Financial Analytics Leadership Council members share 5 challenges, responses to pandemic’s financial long haul

Sponsored by

Since July 2020, Syntellis has shared data, insights and key performance indicators aggregated from more than 900 hospitals and health systems to quantify the financial impact of COVID-19. This valuable data clearly shows year-over-year declines in margins and volumes and increases in expenses. For example, operating margin was down 4.9% without CARES funding, adjusted discharges were down 10% and total expenses per adjusted discharge increased 14.4%.a But the data doesn’t capture how healthcare leaders responded to these challenges.

To understand healthcare finance teams’ COVID-19 response, Syntellis partnered with HFMA’s Financial Analytics Leadership Council (FALCO) to collect data through a December 2020 survey of HFMA members and a January 2021 virtual meeting where more than 25 FALCO members discussed survey results and shared insights. During the roundtable discussion, an important theme emerged: The pandemic’s profound impact on revenue, volume and expenses has created a unique and critical need for data and analytics.

1. Declining operating margins and revenue force planning process changes

No one can accurately predict or adequately plan for a pandemic, but some healthcare organizations embraced the difficult timing by turning it into an opportunity to realize long-needed changes.

For one member’s organization, the pandemic hit right as they embarked on financial planning for fiscal year 2021. As a result, the organization ran without an operating budget for the first six months of the fiscal year. After talking for years about moving from an annual budget to rolling forecasting, the finance team agreed that 2020 was a good time to make the leap. For the second half of the fiscal year, this organization will use rolling forecasting to complement the operating budget. But looking ahead to fiscal year 2022, rolling forecasting will replace the operating budget in its entirety.

Additionally, 71% of HFMA members indicated a focus on making changes to capital planning processes. One member’s organization reevaluated its capital plans in anticipation of the pandemic’s lasting effects, prioritizing investment in telehealth technology and redesigning administrative spaces to account for more remote employees.

2. Changes in payer mix and increased unemployment will have lasting impacts

Increased unemployment and the subsequent changes in payer mix created additional challenges that impacted financial planning and priorities. Fifty-five percent of HFMA members experienced a negative impact on operating margin. To address this, 90% plan to focus on reducing expenses in 2021.

One member’s urban healthcare organization saw firsthand the effect of individuals moving out of the city. The payer mix shifted to include more government payers, and operating margin took a hit. As a result, the organization revisited its 10-year plan, indicating that what was once thought to be a short-term issue would have a longer-term impact on future plans.

Declining profitability also raised the question of whether large capital spends were at risk. Several FALCO members recalled discussions within their respective organizations around reevaluating leases and shifting some administrative employees to permanent remote status to free up space and shift expenses.

3. Sharp drop in patient volumes underscores importance of value-based care and diversified revenue streams

Having the same volume with a different payer mix would present unique challenges of its own, but volume decreases in the ED, OR and chronic condition screenings resulted in additional shifts to the plan — including adjusting capital and cash, reducing overhead expenses and focusing on additional revenue opportunities.

Despite declining volumes throughout much of 2020, 40% of HFMA members were optimistic that their organizations would return to pre-pandemic volumes over the next year. However, for those that typically budget for some level of growth, a return to projected pre-pandemic 2020 volumes would mean coming in below budget in 2021. Looking at performance in individual areas of the organization — such as surgery, outpatient and the ED, among others — may help healthcare leaders identify improvement opportunities and plan accordingly for decreased volumes in other areas.

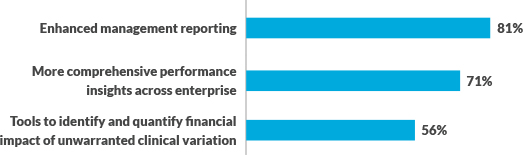

Survey respondents’ data and analytics priorities

One member shared that his organization is already within several percentage points of pre-pandemic volumes by putting the patient first and simply remaining open for business. Rapidly deploying telehealth services was key to supplementing declining outpatient volume. Another member echoed this sentiment, suggesting that virtual ED visits would be part of the new norm, and therefore must be considered in the volume budget. A third member suggested that a strong partnership with the organization’s physician network would deliver growth in primary care and specialty care.

