How the patient financial experience impacts loyalty

The patient financial experience plays a critical role in determining not just whether patients seek care, but also where they receive care and the likelihood that they will stick with a healthcare provider.

Data from a 2022 PYMNTS report sponsored by CareCredit indicates that as the pandemic has tightened consumer finances, even the 54% of Americans making $50K to $100K and 40% of Americans making more than $100K are living paycheck to paycheck. What this means for healthcare providers is that more consumers are using patient financing options to cover out-of-pocket costs of care. In fact, one out of four adults say availability of patient financing, or a payment plan would influence their decision to seek care. So would a range of payment options for fulfilling financial responsibility (29%).

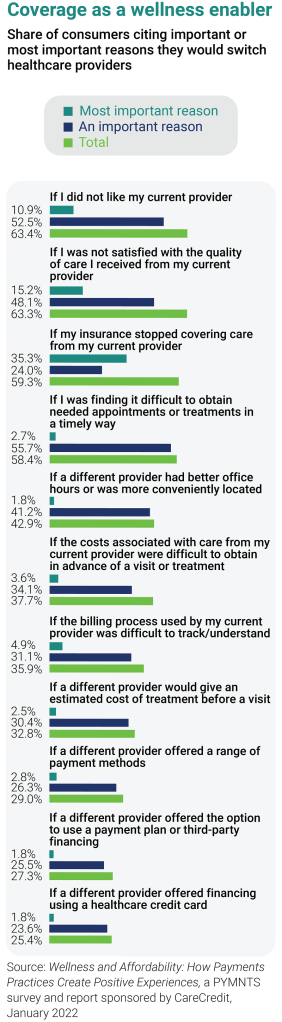

Results of the CareCredit-sponsored survey also point to factors that can dissuade people from seeking care — and that threaten patient loyalty. Three out of five consumers surveyed say they would consider leaving their provider if services were not covered, and nearly 38% would switch providers if costs of care were difficult to obtain before a visit or treatment. Meanwhile, nearly 36% would leave a provider if the billing process were difficult to track or understand.

In this roundtable, leaders from healthcare organizations across the country share insight on the keys to creating patient financial experiences that drive payment while protecting patient retention.

Shannon Burke: We continue to see the patient’s role as payer increasing due to higher out-of-pocket healthcare costs. Has your organization implemented any new strategies or solutions to help patients feel confident that they can manage the cost of care?

Sheldon A. Pink: We wanted to reach out to our community and help educate patients on how their out-of-pocket costs are determined so they would feel comfortable paying their healthcare bills. So about six months ago, we partnered with [a digital payment platform provider] to help address this challenge, and we hope to go live soon. We are extending our payment plans and options, so they have every opportunity to make their payment. In addition, we have integrated payment and patient financing options within MyChart to make the financial experience as seamless as possible. It’s taken a lot of configuration, but it’s well worth it.

Robert Boos: Information is power for a patient in a situation like this. It’s a disservice to push discussions around cost behind the scenes, at the end of the encounter. You want to give them every option you can, from a robust financial assistance and charity care program to a discount for paying their financial responsibility ahead of time to short-term payment plans. And then, if you’re going to offer longer payment options, you want to have a good partner that will allow you to give patients zero-interest, zero-fee financing and help patients set up payment arrangements before they receive care. This helps make sure there isn’t sticker shock later when that actual financial responsibility comes to roost.

Burke: Do you feel that pushing this information out to patients upfront makes it less overwhelming?

Boos: Absolutely. You have a burden with that in as much as a lot of your front-end people don’t like having those financial discussions, and you have to get them comfortable with scripting and get them into the practice of having those conversations, so that it becomes routine for them. You have to let them know: “Knowledge is power. Patients want to know their financial responsibility for care so it can be resolved ahead of time.” The more you can do to give patients this information upfront, the less scary payment becomes.

