Long-term financing rises as top patient concern

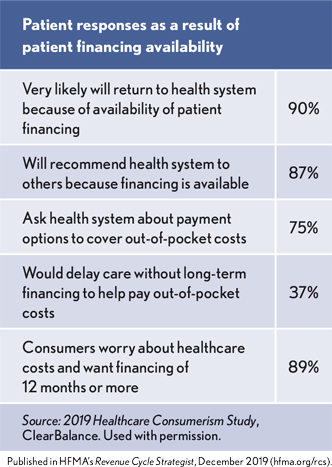

Three quarters of respondents to a patient payment experience survey said they would ask their provider about payment options, according to the ClearBalance 2019 Healthcare Consumerism Study.

In addition, 94% of respondents expect that their providers can share ways to repay medical bills, including long-term financing. An overwhelming majority (89%) of the more than 45,000 survey respondents say they need more than 12 months to repay their healthcare costs.

Other findings confirm the need for long-term financing. Only 29% of consumers have emergency savings to cover six months’ worth of medical expenses, according to Bankrate.com. Sixty-three percent of respondents in the Healthcare Consumerism study save less than $1,000 for medical care.

The silver lining, despite the perception that healthcare is expensive, is most consumers want to pay for their cost of care and they aren’t surprised about having financial conversations.

“Several years ago, we anticipated that revenue cycle management would evolve to a consumer-centric approach,” says April York, senior director of revenue administration for Novant Health. “We’ve been ahead of others in our market, collaborating with patients on payment options that are reasonable while significantly reducing bad debt. The strategy benefits patients, creates loyalty and supports our financial performance goals year-after-year.”