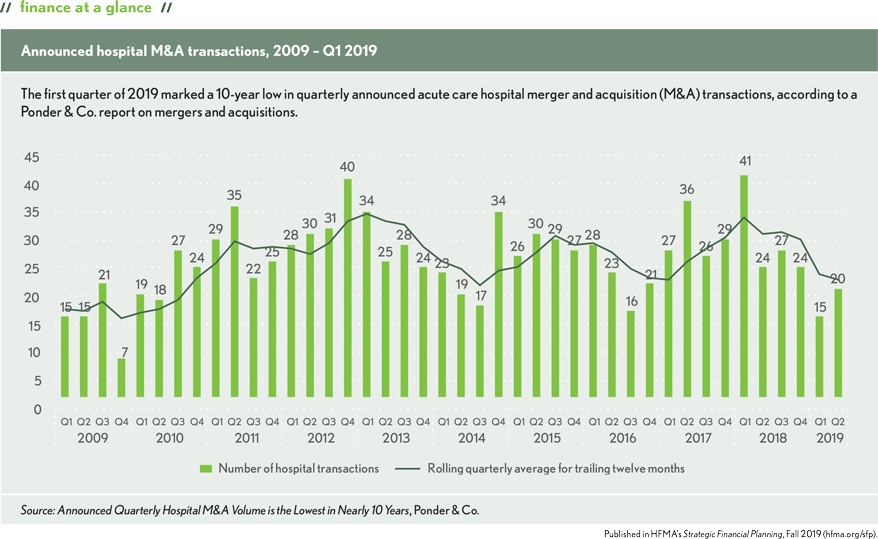

Announced hospital M&A transactions, 2009 – Q1 2019

The first quarter of 2019 marked a 10-year low in quarterly announced acute care hospital merger and acquisition transactions, according to a Ponder & Co. report on mergers and acquisitions. It also marked the first quarter since quarter three of 2016 with less than 20 announced transactions.

One driver of the slowdown is the reduced pace of for-profit divestitures since an active selloff period in 2017 and 2018. Although for-profit healthcare organizations have sold their most isolated and disparate assets during the active 2017-18 period, it is likely that for-profit divestitures will continue as these systems further evaluate and reposition their portfolios, but at a slower pace with less urgency.

The report notes that the slowdown is not a sign that hospital merger and acquisition activity is nearing an end. Reasons include the need to grow at rates that exceed expense inflation and to address payment challenges, technology and capital needs and uncertain value-based payer models.