Why responding to site-neutral payment risk is imperative for hospitals and health systems

Dawn Samaris

James Kinn

As the likelihood of site-neutral payments increases over a range of services, hospitals and health systems must understand which services are most at risk from these changes and determine how quickly they will respond.

Challenges to hospital outpatient department (HOPD) reimbursement rates are coming from all directions. Some commercial payers are refusing to pay HOPD rates for certain procedures without a finding of medical necessity and are committing to increasing the percentage of services health plan members receive at lower-cost sites of care over time. Government programs are steadily moving toward site-neutrality as a principle for payment policies. Meanwhile, consumers are demonstrating a preference for care delivered outside of the hospital.

Here are recent examples of these trends:

- As of 2018, Anthem stopped paying for MRIs and CT scans performed on an outpatient basis at hospitals, unless a review finds the procedure was medically necessary.

- In its 2020 Sustainability Report, UnitedHealth Group committed to ensuring that more than 55% of outpatient surgeries and radiology services will be delivered to members at lower-cost sites of care — specifically, ambulatory surgery centers (ASCs) and freestanding imaging centers instead of hospital outpatient departments — by 2030.

- More than three-quarters of consumers responding to a June 2020 study by CVR and Carmichael & Company said they would prefer receiving care in a location not connected to a hospital. This finding was almost certainly influenced by the COVID-19 pandemic, but it also may indicate a long-term shift in consumer preferences.

- In June 2021, the U.S. Supreme Court declined to hear an appeal challenging the U.S. Department of Health and Human Services’ 2018 Outpatient Prospective Payment System final rule, which effectively equalized the Medicare payment for patient evaluation and management services provided in hospital outpatient and physician office settings. The Supreme Court’s decline of the appeal allows the policy to move forward.

The movement toward site-neutral payments (i.e., paying the same amount for a service or procedure regardless of the site of care) will almost certainly grow over time.

For example, less-invasive surgical procedures and advances in anesthesiology and post-operative pain management are enabling clinicians to perform more joint replacement procedures in ASCs, without the need for an overnight hospital stay. In 2020, CMS went so far as to propose eliminating the inpatient-only (IPO) list, which defines services that Medicare will pay for only if delivered in an inpatient setting.

CMS has since decided not to eliminate the IPO list, but the list will keep shrinking with continuing advances in treatment. And as patients become more experienced and price sensitive as healthcare consumers, their appreciation for the convenience and cost savings that ASCs or other freestanding sites of care can provide will only intensify.

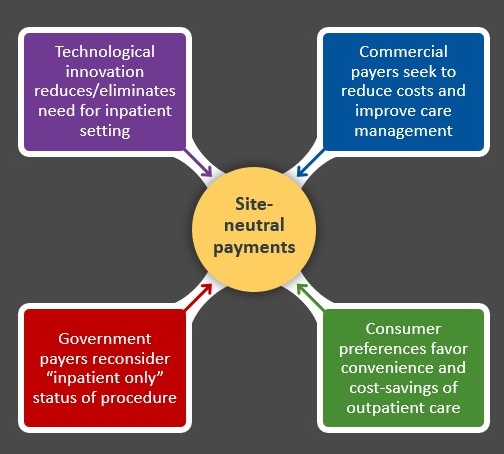

Factors influencing the move to site-neutral payments

Source: Kaufman, Hall & Associates, LLC, 2021

Identifying the services most at risk

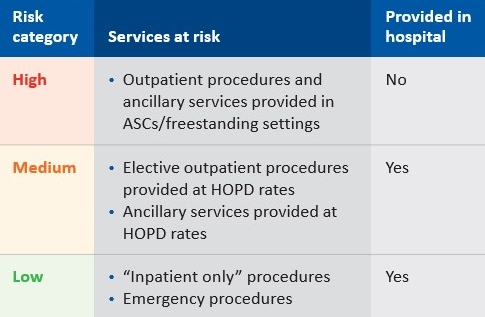

The increasing risk for site-neutral payment reform will have a significant impact on future revenues for healthcare providers. Hospitals’ and health systems’ risk of exposure to site-neutral payments and care model changes can be grouped into three categories (as shown in the exhibit below), with the risk increasing for services that are (or can be) provided outside the hospital’s walls.

Risk categories

Source: Kaufman, Hall & Associates, LLC, 2021

Services that are currently performed within a hospital’s walls are more likely to retain HOPD status for a longer time. They are vulnerable primarily to technological innovations that make it possible to perform these services outside of the hospital, thereby supporting payers’ decisions to not pay an HOPD rate absent a medical necessity (such as an emergency case). Services that have already moved largely outside the hospital are more immediately vulnerable.

