Eric Jordahl: Preparing health system balance sheets for the journey to normalization

The Federal Reserve’s recent signal that it will transition to a tighter monetary policy is an indication that the organization and the economy are entering a new, more stable stage.

Since the COVID19 pandemic struck in March 2020, we have anticipated that responses to it will move through the following three stages:

- Crisis, which was marked by an initial rush to liquidity and the Federal Reserve’s decision to double-down on an accommodative monetary policy first initiated during the financial crisis of 2008-09

- Stabilization, where the focus will transition to the credit and economic/inflationary implications of both the crisis and the crisis response, which may be starting now and may have an extended duration

- Normalization, which will occur at a yet-to-be-determined date with a yet-to-be-determined definition of normal

The Fed operates under a dual mandate to pursue both price stability and maximum employment. Inflation accelerated throughout 2021, but the Fed maintained its focus on its employment mandate under the belief that inflationary pressures on prices were transitory.

As signs increasingly pointed to inflation being something other than transitory, and with labor markets strengthening, the Federal Open Market Committee (FOMC) announced a policy pivot at its mid-December meeting. The wind-down of the Fed’s asset purchases that had been announced earlier will be accelerated, doubling the pace of the taper to bring asset purchases to a full stop by March 2022. Asset purchases are another mechanism for putting more money in the system while encouraging risk-taking by trying to keep a lid on long-term interest rates.

Accelerating the slowdown to a stop will likely change how long rates perform and is expected to clear the way for the Fed to initiate increases in the federal funds rate. All members of the FOMC now project at least one rate increase in 2022, up from a 50/50 split of the members on the need for rate increases at their September 2021 meeting. For more on how the Fed has been responding, see my column in the Winter 2021-22 issue of hfm magazine.a

Treasury bond market remains strong for now

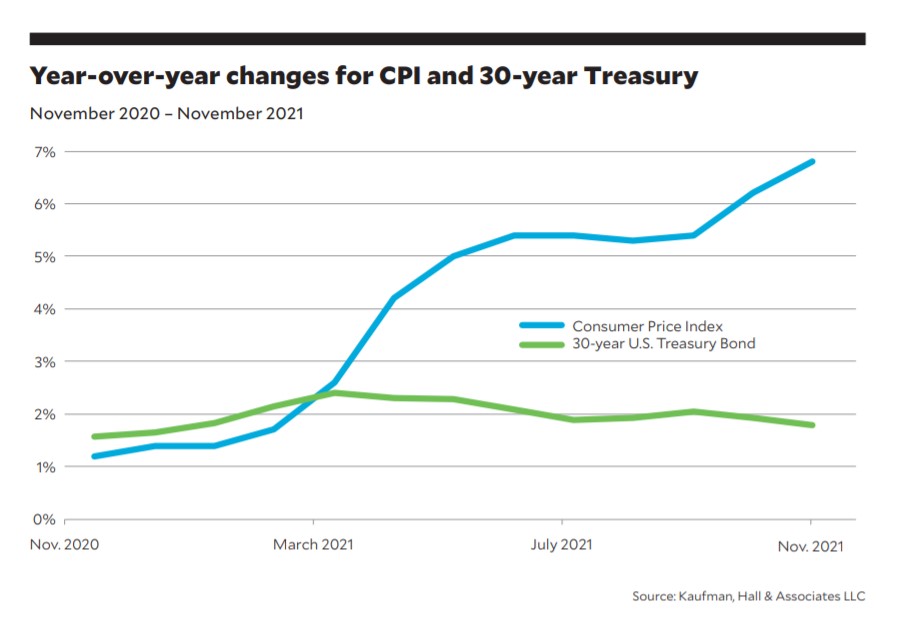

Treasury rates remained largely unaffected by indications of mounting and broadening inflationary pressures through 2021. The exhibit on page shows accelerating year-over-year increases in the Consumer Price Index (CPI), as a proxy for inflation, versus changes in 30-year Treasury rates. From November 2020 to November 2021, annual CPI increases moved from 1.2% to 6.8% and Treasuries moved from 1.57% to 1.79%. Change the start of the measurement period to March 2021, and CPI increased from 2.6% to 6.8% while 30-year Treasury rates fell 62 basis points from a 2.41% starting point.

