The healthcare CFO of the future: How finance leaders are adapting to relentless change

As the healthcare industry acclimates to disruption, major health systems are turning to their CFOs for crucial guidance. Four leaders give insight into what’s in store for the position.

- The forces that are disrupting healthcare require health system CFOs to be nimble and adaptable in performing their duties.

- CFOs are taking more of a strategic role in helping their organizations meet new challenges and capitalize on new opportunities, including innovative partnerships and fresh lines of business.

- Along with their traditional duties as controller, treasurer and economic forecaster, CFOs will help manage profound organizational change.

Dominic Nakis, CFO of one of the country’s largest health systems, goes to work each day at the suburban Chicago office park where his organization moved its corporate headquarters in 2013. While the commute has been constant since then, plenty else about his workday has shifted.

As is true of most health system finance leaders, Nakis is feeling the impact of the changes that are transforming healthcare.

“It’s really expanded my view and approach to my job,” Nakis says. “There’s certainly more in terms of mergers and acquisitions, expanding into new and different lines of business and attempting to incorporate more automation and standardization into work processes.”

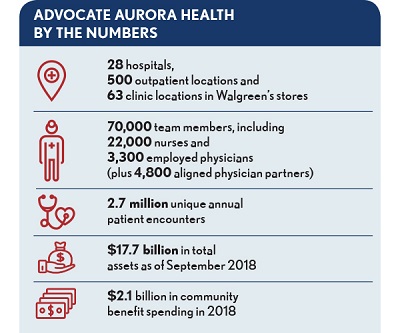

A prime example of the changes: That suburban office is now one of two corporate headquarters for Advocate Aurora Health, the product of a 2018 mega-merger and the ninth largest not-for-profit health system in the country. Nakis, who started as CFO of Advocate Health Care in 2006, played a central role in planning and executing the transaction with Aurora Health Care.

Of all the changes to the CFO role in recent years, the most significant is that it’s become much more strategic. “Especially in mid-sized and larger organizations, the CFO is definitely focused on the future,” says Rick Gundling, FHFMA, HFMA’s senior vice president of healthcare financial practices.

Having eyes on the future requires CFOs to work in partnership with not only their finance teams but also other members of the C-suite. “When I talk to CEOs, many feel like they cannot move their organizations forward without their CFOs,” Gundling says.

CFOs also are having more conversations about technologies like analytics, artificial intelligence and automation that can bring greater efficiency to the revenue cycle and other functions, Gundling says. As their organizations become more technology-driven, CFOs need to understand how to apply such tools to drive down costs and improve operational efficiencies.

Another increasingly critical skill for CFOs is the ability to leverage their business acumen to help educate leaders outside of finance on how they can use data to improve their performance. “In many ways, the CFO is almost becoming a coach to help clinical and operational leaders use their financial data,” Gundling says.

Having a consumer focus also is becoming progressively more important. “In the future, the most successful CFOs will be able to look through the lens of the consumer and purchaser and bring their value proposition to life by increasing quality and decreasing the total cost of care to make care more affordable,” Gundling says.

As exemplified by the four leaders profiled below, CFOs are embracing their new responsibilities. Nakis is soft-spoken by nature, but while posing for a photo, he grows animated when discussing some of the challenges and opportunities that lie ahead for healthcare finance leaders.

“It’s professionally rewarding,” he says in an interview. “It’s part of our role as we work toward guiding the continued evolution of our organization.”

Dominic Nakis, CFO, Advocate Aurora Health

After spending eight years in assurance practice, largely in the healthcare division of Ernst & Young, Nakis joined Advocate Health Care in 1986, when it was known as Evangelical Health Systems. Appointed to the CFO position in 2006, he has helped guide Advocate through a slew of major changes, most recently the 2018 merger with Aurora Health Care. The two systems had a combined 27 hospitals and more than $11 billion in annual revenue at the time of the transaction.

