Acute Care and Critical Access Hospital Occupancy Rate Variability by Location

Occupancy rate is a metric commonly used to examine the portion of a hospital’s inpatient capacity being utilized for inpatient care. It represents the percentage of a facility’s beds that are occupied, on average, each day of a specific period being studied. This percentage is calculated by dividing the number of patient days observed by the bed days available for the period. Frequently, the period studied is one year. The result can provide valuable insight for evaluations of whether adjustments are needed to operating capacities for individual institutions or entire markets.

This analysis is based on Medicare cost report data for all hospital cost reports filed for the period that ended during 2016. The total days of acute care provided and acute care beds for all short-term acute care and critical access hospitals were summarized, and the resulting days then were divided by the bed days available for the year. Bed days were determined by multiplying the number of beds by the number of days in the period, in this case 366, which accounted for 2016 being a leap year.

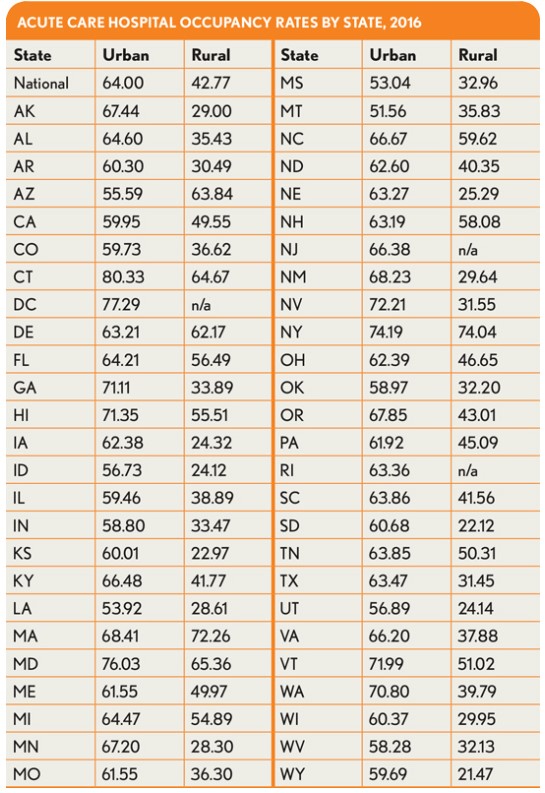

The exhibit below presents national and state-by-state results for hospitals classified as either urban or rural based solely on location. The criteria used by CMS for reclassification by labor market were not considered in this analysis.

These results show significant variation between rural and urban hospitals and higher rates of occupancy among rural facilities in Northeastern states. Hospital operators may find these broad figures useful when beginning to examine their own occupancy rates versus peers and their own specific markets.

This analysis was performed by American Hospital Directory, Inc., Louisville, Ky. For more information, contact William Shoemaker.