Pressure Rising: COVID-19’s ongoing impacts on healthcare labor trends

Across nearly every industry, the COVID-19 pandemic has reshaped how and where people work. For hospitals and health systems, early efforts to stem the virus’s spread spurred organizations to limit the number of individuals moving in and out of care facilities and to abruptly shift non-clinical personnel to remote work environments.

More than a year later, healthcare leaders continue to assess the long-term implications of the pandemic on staffing, overall hiring practices and operations. A national survey of more than 140 HFMA members found that many anticipate workforce changes propelled by the pandemic will become permanent.

Syntellis Performance Solutions partnered with HFMA’s Financial Analytics Leadership Council (FALCO) to conduct the May 2021 survey and host subsequent roundtable discussions for executive insights on how the pandemic is affecting hospital labor trends now and into the future. Five key findings include:

- Health systems continue to shift non-clinical positions to remote work

- Organizations are casting wider nets for recruiting

- Many healthcare leaders expect labor expenses to increase over the next year

- Hospitals are testing creative solutions to address industry workforce shortages

- Finance experts are optimistic key measures of profitability will return

The actual, long-term repercussions of COVID-19 on the healthcare industry remain to be seen. Still, these findings highlight how healthcare leaders nationwide are responding to the disruptions of the past year and preparing for future uncertainties.

Expanding of remote work

While the transition to remote work was driven by necessity during the pandemic, healthcare leaders say it enabled them to grow comfortable with the model and gain a new appreciation for the opportunities it offers. Having greater flexibility about where employees work can be a boon to reducing costs and attracting new talent.

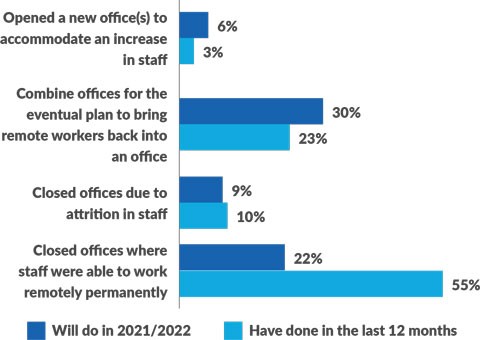

Fifty-five percent of HFMA members responding to the survey said their organizations closed facilities within the past 12 months where they could move staff to remote work. One-third said they plan to close additional facilities and transition more personnel to work remotely in 2021 and 2022. Nearly a quarter (23%) said they combined offices over the past year with plans to eventually bring remote workers back, and 30% said they would do so this year or next.

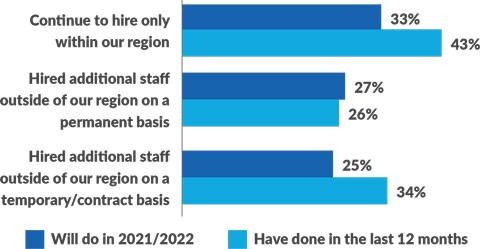

Q. With a remote workforce, many organizations are now hiring in regions outside of their own. How have your hiring practices changed?

One FALCO member said his organization is completely rethinking its facilities’ needs as a result of the pandemic. While top executives will remain onsite, many of the health system’s non-patient-facing employees will shift to permanent remote work. By 2022, those changes will allow the health system to vacate several buildings that it leases and increase occupancy in buildings it owns.

Some organizations are taking a hybrid approach, with positions like billers and coders moving fully remote, and other clinical support personnel working a combination of at-home and in-office days. The CEO of one Midwest health system intends to use a hybrid model to reduce the organization’s square footage facility needs by 25%. Having fewer employees onsite also allows many organizations to cut back on equipment leases for printers, copiers and other standard office items.

Casting a broader net

The demands of the pandemic exacerbated national healthcare workforce shortages. More and more, organizations rely on recruiting beyond their immediate market areas. Fifty-seven percent of survey respondents said they hired temporary or contract staff during the pandemic, and more than a third (34%) said they hired outside their regions for such positions. One-quarter of survey respondents said they plan to look outside their regions to fill additional temporary positions in 2021 and 2022, while 27% plan to hire permanent staff from other areas.

Q. How has your owned real estate changed to accommodate workforce changes due to COVID-19?

Having the ability to recruit employees regardless of where they live opens up the talent pool at a time when many health systems are struggling to fill key positions, one FALCO member said. It also has allowed his health system to retain employees who want the option to move, he said.

