Survey: COVID-19 profoundly affecting patient collections and financial assistance programs

As COVID-19 continues to disrupt the U.S. healthcare system, hospitals and health systems are realizing they must discover ways to shore up and sustain business operations amid a new normal. Organizations must remain focused on key revenue cycle functions, such as patient collections, so they can bring in funds and remain financially viable. However, the economic stressors caused by the pandemic are exacerbating the inherent challenges involved in functions like patient collections. Rising unemployment is leading to greater numbers of uninsured and underinsured patients and causing a spike in self-pay volume. These shifting dynamics are fundamentally altering how healthcare organizations approach patient payment, causing immediate, meaningful and potentially lasting change.

To learn more about hospital and health system leaders’ perspectives on COVID-19 and its effect on patient payment, the Healthcare Financial Management Association (HFMA) conducted an online survey of HFMA Digital Annual Conference attendees. The following research report, sponsored by Parallon, explores key takeaways from this survey.

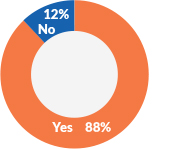

COVID-19 is having a substantial effect on patient collections at healthcare facilities

Fully 88% of healthcare providers indicate that COVID-19 has impacted their approach to patient collections in some way. And nearly 20% (18%) go so far as to say that the virus has impacted their organization’s approach in every way. That means that almost one in five healthcare providers are overhauling their entire patient collections strategy because of the virus.

Hospitals and health systems are handling the volatility by employing various strategies. For example, 70% of healthcare providers have increased patient payment options, 74% have adjusted bad debt placement timing and 61% have delayed credit reporting. In some cases, providers are allowing patients to extend payment terms and delay payments. They are also considering more convenient options that enable contactless payment. These efforts not only streamline the payment process but also make it safer for patients and healthcare organization staff, removing the need for face-to-face financial interactions.

“Many patients were challenged to meet their healthcare financial responsibilities prior to the arrival of COVID-19 due to high-deductible health plans, in addition to all their other financial obligations,” says Rick Gundling, senior vice president, healthcare financial practices for HFMA. “Now, you add a nationwide pandemic, deep economic uncertainty, rapid job losses and a sudden decline in healthcare coverage into the mix, and a larger number of patients are overwhelmed, with some simply unable to meet their responsibilities. Healthcare organizations that are able to offer more payment flexibility and forgiveness will not only help patients in their time of need but build relationships with individuals based on trust and aligned priorities. This patient-centered approach can help lay the foundation for a long-term patient relationship that is positive.”

“While collecting with compassion has always been a key focus, we as an industry need to get more creative in the ways we facilitate those activities,” says Shannon Dauchot, CEO of Parallon’s Revenue Cycle Point Solutions Division. “Beyond increasing flexible payment terms, providers should consider more proactively identifying those patients who may be eligible for either financial assistance or secondary insurance coverage through state, federal and local programs. Often patients and their families are unaware they qualify for these ‘safety net’ programs. Investing in resources to further help these efforts not only aligns with a provider’s mission, it relieves some of the financial insecurities often impacting our patients and their families. During the pandemic, patients have shown a positive sentiment toward healthcare providers. Consumers have demonstrated a willingness to pay their outstanding balances despite other financial obligations they may have, communicating the value they place on healthcare services and the willingness to support frontline workers during

this time.”

The impact of COVID-19

The percent of healthcare roviders that indicate COVID-19 has impacted their approach to patient collections in some way.

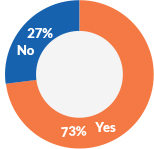

Identifying patients who are uninsured or underinsured is a priority

In the context of the current situation, nearly three out of four (73%) healthcare organizations are taking more steps to correctly identify unemployed patients and patients who are under-insured or uninsured.

“By focusing on those patients who need assistance the most, a healthcare organization can target its financial assistance, charity care and patient financial communication strategies accordingly,” says HFMA’s Gundling. “Understanding a patient’s work status and insurance coverage before they enter the organization for care allows the entity to start financial counseling and the collection assistance process right away. For example, this information can fuel predictive analytics models that can indicate the patient qualifies for charity care and also trigger financial counseling to offer upfront payment plans or other available financial resources. Establishing a workable payment solution faster will help the organization with cash flow while compassionately meeting the patient’s unique needs.”

