lead these conversations or the organization uses an outsourced pre-collection agency that specializes in patient clearance and upfront collections.

“Patient interactions that take place during pre-screening are critical to begin engaging with patients in financial conversations,” says Shannon Dauchot, CEO, revenue cycle point solutions for Parallon. “If you lose the opportunity, then it can be more difficult to educate patients on what to expect, and it becomes a lot more complex downstream. When it comes to financial responsibility, most patients just want to know what to expect to prevent confusion and surprise. They want their providers to help them understand what they owe, when, and what their options are for payment. They want to feel that someone is on their side.”

Respondents also agreed that, to encourage up-front payment, patient access staff must be properly trained on how to compassionately communicate with patients and provide information on their financial responsibilities and options. They indicated that counselors should be able to assess patient propensity to pay and work through any financial issues that might otherwise cause a patient to avoid or postpone needed treatment or evaluation.

“There are comprehensive resources available to help with training,” Wolfskill says. “For example, HFMA provides the Patient Financial Communications Best Practices, which can bring consistency, clarity, and transparency to patient-provider interactions around financial communications and payment.”

Determining Eligibility Is More Than Just Checking Insurance

According to those interviewed, a key component in up-front patient financial conversations is the eligibility process. This process entails determining not only whether the patient has health insurance but also what that insurance covers. The process also can involve looking at potential coverage opportunities, such as state and federal programs, if the patient qualifies.

Some organizations use technology to scrub payer databases and determine where eligibility applies. There are challenges with this approach, not the least of which is that payer databases are not always up-to-date or as timely as they could be. There can also be accessibility issues depending on the payer and the eligibility screening tool.

“Although pulling queries and performing electronic determinations is important, it may not be enough,” Dauchot says. “It is essential to use trained financial counselors who can have a dialog with the patient about other potential coverage sources. For example, an organization may think an individual is uninsured, however after talking with a patient, a financial counselor may learn that the individual is recently unemployed and qualifies for COBRA. In these and other instances, a trained adviser can serve as an advocate for the patient, providing education and walking them through everything from basic Medicaid program eligibility to lesser known funding sources to payment plan options.”

By incorporating eligibility screening into the pre-service interaction, organizations can more deeply involve patients in the process. “We’re moving toward an option where patients can complete an online screening application to help the provider more quickly determine what coverage options are available,” Dauchot says. “Through this information, the organization may also find a source of secondary coverage. For instance, with patients having certain types of services, if the organization collects household size and income, the information can sometimes be used to screen for pharmacy replacement or reimbursement programs. These mechanisms can lessen the financial burden on patients.”

Generating Accurate Cost Estimates Is Difficult but Necessary

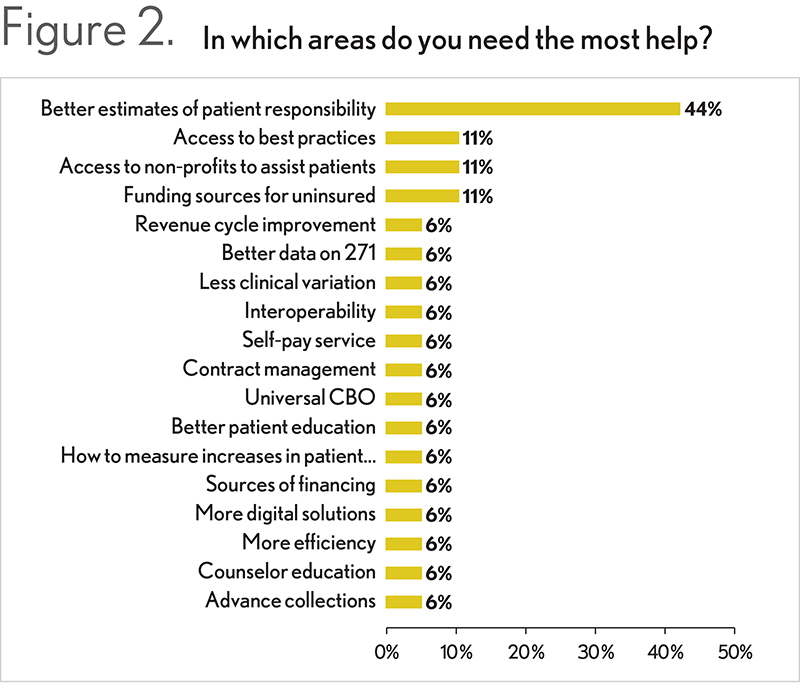

Most respondents indicated that offering greater price transparency in the form of accurate cost estimates is critical to collecting pre-payment or payment at the point of service. Unfortunately, they also stated that generating an accurate estimate is one of the things that is most difficult for them—in part because of the many components involved in creating an estimate and the various factors that can change along the way. (See Figure 2). Problems cited, for example, include inaccuracies from the insurance company, clinical needs that evolve during the procedure, differences among the providers performing certain procedures, and variations in supply variations.