Some executives who were resistant to remote work previously said the pandemic has completely changed their perspective. “If you asked me a year ago about remote work, I would have told you I was uncomfortable with it — I like that face-to-face interaction with my employees,” one member said. “My position has changed. I have a team of 50 now that is entirely remote, and they are just as productive — if not more productive — working remotely than they were in the office.”

Rising labor expenses

Hospitals and health systems nationwide saw labor expenses rise in 2020 as they sought to minimize staff reductions in the face of unpredictable volumes and expand their nursing pools in response to surges in COVID-19 cases. As a result, Total Expense per Adjusted Discharge and Labor Expense per Adjusted Discharge both increased 14.4% from 2019 to 2020.

Nearly half of survey respondents said they expect labor expenses to continue to increase. Another 30% anticipate labor costs will decrease over the next several months compared to last year’s highs, and 23% said they will remain unchanged. During a roundtable discussion, multiple FALCO members said they anticipate 2021 labor expenses will increase compared to pre-pandemic levels, but they are working hard to reduce the exceptionally high costs seen in 2020.

One finance executive estimates labor costs at her health system jumped 20% during the pandemic as the organization paid incentives and bonuses to retain clinical personnel and increased its reliance on temporary staffing agencies to fill nursing needs as COVID-19-related hospitalizations rose. “We got hit in December and January from the COVID-19 surge in the Midwest,” she said. “The labor costs were just insane at up to $180 an hour for contract nursing. That is not a sustainable cost.”

Survey respondents reported significant volume declines across multiple service lines in 2020, contributing to higher per-patient labor costs. Nearly three-quarters saw declines in emergency department visits, 66% reported declines in inpatient orthopedic cases, and 65% saw declines in outpatient surgeries and screenings or visits for chronic conditions.

Addressing staffing shortages with innovative efforts

Demand for registered nurses (RNs) remains high. More than half (55%) of HFMA members responding to the survey said the need for RNs increased over the past 12 months, and 43% expect the need to increase in 2021 and 2022. Forty-two percent reported an increased need for ancillary staff, such as housekeepers and nursing assistants, during the pandemic.

Health systems continue to explore a variety of efforts to address staffing shortages and reduce their reliance on contract labor. In addition to nurses, finance executives say that filling low-paying clinical and non-clinical positions is increasingly difficult. One FALCO member said turnover within the first year at his organization is as high as 90% for some entry-level positions. He and other executives said their health systems are raising starting salaries in response and offering performance incentive programs to help boost pay and recruit and retain a reliable workforce.

To reduce the need for contractors, one health system is offering bonuses and additional per-hour incentive payments for nurses and other clinical personnel to work extra hours. Others have established more flexible staffing models, and internal float pools to shift clinical staff to other facilities as needs arise. In one case, an executive said her health system is developing an automated online scheduling system akin to an Uber or “gig economy” model that would allow workers flexibility to pick up shifts when they choose.

Optimism for the future

Despite the myriad challenges and ongoing repercussions of COVID-19, many healthcare leaders remain optimistic that their organizations will recover. More than half of survey respondents predict key measures of profitability will return to pre-pandemic levels:

- 53% anticipate a return in patient volumes

- 51% expect expenses will drop

- 53% anticipate revenues will increase

In response to mounting pressure from patients, providers and payers to hold down costs, healthcare leaders must closely evaluate pricing strategies, especially for outpatient services where they face the most competition from retail providers, private equity entities and others.

Healthcare leaders must apply the lessons learned during the pandemic to prepare for future unknowns. Many are making fundamental changes to their financial planning processes. Some top priorities cited by survey respondents include introducing rolling forecasting capabilities, streamlining operational budgeting, and integrating comparative analytics and predictive models to inform planning decisions. Such initiatives will help organizations remain agile and informed in the face of any new disruptions that may emerge.

About Syntellis Performance Solutions

Syntellis Performance Solutions, previously Kaufman Hall Software, provides innovative enterprise performance management software, data, and analytics solutions for healthcare organizations. Syntellis’ solutions include Axiom and Connected Analytics software, which help finance, clinical, and operations professionals elevate performance by acquiring insights, accelerating decisions, and advancing their business plans. For more information, please visit www.syntellis.com.

This published piece is provided solely for informational purposes. HFMA does not endorse the published material or warrant or guarantee its accuracy. The statements and opinions by participants are those of the participants and not those of HFMA. References to commercial manufacturers, vendors, products, or services that may appear do not constitute endorsements by HFMA.