Analyzing pre-payment and point-of-service collections efforts

As organizations aim to more reliably collect patient payments, they are beginning to appreciate the advantages of having financial conversations earlier in the patient encounter. When these discussions are consistent, compassionate and data-driven, they can improve collection rates while fostering a positive patient experience.

To learn more about how hospitals and health systems are making strides in proactively collecting patient payments, the Healthcare Financial Management Association (HFMA) conducted intercept interviews with some of its members during its 2019 Annual Conference. The following research report, sponsored by Parallon, explores key takeaways from these discussions.

Healthcare organizations vary on pre-payment and point-of-service collections policies and procedures

Although 96% of people interviewed indicate their organizations have pre-payment and point-of-service collections policies and procedures, there is wide variation in how organizations approach this work.

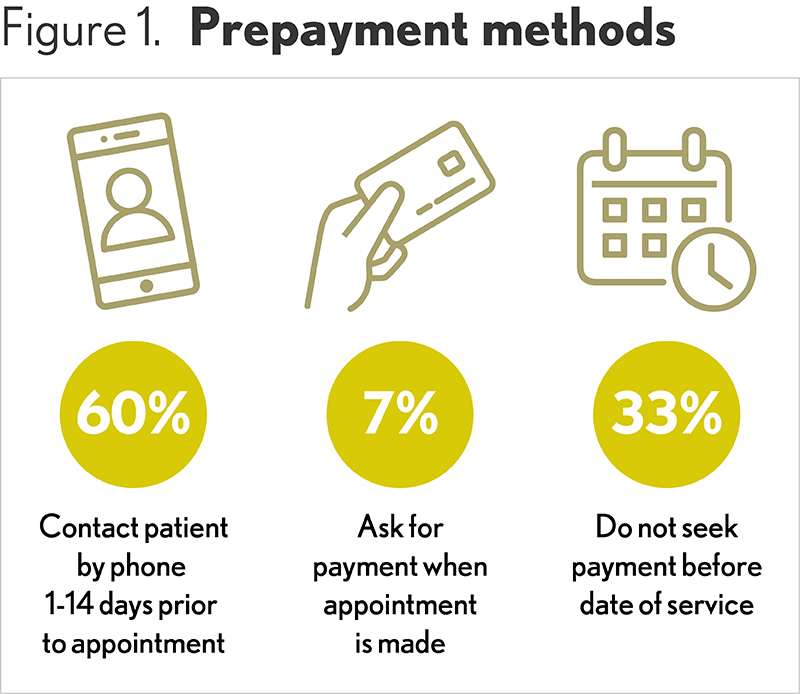

Pre-payment policies. A majority of respondents engage in pre-payment activities. Fully 60% indicate their organizations reach out to patients via phone anywhere from one day to 14 days prior to an appointment or treatment, with the most frequent lead time being five days. Depending on the organization, staff may offer the patient a cost estimate during this call in addition to asking for payment.

At the time the appointment is made, 7% of organizations attempt to collect deductibles and estimated co-pays (if available). Online scheduling tools and a defined pre-registration process enable payment discussions during scheduling.

Organizations with integrated technologies and those that serve a high percentage of self-pay patients are more likely to employ pre-payment tactics. Pre-payment requests also increase with organization size because larger entities tend to have greater access to patient electronic health records (EHRs), payment histories and estimation resources, which enable more data-driven payment requests.

The presence of pre-payment policies and procedures declines as organizations decrease in size. Smaller providers are less likely to have the resources to easily estimate costs and track patient information.

In addition, organizations that serve high percentages of Medicare and Medicaid patients are less likely to ask for pre-payment. Many of these providers do not have any pre-payment or point-of-service policies at all, and some do not have any back-end collection practices except sending a single bill.

