Analysis: Haven’s first moves: Benign or disruptive?

- Amazon is currently offering 2020 plans through Haven for its workers in Connecticut, North Carolina, Utah and Wisconsin, and JPMorgan Chase is offering the plans in Ohio and Arizona.

- The healthcare venture Haven was formed by the leaders of Amazon, JPMorgan Chase and Berkshire Hathaway.

- The three companies have a combined 1.2 million U.S. employees, according to a Healthcare Dive report.

Healthcare Dive is reporting that Amazon is currently offering 2020 plans through Haven for its workers in Connecticut, North Carolina, Utah and Wisconsin, and JPMorgan Chase is offering the plans in Ohio and Arizona.

“The JPM-Haven plans, run by payers Cigna and Aetna, don’t require employees to pay deductibles and do offer financial rewards for fulfilling certain wellness activities like keeping blood pressure below target levels, according to Bloomberg. Co-pays range from $15 to $110 for most services, though higher acuity care like hospitalization is more expensive,” according to Healthcare Dive.

“The Boston-based nonprofit venture, which has an office in New York, has spooked established players fearful of potential disruption. The three companies have a combined 1.2 million U.S. employees,” the article continued [Mulvany note: the three companies include Amazon, JPMorgan Chase and Berkshire Hathaway]. “However, this initial rollout in tandem with traditional health insurers like Aetna, now part of CVS, and Bloomfield, Connecticut-based Cigna could assuage some of those worries. Details about Haven have been scarce since the beginning. In March, the trio launched a website with vague ideas of what it would be focusing on, like leveraging technology and looking at common-sense fixes to lower employer healthcare costs.”

Takeaway

1. I’m not so sure Healthcare Dive’s assumption about the initial rollout of Haven plans would assuage my worries if I was an entrenched player. The venture, which was announced in 2018, didn’t have a CEO until halfway through the year. So, these are the early days.

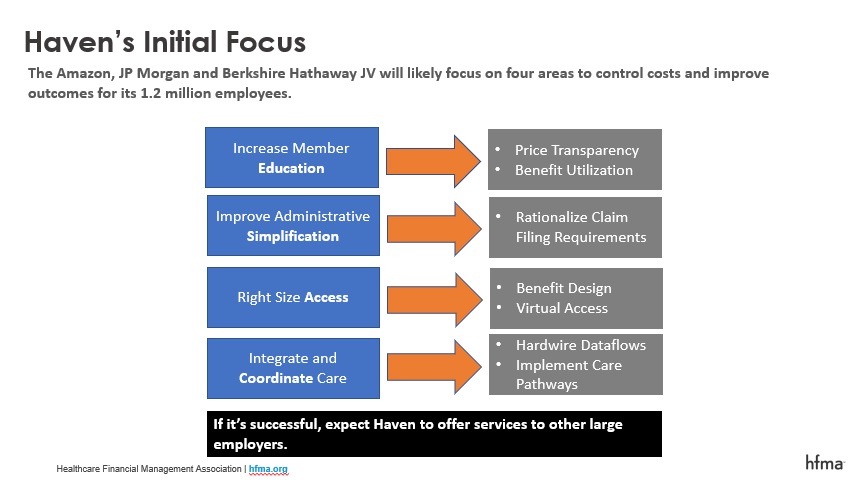

2. Who is one of the selected health plans? Aetna. Last time I checked, CVS/Aetna was one of the major disrupters everyone’s rightly concerned about. So, the fact that CVS/Aetna has partnered with Amazon and JPMorgan would raise my agita level. And when we think about Haven’s goals (see the exhibit below for details), the CVS/Aetna integrated offering should meet most, if not all of them in the near future. In particular, CVS/Aetna is fast approaching being able to meet the “right-size access” need with the planned expansion of HealthHub locations (the preliminary HealthHub pilot stores saw increased store foot traffic, sales and margins so, it’s full speed ahead with at least 600 locations targeted by the end of next year) and a nationwide relationship with Teladoc to provide care via telehealth.

3. An integrated plan with care delivery assets like CVS/Aetna should be able to integrate and coordinate care as they’ll have the claims data and some portion of the members’ clinical data, which will allow for better care pathway development. And finally, it’s not hard to imagine the HealthHub’s instore concierge being able to meet the requirement of increasing member education by helping employees understand their benefit design and the price differences in different sites of service given they’ll have access to price data should someone need a referral for services beyond what the HealthHub can provide.

I think focusing on JPMorgan’s, Amazon’s and Berkshire Hathaway’s combined 1.2 million employees misses the plot. It’s a lot of people, particularly when you add in dependents. And, if you’re in a market where one of these companies is a major employer, it might have the potential to be disruptive to you locally. However, over 180 million people get insurance through their employer. And ultimately, I think that’s what Haven’s aiming at. I would be shocked if they don’t find a way to package their solution, once proven on their employee population, and sell it to other large employers and Medicare Advantage plans.