At some point, however, it seems likely that a combination of inflationary pressures and Fed action will cause a shift in the capital markets. The work in front of health system finance and treasury teams is to understand the consequences of this shift and what it will mean for their organization’s financial performance, credit position and resiliency.

The three parts of a health system

We think of not-for-profit health systems as three companies rolled into one: A mission-driven operating company supported by a finance company and an investment company.

Organizational balance sheets — the responsibility of the finance and investment companies in the health system — have served as a resiliency anchor thus far in the pandemic as health systems have encountered multiple bouts of operational volatility.

From an operational standpoint, the major concern is that these adverse bouts of volatility may be settling into something more permanent. Data from the October and November 2021 issues of Kaufman Hall’s National Hospital Flash Report shows startling levels of margin and expense dislocation. November’s report marked the second consecutive month of operating margin declines, with the median change in operating margin down 3.1 percentage points compared with 2019 pre-pandemic levels. Labor expenses remained stubbornly high, and continued to rise, up nearly 15% from 2019. Once in place, these expense increases will likely have a relatively long tail and continue to challenge operating performance.

Balance sheet resiliency

A tighter monetary policy and rising rates threaten to introduce similar volatility to the balance sheet’s core healthcare resiliency resources: unrestricted cash and investments. These resources will retain their primary resiliency role, even if they become less reliable, but falling or more volatile non-operating returns will underscore health systems’ income statement vulnerability. This may change the idea of how much balance sheet is sufficient to defend a credit position, fund capital, support strategic transformations and do the myriad other things needed to push through stabilization to normalization.

Resource management factors

Amid this uncertainty, the best approach for finance and treasury teams is strategic resource management. This involves continuously reassessing the following four factors:

- The portfolio of resources that are in place to support the organization

- The form of those resources; for example, whether they already are in the form needed to make their best contribution (e.g., unrestricted cash) or require an event or transaction to unlock their full potential contribution (e.g., issuing debt to transform debt capacity into capital or selling non-core real estate to transform a fixed asset into a liquid asset)

- Whether each form makes the best resiliency-risk contribution

- Whether it is possible to change various forms into something more accretive

There will be many different paths to a successful transition from stabilization to normalization, as we move from treating COVID-19 as a pandemic to treating it as an endemic (and manageable) condition. All of them, however, will likely be long and have multiple obstacles in the way.

Healthcare balance sheets — and the teams that manage them — will continue to confront their own dual mandate tension between generating resiliency (offsetting risk) and driving independent return.

They face the same challenge as the Fed: Their ability to navigate from here to whatever is at the end of all this uncertainty will require that they get their dual mandate priorities right at each juncture.

Why long-term investors have been shrugging off irrefutable warnings about inflation

There are several possible reasons for this behavior.

Investors remain more afraid of COVID-19 and its potential for further economic disruption than they are of inflation or anything else. Treasuries remain the global risk haven that investors run to in moments of elevated fear and dislocation. This would suggest that investors have yet to move from a crisis to a stabilization point of view.

Investors still believe that inflation is transitory. If inflationary pressures are the product of stimulus driving demand, paired with supply chain disruptions, both of these factors should eventually moderate and inflation will slow, even if price increases remain in place for an extended period. In this scenario, the longer-term issue is not inflation so much as the adverse credit implications of a higher cost structure.

There is so much capital in the system that investors must remain invested, regardless of what happens with inflation and real returns. This means that the Fed holds virtually all the power and that the only option for investors is to stay in the game and take whatever is given in each moment.

Footnote

a. Jordahl, E., “Hospitals and health systems face risk as the Federal Reserve pursues normalization,” hfm, Winter 2021-22.