On the changing landscape: The industry looked vastly different when Nakis became CFO. “You go back to 2006 and prior, most health systems were primarily inpatient and outpatient hospital providers,” Nakis says. “You had hospitals and maybe you had some physicians.” These days, he notes, large systems are likely to own hospitals, large physician practices, ambulatory sites, post-acute care networks and potentially insurance operations and retail pharmacies. They also face different forms of competition (e.g., Amazon, Apple) than they probably envisioned as recently as a few years ago.

“And as we grow larger in scope and geographical coverage, other opportunities and complexities arise,” Nakis says. “Your people, processes and systems may become more dispersed, which then requires standardization and change management. We are also experiencing other partnership opportunities with for-profit and not-for-profit entities. Additionally, investment programs become larger and more complex. How do you use those investment programs then to help drive the strategies and purpose of the organization?”

On his changing focus: Early in Nakis’s tenure as CFO, he oversaw departments such as construction and facilities, biomedical and clinical engineering. The organization since has shifted those over to the operations team. “While the CFO role will undoubtedly always require an operational focus to achieve positive operating margins, my focus over time has become more strategic in nature,” he says. Such a focus “facilitates the opportunity to engage with all other C-suite executives on a frequent and intense basis to stay abreast of developments and contribute financial perspectives of business activities.”

On the digital transformation: IT is one department with which Nakis has been collaborating especially closely. The finance team has provided valuable perspective as Advocate Aurora installs a new electronic health record and enterprise resource planning system across the newly merged organization. “In terms of our role, it’s working with our business partners to help put together strategic and business plans with ultimate end goals in mind,” Nakis says. “What are we trying to accomplish as we’re going down those paths? What are the paybacks, what are the processes and procedures that we’re looking to replace and eliminate? We help keep a focus on those types of questions as the organization evolves.”

On where he sees the CFO role in five years: Nakis expects to focus even more “on the external environment around the organization. As we seek to transform ourselves, it’s going to require a set of skills in terms of analyzing what are appropriate opportunities for the organization as we enter new lines of businesses. How do we help predict what that impact is going to be on the organization’s sustainability for success in the long run?”

On adapting to change: Nakis says there is no way his formal education and training could have covered all the changes affecting the industry. “You certainly have a base of accounting and financial knowledge that is always going to be of value,” he says. “The experience and learnings that you get when it comes to how to operate as a leader, how to help manage change in the workplace — those are skills and abilities that you learn that are going to carry you throughout your career.” Reading up on new trends and seeking advice from mentors are key approaches, he says. “Certainly we all take risks and you learn from the times you fail, but there’s things you can do to help hone those skills and become successful as you practice them.”

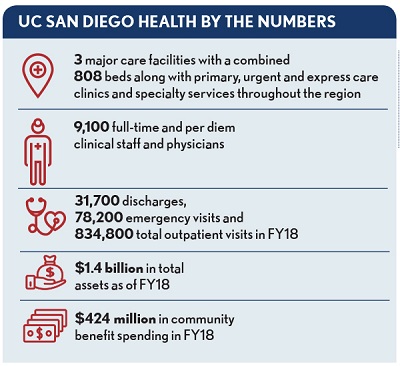

Lori Donaldson, CFO, UC San Diego Health

Donaldson has been with the San Diego area’s lone academic medical center (AMC) since 1990, having started in healthcare after seven years in the banking industry. She was the health system’s controller for 13 years before being appointed as CFO in 2010. She has helped guide the system through a decade of substantial growth during which its revenues increased from a little more than $1 billion to about $2.6 billion. In addition to the same pressures that other health system CFOs are confronting, Donaldson must help UC San Diego Health fulfill an AMC’s tripartite mission of excellence in the clinical, research and teaching realms.

On how her job is different today: The growth of the UC San Diego Health system and the macro-level forces affecting healthcare have impacted Donaldson’s role. “I continue to maintain responsibility over accounting and budgeting, revenue cycles, supply chain,” she says. “A lot more of my time is spent on more cross-functional activities with our contracting department, our quality department — really balancing the financial-stewardship aspects with the strategic role and partnership with our CEO.”