Pinaki Ghosh Ray: This problem is staring us down, and it’s going to magnify in size. The portion of the patient’s liabilities for care is only increasing. Some patients have no insurance; some are on Medicare and Medicaid. I look at this in terms of, “How do we address education, access and needs from the patient’s perspective?” From an education standpoint, you have to allow patients to be educated enough — or have access to become educated enough — that they know what it is they are coming in for, how much they will need to pay for their care and their options for payment. All of this requires transparency. That’s the first thing we have implemented from a strategy standpoint: Letting patients have access to the information they need to make decisions about care. This can be done in a very coached and guided manner for every patient who comes in.

We’re also making sure people have omnichannel options to pay their healthcare bill. With access to technology, for example, they can receive a text message by the time they leave the hospital, saying, “Here’s your anticipated cost for XYZ visit; here are your payment options; how would you like to take care of this bill?” Then, they click on a hyperlink, and they’re able to go in and explore their options. If we drive access, education and communication down to these levels, hopefully we can engage more patients.

Christopher Johnson: We have a single statement for hospital and professional charges, which I think is the greatest thing I’ve seen in my career. It allows us to have one call center for patients to contact with questions about their bill. In addition, our financial assistance program is very generous in our market. We’re trying to push out all patient financial communications electronically. In fact, we just turned on Epic’s text-to-pay feature that lets patients know, “Here’s your balance. How would you like to pay?” And hopefully, there’s a plan for payment that meets every patient’s needs.

It’s clear that there’s a portion of the population that wants to receive digital communications, but there’s also a portion of the population that doesn’t want to engage. We want to make the patient financial process as easy as possible by providing an education component and making sure we’re making payment as easy as we can for patients so that they have every opportunity and every avenue to pay. But I think engaging the disengaged patient remains a challenge for healthcare providers.

Ray: I don’t have a silver bullet for that, but I know, for sure, that patient financial engagement has to be localized. We have to enable our own people — or front desk; our financial counselors who work with dual eligible — so they can spend more time with patients on education. A compassionate approach is crucial: “Hey, I’m here with you; I’m going to help you understand your liability, and there are multiple tools that we can use to help you manage the cost of your care.”

Burke: You said two things that I think are important … about the importance of early estimations and being able to provide consumers with the right education to make payment decisions. Patient financial communications are complex, and revenue cycle staff are heroes for the work they do in navigating these discussions with patients with information and empathy. More and more, we’re hearing health systems say that they need a partner in this effort to help them provide all of the options they would like to offer for patients, including around patient financing. But the underpinning of patient financing programs can be very different depending on who you’re working with.

Johnson: We have to get better at identifying people who will most likely not engage with us around payment. We only have so many resources. We need to direct those resources to the right segment of the population.

Terri Meier: We’ve changed the point at which we assign an account to bad debt, holding onto that account a bit longer as we amp up our self-service functionality with text-to-pay and lean into propensity-to-pay tools. We’ve also hired knowledge workers to answer phones in our customer service department to make the patient financial experience a differentiating factor. My customer service reps are the highest-paid revenue cycle employees because they are vital to the patient financial experience and rates of engagement. Omnichannel communications and self-service create bandwidth for those customer service reps to take the time to educate the patient on why they owe the balance. We’ve collected more cash because we’re building trust with patients, and they’re going to come back to UCSD because their last impression with us, in billing, was not a deal breaker.

With the surge of contactless options available in many different industries over the past two years, consumers have come to expect a new level of convenience in customer service. How are you meeting patients’ evolving expectations when it comes to accessing and paying for healthcare?

Kumar Aditya: There are some patients for whom self-service is the right approach because they just want to know how much they owe and how to pay it, and they don’t want to have a conversation. But there is another population of patients who will still need to talk with a financial counselor — and that takes time. Staffing-wise, you’re still going to need the same amount of staff or similar. You’re not losing staff with the introduction of technology for self-service. Instead, you’re shifting them to this value-added piece.