Technology can be extremely beneficial when crafting estimates. “When using estimation tools, you must ensure the tools can load and update contract terms for all payers,” Wolfskill says. “They should also confirm the accuracy of payments received under the contracts not only to verify correct payment, but also to keep the estimate database accurately updated. The estimate should indicate the total price of the service and the distribution of that price to the payer and the patient. Any written estimates should clearly show how they are prepared.”

Organizations can often see greater accuracy if they look at a procedure’s history. “By pulling the right internal data around a particular procedure or type of visit, you can get a better appreciation of the typical costs involved and refine the estimate in the most effective way,” Dauchot says. “If you have a data warehouse that stores historical information, and you can pull it with an easy point-and-click interface, then you can include the most granular level of detail in the estimate, ensuring greater accuracy while streamlining the process.”

Although boosting the accuracy of estimates is important work, it is also essential to establish an understanding with patients that the data provided is just an estimate. “Because of all the potential variations, it is critical that patients understand that in many cases there is no way to exactly quote their out-of-pocket costs unless all parties agree on a fixed amount up front or with the simplest of benefit plans,” Dauchot says. “You must be sure patients understand that, although you have anticipated potential costs to the best of your ability, new information could come to light or services provided could certainly change.”

Payment Plans Are Popular

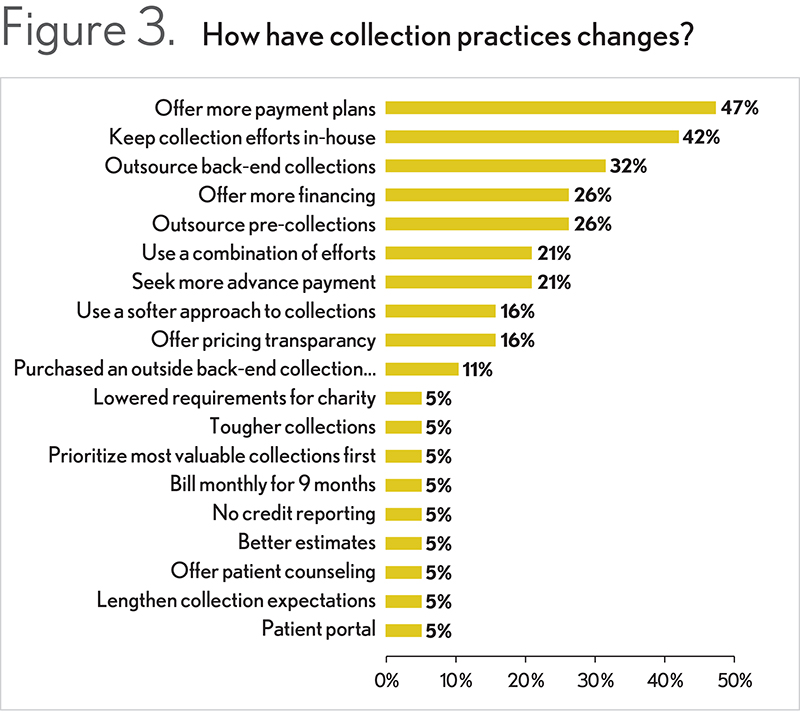

Regarding mitigating the risk of bad debt, one of the methods most frequently cited by the interviewed members was offering generous payment plans that allow patients the option to set regular payments across a more realistic time frame. (See Figure 3.) These payment plans are either managed in-house and follow internal policy or dealt with by vendors. It should be noted that some respondents have encountered compliance challenges when establishing pre-payment plans due to the necessity of keeping patient credit card information on file.

“Although offering generous payment plans is an admirable service, they can be difficult for providers to sustain,” Dauchot says. “If a plan carries on too long, it can be taxing to maintain and support, particularly when you consider that a patient’s circumstances may change over time. Consequently, it is imperative to continuously monitor plans to make sure they are on track. This may involve looking for consumers who are either delayed in paying or skipping payments or have had their credit card company or bank reject the payment. In these cases, proactively reach out to determine if there’s a way to modify the terms to fit their needs. What you don’t want is to let someone default unnecessarily and get lost in the system downstream. Another strategy is to set up robust monitoring to pull “trigger” information that shows when a consumer’s financial situation has changed. Such a solution can regularly review the financial status of a consumer to see if he or she is engaging in different financial behaviors, including obtaining more credit, buying big-ticket items, starting a new job, and so on. By knowing this information, an organization could contact the individual and either offer to shorten the payment arrangement or suggest a pay-off settlement.”