Donaldson estimates that her time these days is equally split between the more traditional duties and the more strategic types of initiatives and investments, including a clinically integrated network and a Medicare accountable care organization. “A good CFO really has to be able to wear both hats,” she says.

On moving beyond a technical focus: Alignment with faculty and community providers is vital to driving the transformational activities that UC San Diego Health is seeking to implement. Donaldson supports alignment by making financial information easier and more transparent for those stakeholders and easier for them to act on.

“I’ve also found that by collaborating with physicians on process improvement activities and in the budget process, they become more engaged and willing to help us do some of the difficult things that we have to do to be successful in this changing environment,” she says. That type of outreach comes naturally to her, she says, simply because she likes working with team members to help them get over their fear of change or the unknown.

On where the CFO role will be in five or 10 years: Donaldson anticipates that trends such as value-based payment models and consumerism will remain big factors for healthcare finance leaders. But she also thinks the torrential change will require CFOs to go back to the basics, in a way. “All of these market forces and challenges in our industry are going to drive CFOs back a little bit toward more of an emphasis on cash and capital management,” she says. “Our balance sheets are going to become more strained. That balance of investing in operations and investing in strategy is going to require a lot of discipline around capital management and how we set our priorities, how we evaluate competing investments.”

On what she would tell aspiring CFOs: To someone who is just starting a career in healthcare finance, Donaldson would emphasize the fast-paced, complex nature of a modern-day CFO position and the need to stay in a mode of continuous learning and adaptation. “You can’t be somebody who is resistant to change,” she says. “To be successful as we look forward, we’ve got to be thought leaders. We have to be innovators. We have to help our organizations find new ways of raising revenue. We have to be willing to look at other delivery models and consider partnering with entities we might not have considered partnering with before.”

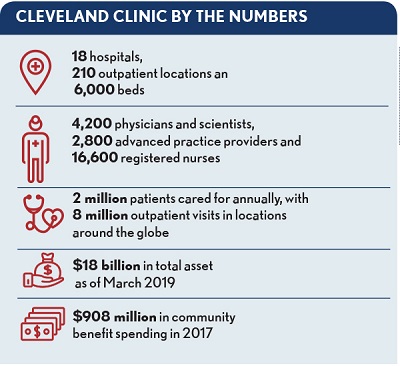

Steven Glass, CFO, Cleveland Clinic

Since becoming CFO of Cleveland Clinic in 2005, Glass has helped guide the internationally acclaimed health system, which now includes 18 hospitals and more than 210 outpatient locations in Ohio, Florida, Nevada, Canada and the United Arab Emirates. Cleveland Clinic, which had $9.8 billion in operating revenue in 2018, is a top-five hospital nationally, according to U.S. News & World Report’s rankings.

On his changing focus: Beyond financial stewardship, Glass now has more responsibility for strategy, market growth and operating performance. He and his team also spend more time educating everyone in the organization, including front-line clinicians and customer-facing positions, about what drives performance. “It is becoming more important that everyone understands how they can achieve their revenue and operational performance goals,” he says.

On being a strategic CFO: Today, Glass collaborates with his system’s chief strategy officer (CSO) more than with any other leader in the organization. “We are working side by side on many growth opportunities and the strategic direction of the organization itself,” he says. One such project is Cleveland Clinic’s new London location, which is scheduled to open in 2021.

Glass can make time for his expanded responsibilities because he has a competent and dedicated finance team. “If you don’t have a strong team and controls, as well as a good infrastructure and the ability to grow talent, you’re going to struggle to shift your focus as a CFO to spending more time on strategy,” he says.

On the skills CFOs increasingly need: To be effective in his changing role, Glass has had to carefully consider how he communicates and collaborates with colleagues. “What has made me successful today is having the communication skills to work with teams far outside of finance and be able to communicate the importance of what we are trying to achieve as an organization,” he says.