Boos: Do you remember 20 years ago, when the airline industry went to kiosks and then into phone devices to book your ticket? We were horrified. “What do you mean, I can’t go talk to the ticket counter?” And we slowly made this change that now, you still can wait in line and talk to someone, but predominantly, we’re dealing with check-in on our device or the kiosk. We’ve adjusted our thinking. So why in healthcare are we so far behind the airline industry of all things? As we start moving toward convenience in customer service, things are going to be more digital. We’ve got to have that ability to be the “new airline.”

Johnson: I continue to say to my team: “We need to be asking the patient how they want to communicate with us. What language do they want us to use in communications? Are they comfortable receiving a text? Do they want to receive their statement on paper or digitally?” This is how you get better at providing the financial experience consumers want. We have to be careful about assuming that patients want to be communicated with digitally. I think text-to-payment is going to be great — it’s going to eliminate tons of manual statements — but there is a portion of the population who will tell you, “I didn’t ask for this.” We need to make sure patients know how to opt out of this service.

Meier: What we’re trying to do now at UCSD is leverage their preferred communication method. Access to payment and patient financing is all MyChart-enabled now. We’re trying to get to know our patients’ needs by looking at their payment history and suggesting payment plan options, and we have multiple channels open for customer service because there are pockets of people who want things a certain way, including the ability to pay cash. We’re continually looking for ways to improve our communications and offerings. How do we make it easy for someone to understand their bill and access their preferred option for payment?

Ray: I want to make sure patients see and use the estimates before they arrive. That’s the actual goal. It’s one thing to check the boxes for the [price transparency] regulation but making sure the patient experience remains intact is something else. That’s where the healthcare industry runs into problems.

Burke: The studies show that the quality of the financial journey is equal to the clinical outcome. And that just shocks me. And, by the way, that’s the last experience that a patient will have with a provider. It doesn’t matter how great the care was; more than half will walk. That’s a generational shift, to me. There’s this whole consumer, walk-with-your-feet, “I will leave if my financial journey is not what I expected.”

Ray: Patients are morphing into consumers, and rightfully so, they will have the power of choosing where they want to go for their care and which payer they choose. We as an industry have to figure out how to support that and engage with our patients around that: That’s where the power of our communication with patients lives.

PANELISTS

KUMAR ADITYA

Director, information technology at Atlantic Health System in Morristown, New Jersey

ROBERT BOOS

Vice president, revenue cycle at Centra Health in Lynchburg, Virginia

SHANNON BURKE

Senior vice president and general manager, health systems at CareCredit in Costa Mesa, California

CHRISTOPHER JOHNSON, FHFMA

Vice president revenue cycle management at Atrium Health in Charlotte, North Carolina

TERRI MEIER, CHFP, CRCR, CSMC

System director, patient revenue cycle at University of California San Diego Health in San Diego, California

PINAKI GHOSH RAY

Vice president, strategy and outsourcing at Prime Healthcare in Dallas, Texas

SHELDON A PINK, FHFMA, MBA, LSSBB

Vice president of revenue cycle at Luminis Health in Annapolis, Maryland

About CareCredit

CareCredit is a health, wellness and personal care credit card with 35+ years experience giving patients the flexibility to pay over time for their out-of-pocket healthcare costs. This includes deductibles, copays and other medical expenses not covered by insurance. Practices get paid in two business days with no recourse* (CareCredit assumes the liability), helping providers save time, increase cash flow, and reduce A/R. For more information CALL: (800) 859-9975 or VISIT: www.carecredit.com/hfma

*Subject to the representations and warranties in your agreement with CareCredit, including but not limited to only charging for services that have been completed or that will be completed within a specified period of time, always obtaining the patient’s signature on in-office applications and the cardholder’s signature on the printed receipt.

This published piece is provided solely for informational purposes. HFMA does not endorse the published material or warrant or guarantee its accuracy. The statements and opinions by participants are those of the participants and not those of HFMA. References to commercial manufacturers, vendors, products, or services that may appear do not constitute endorsements by HFMA.