Hospitals forecast declining revenues, lower procedure volumes and greater telehealth adoption due to COVID-19

Although healthcare organizations remain focused on managing the day-to-day realities of COVID-19, they are also eyeing the future and thinking through how the crisis will impact them clinically, financially and operationally. To gain a better understanding of healthcare executives’ perspectives on the pandemic, the Healthcare Financial Management Association (HFMA) surveyed 174 industry leaders in early May. Participants included C-level executives, vice presidents and directors across hospitals, health systems and group practices. Guidehouse analyzed the research conducted by HFMA, and the following sections discuss key takeaways.

Most leaders anticipate major revenue and volume drops

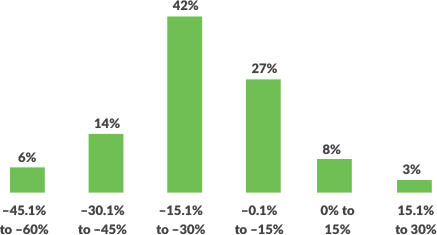

Nearly nine out of 10 healthcare executives predict their organizations’ revenues will be lower at the end of 2020 as compared to pre-COVID-19 levels. While almost two-thirds expect decreases of greater than 15%, one in five forecast decreases of more than 30%. On the positive side, respondents expect the long-term view won’t be as grim, foreseeing only 3% lower revenue one year from now.

One of the reasons behind the revenue decreases is the precipitous drop in elective procedures as organizations have had to cancel nearly all non-emergency activities to keep patients and staff safe. “Although organizations are starting to schedule these procedures as states open up and stay-at-home orders lift, the volume remains relatively low,” says Rick Gundling, senior vice president, healthcare financial practices for HFMA. “In some cases, this is because people are hesitant to visit a healthcare facility and are delaying non-emergent procedures until they feel more comfortable. In other instances, they have lost insurance coverage due to job loss and are delaying elective procedures until such a time when they can better afford them.” It is unclear when volumes will be restored. Half of executives surveyed anticipate it will take through the end of the year or longer for pre-COVID volumes to return.

Figure 1: How do you expect your future revenues to compare to pre-pandemic revenue levels?

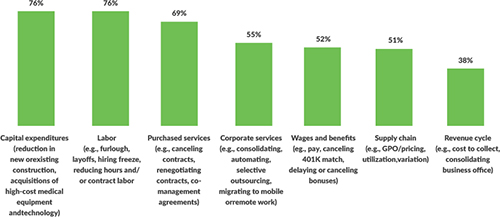

Cost reduction efforts are focused on key areas

To offset COVID-19’s financial impacts, healthcare organizations are trying to rein in expenses, and there are certain areas receiving more attention than others. For example, 76% of respondents indicate they are cutting back on capital expenditures, including new and existing construction. The same percentage are tackling labor costs through furloughs, layoffs and hiring freezes. Nearly 7 out of 10 are canceling or renegotiating purchased services contracts and co-management agreements.

“Healthcare has largely been insulated from previous economic disruptions, with capital spending more acutely affected than operations, but this time may be different,” says David Burik, partner and payer/provider consulting division leader at Guidehouse. “Providers are facing a long-term decrease in commercial payment, coupled with a need to boost caregiver and consumer-facing digital engagement, all during the highest unemployment rate the U.S. has seen since the Great Depression. For organizations in certain locations, it may seem like business as usual. For many others, these issues and greater competition will demand more significant, material change.”

Telehealth and work-from-home are gaining favor

With the Centers for Medicare & Medicaid Services (CMS) suspending certain telehealth regulatory barriers and offering more attractive reimbursement models for virtual healthcare visits, the industry has seen a rapid adoption of telehealth. That said, providers are not necessarily prepared to shift to remote care delivery. Although 67% of respondents predict their organizations will use telehealth at least five times more than they did pre-pandemic, only one-third believe their organizations have all the needed telehealth capabilities.

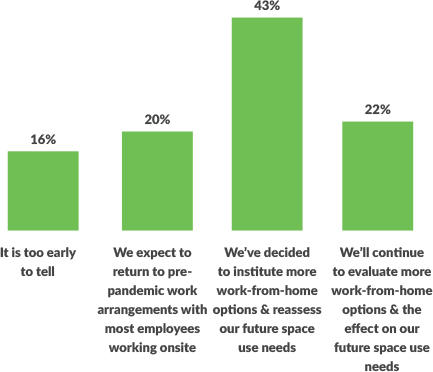

There are also significant changes in organizations’ working arrangements. For example, many have transitioned non-essential personnel to remote work. These non-traditional setups may remain after the pandemic ends. Just one in five executives expect their organizations will return to the predominately onsite work arrangements established before the pandemic, and 22% have already made the decision to increase work-from-home options and reassess future space-use needs going forward.

With the rapid increase in work from home and telehealth, executives are seeing the need for greater digital security. Almost two-thirds of respondents aren’t comfortable with their organization’s current cybersecurity capabilities and protocols, and 15% indicate these safeguards will require significant enhancements going forward.

Figure 2: What areas are you likely to target for intermediate- and long-term cost-reduction opportunities?

It appears that telehealth and other digital strategies are here to stay. More than seven out of ten executives say their organizations will look to digital strategies, including telehealth and contact centers, to grow future revenue. Other areas of focus will include service line strategies, such as growing core businesses and exiting losing businesses (66%), and revenue cycle improvements (57%), including enhancing accounts receivable and collections.

Figure 3: How will the work-from-home experience impact your strategy for flexible work and space planning in the future?

“Through all the uncertainty COVID-19 has presented, one thing hospitals and health systems can be certain of is their business models will not return to what they were pre-pandemic,” says Guidehouse Partner Chuck Peck, MD, a former health system CEO. “A comprehensive consumer-facing digital strategy built around telehealth will be a requirement for providers. Moreover, shifting hardware and physical assets to the cloud and use of robotic process automation has proven to be successful in improving back-office operations in other industries. Providers will need to follow suit.”

About Guidehouse

Guidehouse’s Health segment is comprised of clinicians, scientists, former provider and public health administrators, and other experts with decades of strategy, consulting, funding and policy, revenue cycle management, digital and retail health, managed care, and outsourcing experience. Our professionals collaborate with hospitals and health systems, government agencies, life sciences companies, and payers, providing strategic insights and performance improvement solutions that help them redesign, revitalize, and transform their operations. For more information about the Guidehouse Health team, which has earned multiple Best in KLAS Awards, visit www.guidehouse.com/centerforhealthinsights.