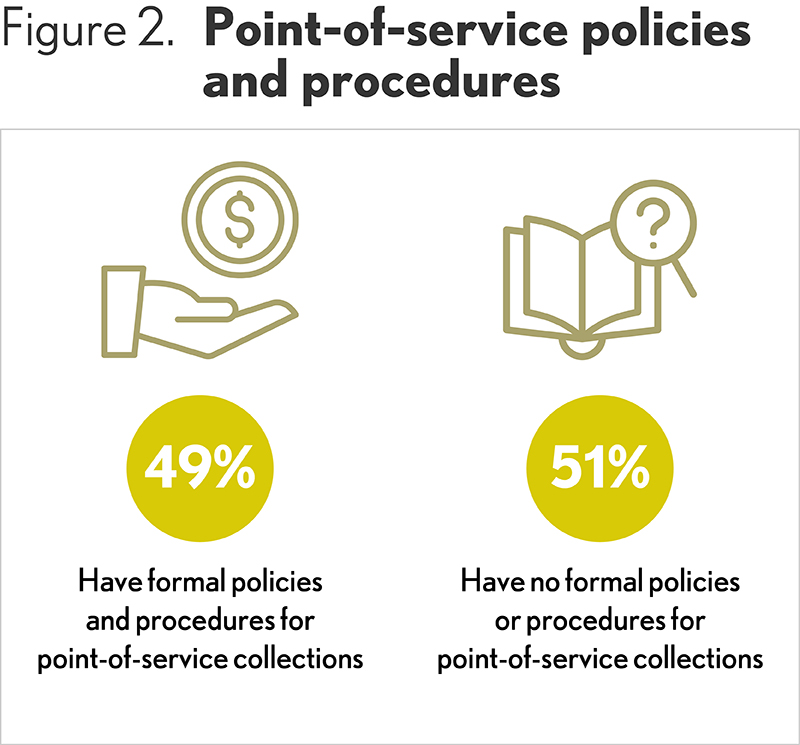

Point-of-service collections. Nearly half (49%) of survey participants say they have point-of-service collections policies and procedures in place. As with pre-payment, the organization asks the patient to pay deductibles and co-pays (if available). Point-of service processes are more commonly used for walk-in and emergency department (ED) patients because there is no patient engagement prior to the patient visit. For non-emergency walk-ins, payment in advance is usually requested. For emergency patients, collection is more often attempted during a bedside visit prior to discharge.

In some cases, organizations provide patients with multiple opportunities to pay that span from pre-payment through point-of-service. For example, according to one organization, pre-payment is handled through a centrally located preregistration/insurance team that verifies benefits and calls to provide a patient estimate. During this conversation, the team member requests payment, but it is not mandatory for the patient to pay at the time. If the team member can’t reach the patient, then at check-in, the patient access team provides the patient with the estimate, requests payment and notifies the patient of any outstanding balance. Even if the individual is still not able to pay, he or she will not be denied treatment. Instead, the patient is referred to a financial counselor for further assistance.

Whether open dialogue is initiated by providers prior to or at the point of service, engaging patients in discussions about medical treatment, personal needs, financial capabilities and available choices is central to pre-pay and point-of service collections for many providers. Survey respondents indicate their organizations rely on personal and transparent conversations with patients to help individuals make better decisions and avail themselves of the various resources open to them.

“The earlier an organization starts patient financial conversations, the better,” says Shannon Dauchot, CEO, Parallon, Revenue Cycle Point Solutions division. “Delaying until after the patient encounter concludes can be more difficult and can result in some unpleasant surprises for patients and the organization. By serving as a partner to the patient and family and helping them understand their responsibilities and how they can meet them, an organization will not only increase patient collections but provide a more compassionate financial experience in the process.”

Staff training can improve consistency and confidence

To prepare staff to effectively engage patients around their financial obligations, nearly 30% of people interviewed said their organizations offer specialized training. Depending on the organization, this education might focus on the importance of upfront collections; training around specific procedures such as how to read eligibility screens or create cost estimates and/or helping employees overcome any discomfort with asking for money.

“Although many front-office staff come from other positions across diverse industries where they have had to ask customers for money, they have not often had to resolve disagreements about how much is owed,” says Todd Nelson, director, partner relationships and chief partnership executive at the Healthcare Financial Management Association.

“In healthcare, these kinds of challenging conversations are more common,” said Nelson. “Perhaps the patient doesn’t fully understand his or her insurance coverage and doesn’t think he or she owes money. Or, maybe the patient has never been asked to pay at this point in his or her care and wonders why the organization is asking now. In these instances, staff may not want to upset the patient, so they agree to bill the individual later. Unfortunately, this can set up challenges on the back end. To mitigate risk, encourage payment and support a compassionate financial experience, training should guide staff in how to navigate these complex and sometimes emotional situations.”

Third-party trainers can be especially beneficial with this type of training, offering real-world scenarios in which an organization’s staff can gain valuable practice and experience.

Not only is training important to increase staff confidence and proficiency with patient financial communications, it is also helpful in establishing consistency between staff members and across departments. Survey respondents from organizations with more than one facility tend to blame lack of training for inconsistencies between locations, which can lead to uneven patient experiences and more back-end rework as staff aim to collect money that should have been gathered up front. Inaccurate pre-payment posts also result in back-end confusion and are possibly the result of poor training as well.

Training methods. Organizations are using a variety of training methods to educate staff. For example, some have found scripting to be a good way to build staff confidence while ensuring uniformity. When staff have multiple script options, they can use what works best depending on the patient and situation.

Survey participants also rely on observation and coaching, as well as team huddles. One organization notes that if a manager sees room for improvement in a way a staff member speaks to a patient, he or she can address it during huddles as a real-world example, being careful not to specifically call out the individual but use the scenario as a teaching moment.

