A closer look at healthcare payment methods

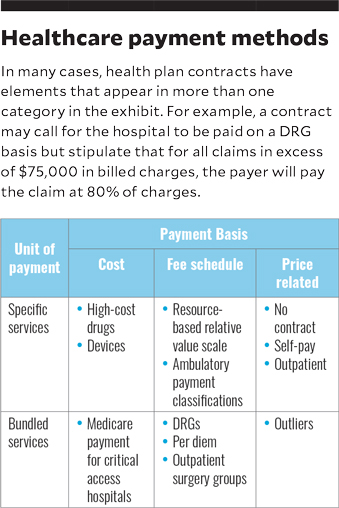

To better understand the three myths regarding the benefit of replacing percent-of-charge provisions with fixed fees, a short description of alternative payment methodologies is critical. The exhibit below presents a scheme for categorizing payment plans by:

- Payment basis

- Unit of payment

Payment basis describes how a payer determines the amount to be paid for a specific healthcare claim. There are three payment bases:

- A cost-payment basis simply means that the underlying method for payment will be the provider’s cost, with the rules for determining cost specified in the contract between payer and provider. Cost-payment arrangements are rare outside of Medicare payment for critical access hospitals.

- A fee-schedule basis means the actual payment will be predetermined and will be unrelated to the provider’s cost or its actual prices. Usually fee schedules are negotiated in advance with the payer or are accepted as a condition of participation in programs such as Medicare and Medicaid.

- A price-related-payment basis means the provider will be paid based on some relationship to its total charges or price for services. For example, a payer may negotiate payment at 75% of billed charges for all services or for selected areas such as outpatient procedures.

Unit of payment refers to methods of grouping the services provided to a patient:

- In a bundled services arrangement, services provided to a patient during a care encounter are aggregated into one payment unit. For example, health plan contracts often pay for inpatient services on a per-day or per-DRG basis. Payment is fixed based on a negotiated fee schedule (e.g., $1,000 per day to cover all services provided) and is the same regardless of the level of ancillary services provided. Higher degrees of bundling include payment for certain episodes of care or for a covered life in a capitated arrangement.

- In a specific services payment arrangement, the individual services provided to a patient during a care encounter are not aggregated. An example is a contract that pays for outpatient surgery based on a fee schedule for the surgery as well as separate payments for any imaging or lab procedures performed.