This analysis depends on industry trends and regional and local market conditions, not the decisions of an individual organization. If most providers have moved a service to freestanding sites, for example, the decision by one hospital to retain the service within its walls can still leave it exposed to risk.

In calculating the timing and impact of the risk, management should consider three questions:

- For outpatient services performed outside the hospital — and for those procedures and services likely to move to outpatient status — what is the differential between inpatient and outpatient rates, and between HOPD and current freestanding rates?

- For outpatient procedures and ancillary services provided at the hospital, how vulnerable are these procedures and services to medical necessity review by payers?

- For procedures that currently are performed on an inpatient basis, how many of the inpatient procedures are elective? What is the likelihood that inpatient procedures could lose IPO status over time?

With an understanding of the services likely to be affected, the expected timing of rate changes and the rate differentials between current rates and outpatient and freestanding rates, management can plot the potential financial impact of the risk.

Quantifying the risk: A case example

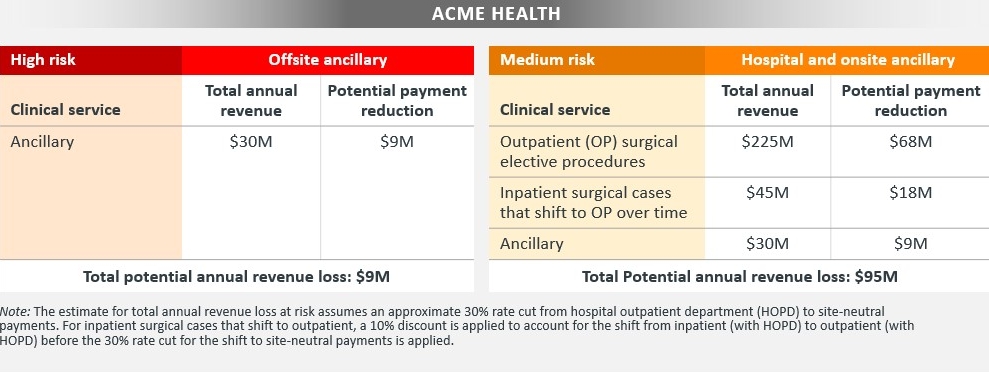

Consider that the hypothetical health system ACME Health owns a hospital and an offsite ancillary location. The hospital also offers ancillary services (e.g., MRI, X-rays) onsite, within the hospital’s walls. The offsite ancillary location is receiving HOPD rates today from both commercial and government payers.

The exhibit below illustrates the potential risk of exposure to site-neutral payments facing ACME Health for services for which HOPD rates are paid today in different service settings.

ACME Health’s site-neutral risk exposure

Source: Kaufman, Hall & Associates, LLC, 2021

In this example, the potential risk of commercial and governmental payers moving from HOPD to site-neutral rates first starts with those ancillary services provided outside the hospital walls, which are at highest risk; a potential annual revenue loss of $9 million could occur almost immediately.

For services receiving HOPD rates that are provided within the hospital walls — which are at medium risk — ACME Health’s risk analysis should focus on three types of services:

- Outpatient elective procedures

- Inpatient procedures that will likely shift to outpatient over time

- Ancillary services still provided within the hospital walls

Depending on the pace of change, the potential annual revenue loss for these medium-risk services could amount to about $95 million within the next two to five years, not accounting for inflation.

Combined, annual revenue for both high- and medium-risk services could amount to about $104 million.

Strategic considerations

In most instances, the move from HOPD to site-neutral rates will have a negative impact on revenue and direct margin. This impact may be mitigated or neutralized if the health system can reduce excess hospital capacity and the accompanying fixed costs, or if there is demand for inpatient services that could replace those that are moved to freestanding sites.

For most hospitals and health systems, however, the most significant strategic question is one of timing: Is it better to wait until rate shifts occur, or to take a near-term revenue loss in exchange for an early position as a lower-cost alternative in the market?

This decision will be informed by several factors, including the following:

- Current options in the market. If freestanding sites of service are not developed, do insurers and referring clinicians have other lower-cost options to consider in the market?

- Consumer-driven strategies. Could the use of freestanding sites enhance quality metrics, the patient experience or clinician satisfaction?

- Partnership opportunities. Are there opportunities to partner with independent physician groups on an ambulatory strategy and further align the hospital or health system with physicians in the market?

- Value–based opportunities. Does the market have large employers or payers who would be interested in center of excellence or bundled payment opportunities that could increase market share?

Over time, hospitals and health systems will need to address a bigger consideration: whether retaining or growing volume at a lower direct margin is better than having no volume at all. Clearly, these leaders cannot direct the course of change in care delivery and payment models. But significant dollars are at stake, and decisions on how to adapt to these changes remain well within their control.