Along with payment plans, no-interest loans—where the provider covers the carrying fees—are another option that gives patients an opportunity to build or rebuild their credit by meeting the terms of the loan. “Regardless of whether you offer a loan or a payment plan, you must be realistic about the patient’s ability to pay,” says Wolfskill. “If a patient can pay only $20 a month on a $10,000 balance, the claim is most likely never going to be resolved. In these instances, the patient should be screened for financial assistance. Before pushing payment plans, make sure that financial assistance isn’t the most appropriate solution for the patient’s financial situation.”

A Portal Can Enable a Better Patient Financial Experience

Survey participants indicated that the introduction of online payment portals has had a positive effect on patient payments. The convenience represented by online access, combined with payment plan alternatives, allows patients to avoid the embarrassment or discomfort of discussing their payment options with patient access team members, while still providing payment flexibility.

In addition to being easy-to-navigate, a portal should provide full transparency into what the patient owes, for which services, and on which dates—ideally including the patient’s statement as a PDF. “Patients should have multiple ways to access the portal, including through the provider’s clinical patient portal,” Dauchot says. “When you have a single sign-in for both tools, you enable easier access and drive up usage for both. It also is wise to have a team of people supporting the portal because even though the tool allows for greater self-service, there will be times when patients need technical assistance or the payment options offered don’t meet their needs.”

The key to getting patients to pay through a portal is to make sure they are aware of the technology and signed up to use it. “The most effective portals easily enable patient payment and streamline the process,” Wolfskill says. “There is an argument that portals, with all their security requirements, may not be the most consumer-friendly way to drive electronic payments. In certain situations, a free bill-pay service or mobile payment app may be more efficient. Ultimately, organizations must focus on how they motivate patients to resolve their balances quickly and accurately via whichever electronic option they prefer to use.”

The In-House Versus Outsource Debate Still Exists

When asked whether they keep collections efforts in house or leverage an outside resource, the interviewed members’ response were split. “It can take a tremendous amount of staff time to support an empathetic and strong patient collections program,” Dauchot says. “However, by working with an outside partner that specializes in this work, an organization can remain compliant with the various rules and regulations while letting internal staff focus on other core aspects of the revenue stream. For example, if an organization truly wants to move the needle on patient collections, it should consider having a method for outreach, such as technology-enabled outbound dialing and workflows, which can help with payment reminders, coordination of benefit requests, collections, and so on. In many cases, an outside partner is well-equipped to handle the state and federal regulatory requirements that go along with this type of outreach. More specifically, a partner can ensure you are in compliance with the Telephone Consumer Protection Act (TCPA), which requires you to have consent by a consumer to use auto-dialer technology when calling a cell phone—a key element in making effective outbound calls in today’s environment. You may think if a patient gives you his or her cellphone number, then you have consent, but it’s not that cut and dried. There are many nuances to this work, and to be compliant, organizations must regularly scrub their databases and be vigilant about consent, as well as lesser known state regulations. It is a complex, costly process, but it can be even more costly if you get it wrong and are subject to litigation or hefty penalties.”

The Challenges Continue

The need to effectively and efficiently collect patient payment is not going away, and organizations must develop processes that enable a better patient financial experience to drive patient satisfaction and revenue. By focusing on key areas such as eligibility, cost estimation, payment plans, and portals, organizations can bring their work to the next level. Leveraging the resources of an outside vendor can be helpful as these companies often have the expertise and resources necessary to make substantial inroads to success without overwhelming internal staff.

About HFMA’s Annual Meeting Intercept Survey: Improving Patient Financial Engagement

HFMA stationed research interviewers throughout common areas at the Annual Conference to speak with attendees about operations resulting from increased patient financial responsibility. Altogether, 31 providers were interviewed. Interviewers introduced general topics for response, then probed specific responses as deeply as time and ability allowed.

About Parallon

Parallon brings decades of experience optimizing the financial health of our clients by addressing complex challenges spanning the revenue cycle. Parallon represents ten percent of the U.S. healthcare provider industry, serving more than 650 hospitals and 2,400 physician practices. Our tailored solutions include Medicaid eligibility and advocacy services; early-out, self-pay services; small-dollar insurance resolution; delinquent account collections; third-party liability and workers’ compensation services; extended business office and insurance services; and physician billing and A/R resolution. Learn more at www.parallon.com.