On collaborations with tech: For the past 15 years, Glass has overseen Cleveland Clinic’s data analytics and business intelligence functions, which continue to expand as the organization leverages analytics tools to reduce variation, improve quality and reduce costs.

Glass also works closely with the health system’s head of compliance and its chief information officer on cybersecurity issues, particularly as the organization explores mergers and acquisitions. “Review of cybersecurity has become a key component of due diligence,” he says.

On where he sees the CFO role in five to 10 years: Glass predicts that teamwork among C-suite members will be critical to the ability of health systems to improve care quality, the patient experience and financial and operational performance. He also believes that the responsibilities of CFOs, COOs and CSOs will continue to overlap.

“Ten years ago, there were very clear lines between those roles,” Glass says. “Ten years from now, we are going to see the further blurring of those lines.”

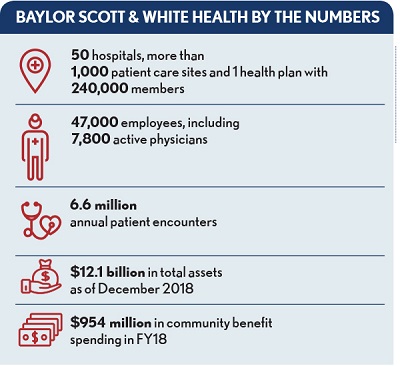

Penny Cermak, CFO, Baylor Scott & White Health

Prior to becoming the system CFO in April 2019, Cermak served as Baylor Scott & White’s senior vice president and CFO for hospitals and clinics for two years. In that role, Cermak led the integration of the health system’s financial operations following the 2013 merger of Baylor Health Care System and Scott & White Healthcare. Today, the Dallas-based health system includes 50 hospitals and more than 1,100 access points.

On the forces reshaping the CFO role: Integration has broadened the role of the CFO beyond financial oversight, particularly in large organizations, Cermak says. “The role of the CFO is becoming more focused on leading other leaders,” she says. “For example, I’ve spent hours working one-on-one and in teams with our regional and entity executives — presidents, CMOs, CFOs, CNOs — to ensure we’re on track with targets. A lot of that work is engaging with the leaders to develop action plans and new ways of looking at the possibilities.”

On creating alignment across the system: An emerging responsibility of CFOs in large integrated health systems is promoting alignment. In her new role, Cermak oversees 22 CFOs representing the system’s hospitals, clinics, health plan and accountable care organization. “By having all of the CFOs on my team, we are able to standardize and align across the organization,” she says. This reporting structure also helps finance leaders share best practices and transfer effective processes across the system, she says.

On having a long-range view: Beyond helping leaders develop action plans to contain costs, today’s CFOs also are responsible for driving growth to ensure financial viability, Cermak says. For example, Cermak and her team have been collaborating with clinical and operational leaders to expand healthcare services in markets across Baylor Scott & White’s service area.

As healthcare organizations put more focus on the future, Cermak says, CFOs can use their logic-based and financial skills to help their executive teams prioritize strategic investments. “We have to be very diligent about where we invest and how our next dollar is best spent to support the organization’s mission,” she says.

On the importance of good communication: Cermak hosts regular live or virtual “huddles” to facilitate communication with her team and other leaders in the health system. “Moving into this role, I am even more cognizant of the need to be an effective communicator, especially across such a large organization,” she says. She leverages her communication and change management skills to help ensure that messages from her office are not only appropriate but also inspirational. “We are in it together — listening to and communicating with our talented people emphasizes their important role in achieving our ambitions,” she says.

On where she sees the CFO role in five to 10 years: Ongoing cost pressures and the shift toward value-based care mean that CFOs’ skills and expertise will be valued by other organizational leaders for years to come, Cermak says. Given the industry’s continued evolution, she believes all healthcare organizations can benefit from CFOs who are innovative and creative yet disciplined. “Our boards and our teams are counting on us to ensure that our organizations are positioned to drive thoughtful, positive change,” she says.