2 tools to help providers optimize patient payment plans and boost collections

Healthcare organizations can work toward a more efficient patient payment process by analyzing the cost of payment plans.

As rising deductibles and out-of-pocket responsibility strained the ability for people to pay hospital bills, many providers began supporting patients and mitigating bad debt by offering interest-free extended payment options. Although growth has been substantial, with many organizations building large portfolios of such loans, providers are often unaware of the true cost of offering these payment programs.

The first tool and one of the most effective and illuminating methods to determine the built-in costs of payment plans is using a net present value (NPV) of cash flows. Sometimes called discounted cash flow analysis, this approach simply calculates the value in today’s dollars of a future stream of incoming and outgoing cash flows. The tool enables organizations to quantify and compare the impact of extending monthly payments interest-free for varying lengths of time.

3 essential NVP calculation components

The three essential components of the calculation are as follows.

Weighted average cost of capital (WACC). An organization sets an expected return on invested capital, which is usually much higher than its cost to borrow money. The blend between desired return and borrowing cost is the WACC. This rate is used to discount the cash flows received from payment plans to current dollars.

Servicing cost. Collection costs consist of actual expenses associated with FTE servicing of the payment plans (phone calls, payment posting, etc.), credit/debit card acceptance fees, monthly statements, delinquent notices, nonsufficient funds fees, bank processing fees and other outlays. Note that, except for the card acceptance fees, these servicing costs generally do not vary based on the amount being collected. That means smaller balances are costlier on a percentage basis than larger ones. At $5 per account monthly service cost, a patient paying $20 per month is effectively receiving a 25% discount, while someone paying $50 is receiving a 10% discount.

Bad debt rate. The bad debt rate is directly available by isolating and tracking defaults specifically for payment plans. However, most healthcare organizations lump payment plans together with all self-pay accounts, skewing the numbers. Payment plans should perform better as a rule than the entire self-pay portfolio because patients have verbally committed to the loan terms and payment amounts. A provider’s demographics, service lines, service quality, repayment terms and ability to service payment plans effectively will all affect bad debt rate.

It is also important to address that there is often a temptation for an organization to pass on some of the costs associated with payment plans to those utilizing the option. However, while the rationale for such an approach might be justifiable, the reality is for many patients already in a tough situation, a provider passing on hidden costs in the form of plan fees or interest would create further financial hardship.

Bringing it all together: An illustration

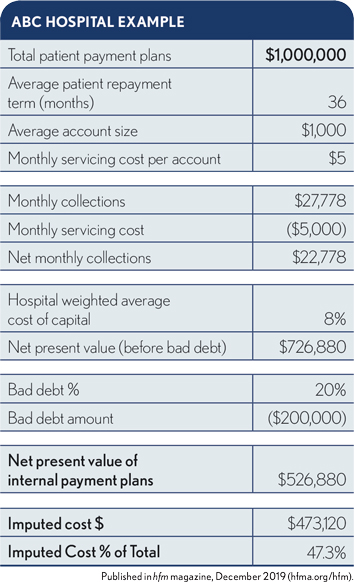

The exhibit below shows how the second tool, a simple calculator can be constructed using these variables.

In this example, ABC Hospital has the following characteristics:

- 1,000 payment plans currently being serviced

- $1,000 average balance

- $5/month/account servicing cost

- 8% weighted average cost of capital as determined by the CFO

The present value calculation shows that, post-bad debt, this million-dollar portfolio carries an imputed cost of $473,000 for a 47.3% rate. While the 53% capture level likely substantially exceeds the receipts expected if the accounts went to bad-debt collection, the cost still represents a significant target for savings.

Solutions to minimize imputed cost and maximize collections

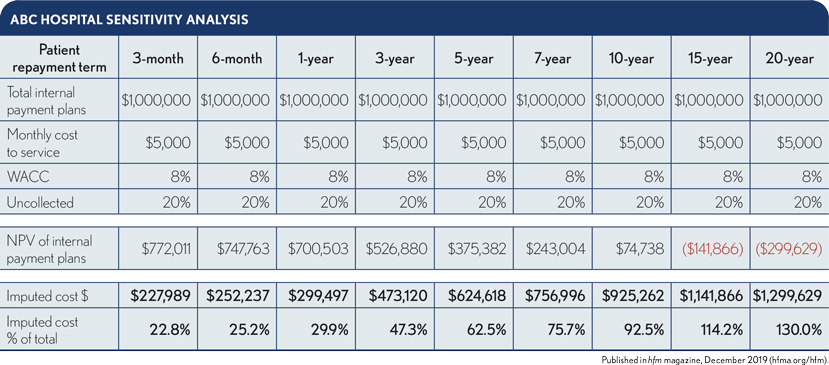

Armed with this tool, ABC Hospital can evaluate ways to minimize its imputed cost and maximize collections. Two easy methods to improve results are to increase minimum payments or shorten payment terms. The exhibit below shows a sensitivity analysis on the latter option across a range of term lengths. It shows the imputed cost percentage for three-month plans just under 23%, rising substantially as the duration extends. In fact, at a 15-year repayment term, ABC Hospital would lose money on the loan portfolio.

Working with an organization’s own metrics and assumptions, leaders can perform the analysis to model and evaluate various scenarios such as capping duration at two years or working with a third party for longer-term contracts.

Moving forward, patient payment plans will continue to increase in both volume and dollars. Healthcare organizations that have not done so already are in a great position to leverage the opportunity to fine-tune their current plan offers and optimize existing portfolios using available data and discounted cash flow analysis. The impact can be substantial.

Payment plan challenges every provider should consider

Although extended patient payment programs are critical to effective financial management and patient satisfaction, they carry significant risk and cost exposure. These plans place providers in a difficult position, pulling focus and resources toward long-term financial servicing and away from patient care.

Additionally, most organizations lack the financial resources and expertise to effectively manage these programs because:

- Payment terms can vary widely from patient to patient.

- Some patients carry multiple plans, making tracking more complex.

- Staff may not have bandwidth to follow-up and collect on delinquent plans given other revenue cycle priorities.

Offering payment plans is vital to serving the provider’s community and maintaining the organization’s financial health. However, an examination of the true cost of time and resources to service such plans, as described above, is necessary..

Perspective: Payment plan cost measurement

There are various ways to calculate the built-in cost of providing and servicing patient payment plans. Regardless of the calculation method, there is a real cost for an organization to delay payment on its receivables. For some accounts, it takes patients years to pay off the plan. And all the while, the provider is also incurring a service cost. Organizations often prefer to offer prompt-pay discounts where possible to avoid the cost.