Survey: Revenue cycle continuity is imperative during the COVID-19 pandemic

Since the start of the COVID-19 public health crisis, hospitals and health systems have worked tirelessly to shore up and sustain revenue cycle operations amid fluctuating patient volumes. Key functions like patient collections top the priority list as organizations strive to overcome current economic challenges and accommodate patient constraints while maintaining cash flow and preserving revenue.

To learn about hospital and health system leaders’ perspectives on COVID-19 and its effect on the revenue cycle, the Healthcare Financial Management Association (HFMA) conducted an online survey of HFMA Digital Annual Conference attendees. The following research report, sponsored by TruBridge, explores three key takeaways from the survey.

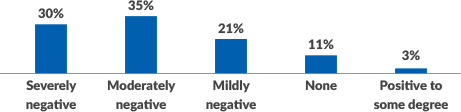

The negative impact on revenue cycle operations was universal

Nearly nine out of ten (86%) healthcare providers saw a negative impact to revenue cycle operations during the first months of the crisis. Larger organizations reported the greatest impact, and very small providers the least. In some cases, organizations were prepared for the disruption. Three-quarters of those that had a business continuity plan for managing revenue cycle operations in a distributed workforce found their plan to be effective. However, one out of five providers did not have such a plan, which may have put their organization at risk. The majority of providers that outsourced revenue cycle or coding services did not see disruption to those services. Those that did were more likely to be larger organizations.

“The amount of risk introduced into revenue cycle operations as a result of the pandemic has been significant,” says Chris Fowler, president of TruBridge. “In general, the pandemic is magnifying two areas of deficiency. First, it’s showing many organizations that they have outdated business processes or products, or in some cases people who don’t have the correct training, tools or skills to perform in a largely remote environment. Second, it’s teaching organizations there’s a greater need to lean on technology to ensure they maximize revenue, especially related to self-pay cash collections and holding payers accountable for reimbursement that’s exactly aligned to contract terms.”

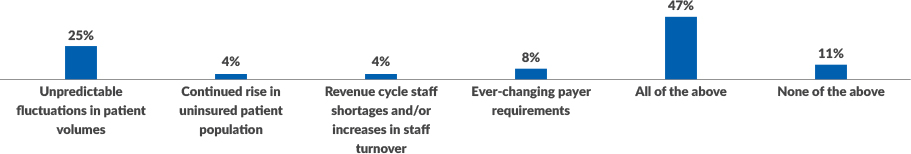

Many providers see a combination of risks presenting a threat to long-term business continuity

According to survey respondents, unpredictable fluctuations in patient volumes represent the single biggest risk to maintaining long-term revenue cycle continuity, with 25% of respondents pointing to this as a concern. However, more respondents note that a several factors are causing risk. Almost half of respondents (47%) note in addition to patient-volume fluctuation, the rise in uninsured patients, staffing shortages and turnover, and the ever-changing regulatory environment are all impacting their organizations’ ability to safeguard revenue cycle continuity.

The impact of COVID-19 on revenue cycle operations

Please describe the impact COVID-19 had on your revenue cycle operations during first months of the crisis.

“The many pressure points that can affect revenue cycle operations have been around long before the pandemic began,” says Rick Gundling, FHFMA, CMA, senior vice president, healthcare financial practices for HFMA. “However, the crisis has accelerated many of these factors, highlighting the need for hospitals and health systems to review their strategies for communicating well with consumers, maintaining cash flow and reducing revenue loss. By taking a multifaceted approach that considers both known and potential risks, an organization can better prepare to navigate the bumpy road that lies ahead.”

Risks to business continuity

What is your organization’s most significant risk related to maintaining long-term revenue cycle business continuity?

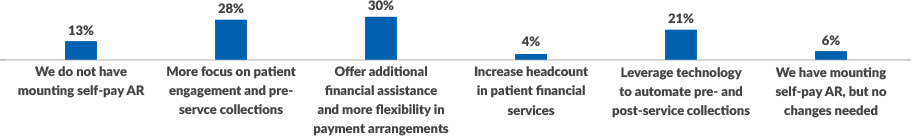

Maintaining patient revenue is a key focus

The pandemic-fueled economic uncertainty is increasing self-pay accounts receivable risk. As patients lose their employer-sponsored health plans or struggle to meet their high deductibles, many healthcare organizations are seeing their A/R numbers rise. To address this issue, hospitals and health systems are looking for ways to meet patient needs while still consistently collecting revenue, focusing on strategies that consider rising consumerism. Nearly one-third (30%) are offering financial assistance and more flexibility in payment arrangements while 28% are focusing more on patient engagement and pre-service collections. Technology has an important role to play in this area, as automation of pre- and post-service collections is the third most popular way to handle mounting self-pay A/R.

“Self-pay cash collections have been significantly impacted during the pandemic,” says Fowler. “However, contrary to what many likely assume, there are healthcare organizations that are seeing record-breaking cash collections during these unprecedented times. The high collection levels are a direct result of implementing best practices around staff professionalism and education, as well as technology, and applying these components at the beginning of a patient’s pre-screening process. What we hear from clients is that when these best practices are utilized, patients are 60% more likely to pay in-full within the first six months. An added bonus is the increased ability of the healthcare organization to assist patients who truly cannot pay.”

Self-pay collections strategies

What is your organization’s most significant risk related to maintaining long-term revenue cycle business continuity?

Remaining flexible and open to change is essential

As COVID-19 cases continue to rise in the United States and around the world, it’s clear that the pandemic is far from over. Although no one knows for sure how the next year will unfold, it is imperative that organizations be proactive about meeting patient needs regarding payment and pursue strategies that are rooted in compassion but also establish an infrastructure that supports consistent and timely collections.

About HFMA’s Digital Annual Conference Online Survey

HFMA conducted an online survey of Digital Annual Conference attendees during the month of July, reaching a wide range of HFMA members who hold leadership positions in revenue cycle and other financial, operational and business areas. The survey included closed-ended questions. HFMA received between 275 and 320 responses, depending on the question asked.

About TruBridge

TruBridge, a member of the CPSI family of companies, provides business, consulting and an end-to-end revenue cycle management (RCM) solution. With our arsenal of RCM offerings that include an HFMA Peer Reviewed® product and an HMFA Peer Reviewed® complete outsourcing service, TruBridge helps hospitals, physician clinics, and skilled nursing organizations of all sizes become more efficient at serving their communities. For further information visit www.trubridge.com.

This published piece is provided solely for informational purposes. HFMA does not endorse the published material or warrant or guarantee its accuracy. The statements and opinions by participants are those of the participants and not those of HFMA. References to commercial manufacturers, vendors, products, or services that may appear do not constitute endorsements by HFMA.