Further, the recent shift from volume-based reimbursement to value-based care presented the question of whether the pandemic would expand those arrangements or force organizations in a different direction. As one member pointed out, value-based care reinforces healthcare organizations’ financial challenges and puts a sharper focus on the need to perform well. She also shared that her organization is looking to additional revenue streams — such as expanding urgent care centers — to help offset the pandemic’s financial impacts.

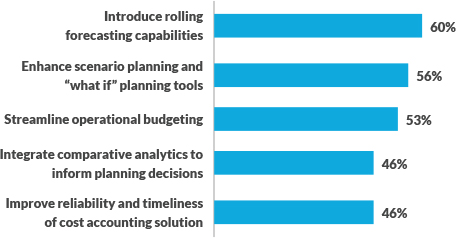

Survey respondents’ changes to planning solutions

4. Increased expenses drive additional need for agility

As every healthcare finance leader knows, plans and actuals don’t always align. Despite healthcare organizations’ earnest efforts to cut costs, Syntellis’ Axiom™ Comparative Analytics data shows that hospital expenses were actually higher in 2020 than in 2019, with only two months — April and May — showing year-over-year decreases in total expense and total labor expense. This same data also revealed total expense per adjusted discharge and labor expense per adjusted discharge remained higher than in 2019.b

As one member explained, it’s no surprise that the total expense per adjusted discharge was higher in 2020 than in 2019. Hospitals dealt with significant increases in the cost of supplies and commodities while at the same time addressing supply chain challenges. But, where one expense category increases, another must decrease to hit the target.

If this trend continues, healthcare organizations have two options: hold the line with current expenses in hopes that volumes will indeed recover or find new ways to reduce costs.

Deploying tools to support labor productivity emerged as a top strategy to control costs in 2021. One member shared that her organization relies heavily on daily productivity data for both physicians and staff. Even though productivity wasn’t a challenge for her organization in 2020, nursing shortages meant having to rely more heavily on agency resources that came at an increased labor cost. Having granular access to both productivity and labor data provided the organization with a clear picture of levers available to pull to reduce costs and meet expense targets.

5. Healthcare finance leaders need data and analytics now more than ever

FALCO members’ final discussion point was centered around the increasing appetite for more data and analytics as decision-making timelines have accelerated. For some finance teams, this may mean an increased burden. Still, for others, it represents an opportunity to leverage new tools, data and analytics to aid decision-making and ultimately elevate the finance office.

Data and analytics will be vital to COVID-19 recovery efforts in the months and years ahead. In the face of intense volume and revenue pressure, and increasing expenses, FALCO members recognized that controlling costs and optimizing efficiency will be essential to lasting recovery, but also that achieving those objectives is increasingly difficult without access to data and analytics. Monitoring, analyzing and reporting on organizational performance will help identify and swiftly act upon opportunities for improvement.

About Syntellis Performance Solutions

Syntellis Performance Solutions, previously Kaufman Hall Software, provides innovative enterprise performance management software, data, and analytics solutions for healthcare organizations. Syntellis’ solutions include Axiom and Connected Analytics software, which help finance, clinical, and operations professionals elevate performance by acquiring insights, accelerating decisions, and advancing their business plans. For more information, please visit www.syntellis.com.

This published piece is provided solely for informational purposes. HFMA does not endorse the published material or warrant or guarantee its accuracy. The statements and opinions by participants are those of the participants and not those of HFMA. References to commercial manufacturers, vendors, products, or services that may appear do not constitute endorsements by HFMA.

Footnotes

a. Top 5 Healthcare Finance KPIs for 2020, Syntellis Performance Solutions, January 2021. www.syntellis.com/resources/article/top-5-healthcare-finance-kpis-2020.

b. 2021 Healthcare Financial Trends Report, Syntellis Performance Solutions, January 2021. www.syntellis.com/resources/report/2021-healthcare-financial-trends-report.