Survey: Health systems push toward risk-based payment models, payer-provider partnerships

The lines between payers and providers are increasingly blurred, as provider organizations gravitate to risk-based payment arrangements and payers build primary care capacity that challenges health systems’ success.

That trend was documented in a Healthcare Financial Management Association survey of more than 100 health system CFOs and finance and managed care executives. The survey was conducted in July and August 2021. The Guidehouse Center for Health Insights analyzed the 2021 Risk-Based Healthcare Market survey findings, and the following sections discuss key takeaways.

Risk-based models gain traction

Health systems that have the right financial, clinical, operational and analytical capabilities in place will continue evaluating and embracing risk-based arrangements, said Todd Nelson, director, partner relationships and chief partnership executive at HFMA.

“We believe this will be the case due to the need to align the payment incentives with the outcome-based approaches needed for cost effectiveness of health,” he said.

Indeed, nearly 60% of health systems responding to the survey plan to advance into risk-based Medicare Advantage models this year; in 2019, just 51% of provider organizations were doing so.

Beyond Medicare Advantage, health systems are diversifying their risk-based payment strategy with a broader array of business lines. Guidehouse partner Richard F. Bajner Jr., who leads payer and provider teams within the company’s Health segment, said systems are increasingly interested in owning the premium dollar through risk-based arrangements to counter the vertical integration strategies of major insurers.

“Large payers have been more aggressive in building and even investing directly in primary care assets to gain control over the flow of care and better manage services delivered to members, compounding the need for payers and providers to align closely on market strategies,” Bajner said.

“These moves have led health systems to gravitate toward programs more favorable for risk-based collaborations — or payvider models — such as Medicare Advantage, managed Medicaid and self-insured models.”

Vertically integrated health plans loom large

More than half — 52% — of survey respondents cited vertically integrated health plans, such as UnitedHealthGroup, as the single market disruptor creating the greatest barrier to their success. In a distant second place, consumer-facing organizations such as Apple, Amazon, CVS and Walmart were cited by 17% of health system respondents.

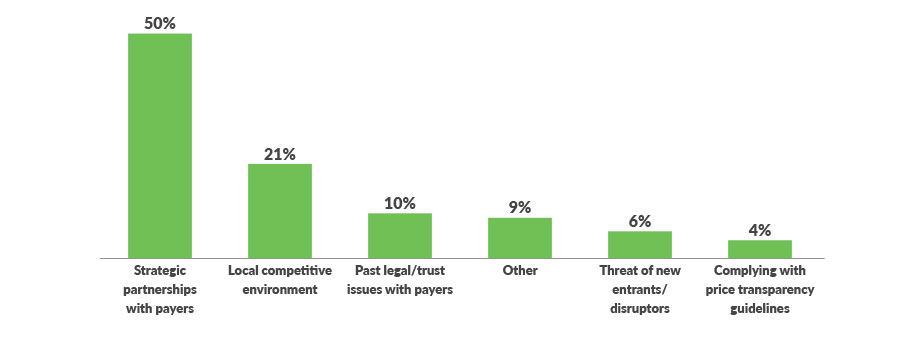

Indeed, while health systems are attracted to payvider opportunities such as Medicare Advantage, managed Medicaid and self-insured models, 50% of survey respondents said strategic relationships with payers are the top challenge in pursuing them.

Traditional payer and provider relationships have taken a hit in this evolving market, but Guidehouse sees great potential for payvider models that create value for both entities, said Travis Sherman, director in Guidehouse’s Health segment.

“The one-size-fits-all, ‘I-win-you-lose’ approach is no longer a good business model,” he said. “Industry disruption has created new opportunities for health systems to rethink the structure of their payer and provider partnerships, reassess their markets for new entrants with a willingness to innovate together and readjust their network strategy to align with where their market is going.”

Savvy organizations are well-positioned to adjust to changing conditions. “Health systems have a long history of developing, evaluating and thriving under partnership arrangements,” HFMA’s Nelson said. “They have consistently evaluated community need to determine what is the best for the health of the population.”

Top external challenges with pursuing payvider models or increased levels of risk/capitation/joint venture arrangements

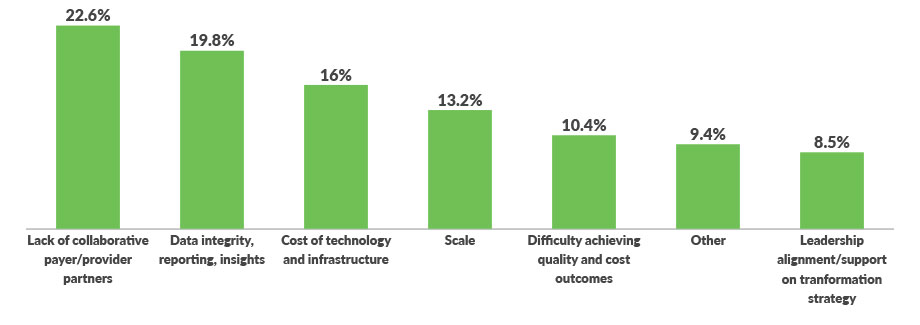

Top internal challenges related to increased levels of risk arrangements

Leaders worry about hitting budgets

The changing payer-provider dynamic comes during a time of uncertainty for health system leaders. When the survey was fielded in summer 2021, more than 40% of health system leaders said they were unsure they would meet budget for that year. The current year is not likely to be much easier.

“In 2022, health systems will continue to see pressures of workforce shortages, supply constraints and new market entrants, all of which will create pressure to maintain budget performance,” Nelson said. “Those systems that have embraced creative solutions to these issues throughout the pandemic will be strongly positioned to improve performance.”

Data issues present potential problems

The changing payer/provider environment makes a reassessment of investments, partnerships and business models for 2022 more important than ever, said Nicole Fetter, MD, a director in Guidehouse’s Health

segment.

“Unfortunately, many well-intentioned payer and provider partnerships never come to fruition due to challenges with operationalizing and implementing risk-based models,” she said.

Knowing who to partner with and achieving meaningful results requires the savvy use of data to both understand local markets and better manage care. More than one-third of survey respondents cited data issues — including costs, integrity, reporting and insights — as their top internal challenge to accepting more risk-based payment arrangements. Nearly a quarter said the biggest barrier is a lack of collaborative payer/provider partners.

“Organizational commitment, a cohesive governance structure and adequate investment in a strong data-driven infrastructure are required to overcome these obstacles and achieve success,” Dr. Fetter said.

Payvider model success requires new capabilities

While half of respondents are building these capabilities in-house, 30% are partnering with payers to support risk-based capabilities and nearly 21% are outsourcing services to a third-party organization.

About Guidehouse

Guidehouse is a leading global provider of consulting services to the public sector and commercial markets, with broad capabilities in management, technology, and risk. The company’s Health segment integrates consulting and outsourcing expertise to help hospitals and health systems, government agencies, life sciences and retail companies, payers, and other organizations solve their most complex issues and deliver innovative services to their communities. With 11 KLAS #1 rankings, Guidehouse was also ranked 2021’s third largest healthcare management consulting firm by Modern Healthcare. www.guidehouse.com/healthcare

This published piece is provided solely for informational purposes. HFMA does not endorse the published material or warrant or guarantee its accuracy. The statements and opinions by participants are those of the participants and not those of HFMA. References to commercial manufacturers, vendors, products, or services that may appear do not constitute endorsements by HFMA.