Survey: Hospitals and health systems prioritize automation technology and cybersecurity to battle pandemic

Cost-conscious healthcare leaders seeking to increase efficiency in corporate services are generating success through automation technology, but most hospitals and health systems have yet to optimize their use of technology to full effect. That takeaway comes from a recent Healthcare Financial Management Association (HFMA) survey in which 112 healthcare leaders shared their views and projections about corporate services and health IT. The survey was fielded earlier this year, and participants included CFOs and other financial and revenue cycle executives. Through its Center for Health Insights, Guidehouse analyzed the research conducted by HFMA, and the following sections discuss key takeaways.

Automation technologies gaining steam

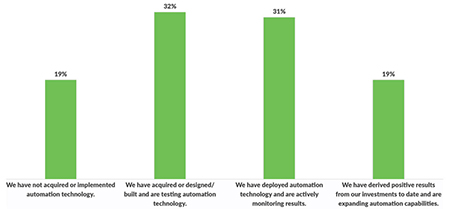

The use of automation technology among hospitals and health systems is on the upswing, with 82% of respondents already on their automation journey. The majority of those are still in the early stages, either testing the technology or already deployed and actively monitoring results. But 19% report that their automation investments have driven positive results, and they are expanding their capabilities.

The increased use of automation as a cost-reduction strategy includes organizations that lack the resources needed to deploy the technology themselves, said Bill Jones, a Guidehouse partner and managed services leader.

“For these providers, leveraging vendor partnerships and outsourced services is a strategic investment to successfully achieve economies of scale and realize the benefits of automation,” he said.

Optimization opportunities abound

Only 8% of hospitals and health systems are using a fully optimized enterprise resource planning (ERP) system, the survey found. About 32% of health system leaders said they have deployed a system, but it is not optimized yet — but just 16% of hospitals are at that point.

Although the Office of the National Coordinator for Health IT has made regulatory moves that improve interoperability — allowing providers to easily and securely exchange data and automate technologies — many providers have yet to take full advantage of the opportunity, according to Guidehouse leaders. One example: 30% of providers report they may be at least two years away from deploying an ERP system, and 15% say they have no plans to do so.

Providers can drive efficiency gains, especially in corporate services, by optimizing technology, said Subra Sripada, a Guidehouse partner and Health IT Solutions co-leader.

“Underperforming or underleveraged ERP assets, for instance, significantly slow down operations, productivity and employee engagement,” said Sripada, a former health system chief information officer. “In many cases, providers are not taking full advantage of the benefits their technology investments offer to solve their greatest business challenges — and it’s working against them in terms of efficiency and security.”

Automation technology yielding returns for nearly 20% of hospitals

Cybersecurity emerges as a growing priority

Nearly 30% of survey respondents identified cybersecurity as their top priority for technology enhancement over the next year. About 43% of providers cited using modern security technology to monitor network and device anomalies as their top strategy.

Yet very few respondents reported taking basic steps to improve their organization’s cybersecurity. As they grow through mergers and acquisitions, health systems increase their risk of cybersecurity attack if they layer on new technologies instead of replacing old ones. The survey found that just 1% of providers are tracking their technology assets and only 9% have removed legacy software.

Cybersecurity attacks can disrupt the ability of a hospital, health system or physician group to provide patient care, said Katie Gilfillan, MSW, HFMA’s director of Healthcare Finance Policy, Physician and Clinical Practice.

“If access to care is interrupted, this creates a risk to the surrounding community and patients’ privacy, health and safety,” she said. “Creating a culture of patient safety within the organization, which includes a focus on cybersecurity, will help to maintain a focus on this growing risk to healthcare providers and the patients they serve.”

Leaders focus on corporate services spend

On average, corporate services account for 10.38% of total operating revenue for hospitals and health systems. The COVID‑19 pandemic has intensified pressure for health systems to focus on their financial and operational performance, said Michele Mayes, Guidehouse partner and Operational Effectiveness solutions leader.

Nearly half (47%) of respondents expect their organization’s corporate services budget will increase by up to 10% in the next 12 months, while 25% of respondents project decreased spending. Although budget tightening is always painful, a majority of survey respondents believe they can reduce spending on corporate services without hurting service quality or efficiency. In fact, 45% of respondents think they could reduce spending by up to 10%, and 20% think they could reduce spending even more with no ill effect.

Providers are targeting the supply chain, IT and revenue cycle management as the three top priorities for reduced spending. While supply chain and revenue cycle management are key areas to target, Mayes points out that optimizing can improve efficiency and create a more resilient future. “The technology itself won’t solve the problem, but wrapping better processes and structure around an optimized solution will,” she said.

Nurse shortage tops staffing challenges

The pandemic has taken a heavy toll on providers’ staffing efforts. A full 69% of executives said nursing shortages have worsened compared to a year ago. The next-biggest hit: behavioral and mental health providers, with 32% saying shortages have increased in the past year.

Survey respondents also identified staffing shortages for advanced practitioners, coding/revenue cycle experts, physicians and IT-related experts such as data scientists and engineers.

The nursing supply will likely continue to be a challenge, particularly in rural areas and for certain types of patient care needs, including mental and behavioral health and long-term care, Gilfillan said. The pandemic required hospitals and health systems to rapidly shift workforce resources to meet surges in demand for care. This required nurses to take on new roles and responsibilities, highlighted scope of practice issues, and created new ways that patients access care and engage with providers such as through telehealth.

“As health systems reset after the pandemic, considering these factors has become important for optimizing the resources available and planning for future care needs,” HFMA’s Gilfillan said.

With 11 KLAS #1 rankings, the Guidehouse Health team helps hospitals and health systems, government agencies, life sciences companies, and payers strategically redesign, revitalize, and transform their operations.

About Guidehouse

Guidehouse is a leading global provider of consulting services to the public and commercial markets with broad capabilities in management, technology, and risk consulting. We help clients address their toughest challenges and navigate significant regulatory pressures with a focus on transformational change, business resiliency, and technology-driven innovation. Across a range of advisory, consulting, outsourcing, and digital services, we create scalable, innovative solutions that prepare our clients for future growth and success. The company has more than 10,000 professionals in over 50 locations globally. Guidehouse is a Veritas Capital portfolio company, led by seasoned professionals with proven and diverse expertise in traditional and emerging technologies, markets, and agenda-setting issues driving economies around the world. For more information, please visit: www.guidehouse.com.

This published piece is provided solely for informational purposes. HFMA does not endorse the published material or warrant or guarantee its accuracy. The statements and opinions by participants are those of the participants and not those of HFMA. References to commercial manufacturers, vendors, products, or services that may appear do not constitute endorsements by HFMA.