Providers have seen overall patient volumes drop in recent months, and in some markets, they have plummeted to record lows. “Shifting staff to align with reduced volumes, while protecting an organization’s human resources, has become both an art and a science,” says Dauchot. “Specific to the uninsured patient volumes, some providers have changed the way they provide coverage assistance. At Parallon, we’ve moved many of our patient benefit advisers from the bedside environment into a community outreach approach. This proactive action is assisting local communities across our markets by providing coverage information and program assistance to those who’ve become recently unemployed and uninsured. While this approach may not link our actions to a specific inpatient or outpatient visit, it creates coverage security for those vulnerable citizens who struggle to understand their options as they move into the ranks of the unemployed. It’s the right thing to do for our communities because at the end of the day, it’s about taking care of people and families, and protecting their access to healthcare.”

Identifying uninsured or underinsured patients

The percent of healthcare organizations taking more steps to correctly identify unemployed patients and patients who are underinsured or uninsured.

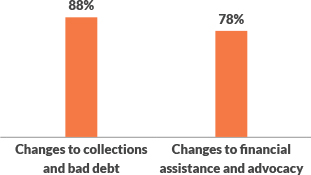

The pandemic will have long-lasting effects on patient collections, bad debt and financial assistance programs

While healthcare organizations have seen immediate changes due to COVID-19, many anticipate things will continue to evolve over the next year. Almost 9 out of 10 (88%) healthcare providers predict some level of change to their patient collections practices going forward.

Perspectives on what the changes will entail vary across respondents. One in five (19.59%) indicate they will involve greater flexibility and leniency regarding payment. Respondents suggest their organizations will be less pushy about collecting self-pay balances, extend payment timeframes before sending a patient to collections, consider discounts for pre-payment and full payment, adopt flexible payment terms, and offer alternative payment models, such as lines of credit. Respondents use words like “compassion,” “flexibility” and “creativity” to illustrate their organization’s commitment and approach to meeting patients where they are financially and helping ease the burden of healthcare costs.

Organizations also see that their current work in altering the timing for bad debt placement and credit reporting will continue. Three out of four providers (76%) whose organizations have changed their timing expecting it to continue at some level into 2021 and beyond.

Providers are also anticipating adjustments to their financial assistance and advocacy programs, with 78% predicting further change in the next year. Most changes involve increasing resources dedicated to financial assistance and/or advocacy and more patient contact and outreach. This may include increasing charity care write-offs, expediting presumptive charity care programs and moving more bad debt into charity care.

“The changes stemming from COVID-19 are shaping up to be significant and long-lasting,” says HFMA’s Gundling. “Organizations can expect further disruption and difficulty in the coming year, however there is also the opportunity for improvement. While almost no one anticipated a pandemic, organizations have the chance to use it to realize true change in patient collections, making the process more efficient but also inherently more patient-focused and compassionate.”

Many provider and support organizations have been hit hard financially, with their revenue cycle landscape potentially changed long term. “Even amidst these challenges, our collective compassion and the desire to provide assistance where there is a need — bringing resources, flexibility, responsiveness and creativity to help those in crisis — should remain unchanged,” says Parallon’s Dauchot. “As an industry, it will be interesting to see what our legacy will be going forward. How will providers care for the financial health of their patients, just as they do their physical health? These questions are at the forefront of our industry now, more than ever. How we respond, how we drive our mission of caring and compassion, is up to us.”

Changes in the coming year

The percent of healthcare organizations that predict some level of change in the coming year.

An uncertain future is the only certainty

Although the pandemic is far from over, and no one knows how the next 12-to-24 months will unfold. One thing is for sure: COVID-19 will continue to impact the healthcare arena, and organizations will need to continuously revisit their patient collections efforts to make sure they keep the needs of their patients in mind while ensuring a solid and reliable strategy for collecting money that enables long-lasting financial viability.

About HFMA’s Digital Annual Conference online survey

HFMA conducted an online survey of Digital Annual Conference attendees during the months of June, July and August, reaching a wide range of HFMA members who hold leadership positions in revenue cycle and other financial, operational and business areas. The survey included both open-ended and closed-ended questions. HFMA received 565 to 617 responses to the close-ended questions and 468 to 521 answers to the open-ended ones, depending on the question asked.

About Parallon

Parallon is a leading provider of healthcare revenue cycle management services. With a long track record of operational excellence, Parallon brings extensive knowledge and a broad portfolio of custom solutions to every partnership. We provide customized revenue cycle solutions, including eligibility and advocacy, early-out self-pay, early-out small-dollar insurance resolution, bad debt collections, third-party liability and workers’ compensation, extended business office and insurance services and physician billing and A/R resolution. Parallon has more than 18,100 colleagues and serves more than 4,300 hospitals and physician practices. Parallon is headquartered in Nashville, Tennessee, with 17 operational locations across the country. For more information about Parallon, visit Parallon.com.