“HFMA also offers comprehensive training resources,” says Nelson. “For example, HFMA’s Patient Financial Communications Training Program can provide guidance in how to bring consistency, clarity and transparency to patient-provider payment interactions.”

Organizations are expanding financial counseling and payment options

To encourage and empower patients regarding their payment responsibilities, hospitals and health systems are enhancing their financial counseling services and diversifying their payment options. One out of three respondents say their organizations provide personal financial counseling to their patients. Although the nature of this work varies by organization, it generally entails discussing how the different treatment options affect the patient financially and working through the available payment options.

The timing of financial counseling is important, and depending on the situation, can cultivate a stronger patient-provider relationship. For instance, one organization has started including financial counseling as part of ED discharge. Before implementing this strategy, patients didn’t realize financial assistance was available and would not attend follow-up appointments or seek follow-up care for fear they couldn’t afford it. By starting financial counseling at ED discharge, the patient can see what financial options are possible and find appropriate ways to pay for continuing care. This can prevent the patient’s condition from recurring or escalating and avoid future unplanned emergency visits.

Although providers would ideally like patients to pay for care, they all acknowledge that their organizations would not refuse to treat a patient who could not or would not pay in advance. That said, 5% did indicate they allow physicians to refuse to perform elective procedures which are not prepaid.

Patient payment options. To ease the payment process, nearly 20% of respondents offer in-house payment plans, which are generally interest-free and range from four months to 24 months. Not surprisingly, organizations find that patients tend to spread large debts (more than $1,500-$2,500) over longer time periods than smaller debts.

Some providers (16%) offer discounts to self-pay patients, ranging from 3% to 77%, with 25% being the most common discount. Sliding scales are in place with 9% of respondents, allowing lower income patients to receive medical services at a reduced cost.

Valuable Training Resources

- Observation and coaching

- Huddles

- Scripting

- Third-party resources

- Online training modules

- Videos

Collecting money in advance has numerous benefits

Survey respondents are nearly unanimous in appreciating the value of pre-payment and point-of-service collections, and 11% indicate they have either a strong belief or absolute proof that pre-pay and point-of-service payments reduce their days-in-A/R. Respondents’ A/R days range from 37 to 60 with the average being 47.

Pre-pay and point-of service payments are thought to lower bad debt as well. One respondent indicates the organization’s bad debt has declined 4% as a result of pre-payment and point-of-service payment policies and procedures.

About HFMA’s Annual Conference intercept survey:

Analyzing pre-payment and point-of-service collections efforts

HFMA stationed research interviewers throughout common areas at the Annual Conference to speak with attendees about their processes for pre-payment and point-of-service collections. Altogether, 39 providers were interviewed. Interviewers introduced a general topic for response, then probed specific responses as deeply as time and ability allowed. Follow-up interviews were conducted to gather further insight and information.

Consistency is essential

Respondents point out that inconsistent pre-payment and point-of-service policies can result in misalignment between the front- and back-end of the revenue cycle. For example, if there are discrepancies between the patient estimate and what is owed, it can cause patient frustration and the individual may complain to the back-end staff, even though the front-end staff were providing estimates. If there is not transparency between the front- and back-end, and solid policies for how to address irregularities, it can be frustrating to all involved.

Survey participants indicate the following three solutions could potentially mitigate misalignment issues:

- Implementing integrated technology that facilitates consistency between staff and across clinical and financial departments

- Having both the front- and back-end of the business office report to a single person

- Collaborating around solutions and communicating on an ongoing basis

- Conversely, the more siloed the front- and back-office are, the more problems the organization will face in effectively collecting money from patients, fostering a positive financial experience and limiting bad debt.

Remaining focused is key

Having solid and reliable processes for pre-payment and point-of-service collections is critical to advance an organization’s patient collections efforts. Clear policies, multifaceted staff training, timely financial counseling and varied payment options are all critical to helping organizations realize success. Hospitals and health systems looking to make improvements in this area do not need to recreate the wheel. By accessing and employing best practices and technologies, and leveraging the expertise of outside resources, an organization can reimagine its patient payment processes to lay the foundation for long-term financial wellness.

About Parallon

Parallon is a leading provider of healthcare revenue cycle management services. With a long track record of operational excellence, Parallon brings extensive knowledge and a broad portfolio of custom solutions to every partnership, including eligibility and advocacy services, early-out self-pay services, early-out small-dollar insurance resolution, bad debt collections, third-party liability and workers’ compensation services, extended business office and insurance services and physician billing and accounts receivable (A/R) resolution. Parallon enables providers to care for and improve the health of their communities by optimizing financial performance, navigating regulatory challenges, providing operational best practices and leveraging the latest technology. Parallon has more than 16,700 colleagues and serves more than 760 hospitals and 3,000 physician practices. Parallon is headquartered in Nashville, Tennessee, with 19 operational locations across the country.